Digital banking fintech solutions for better channel engagement

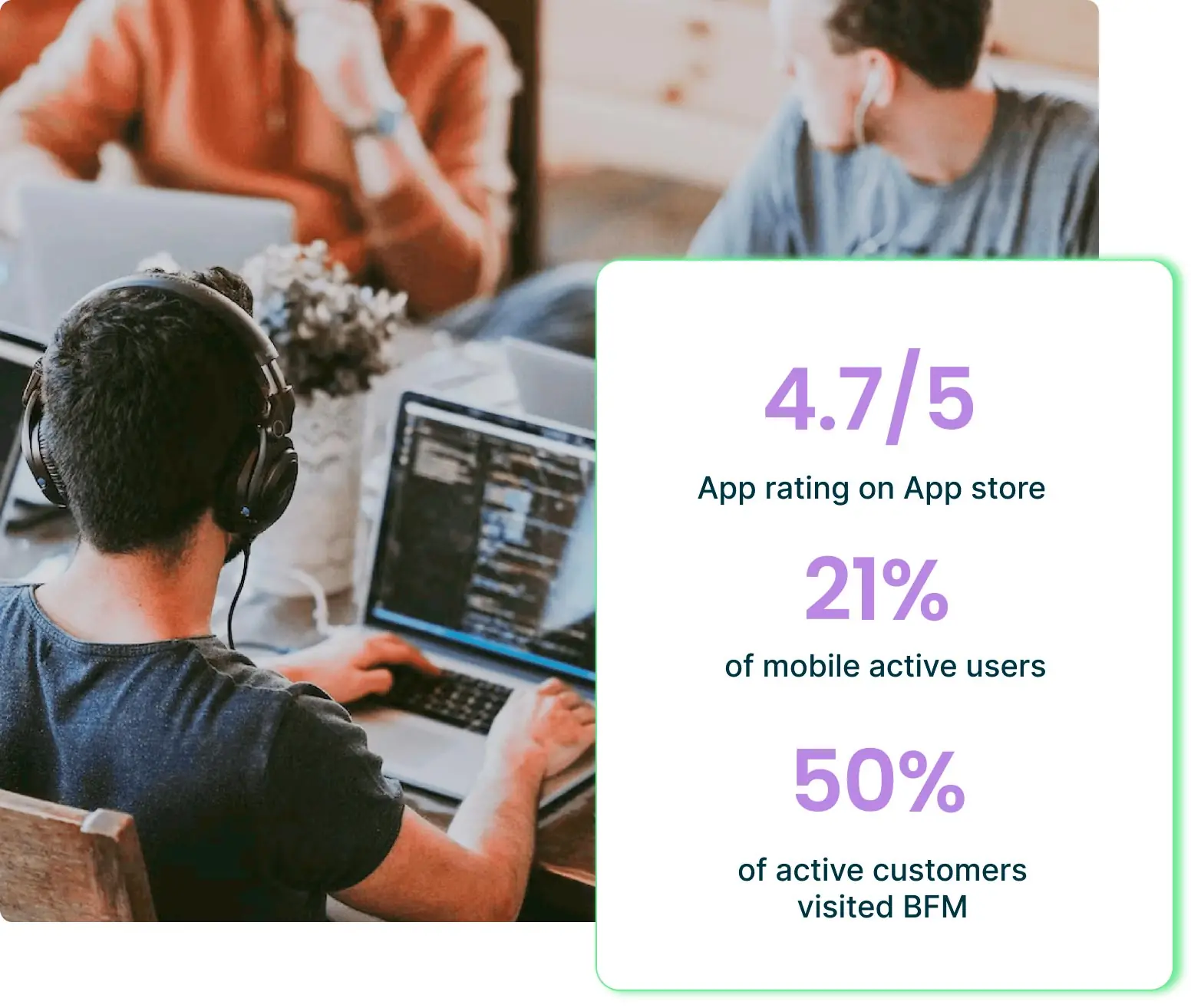

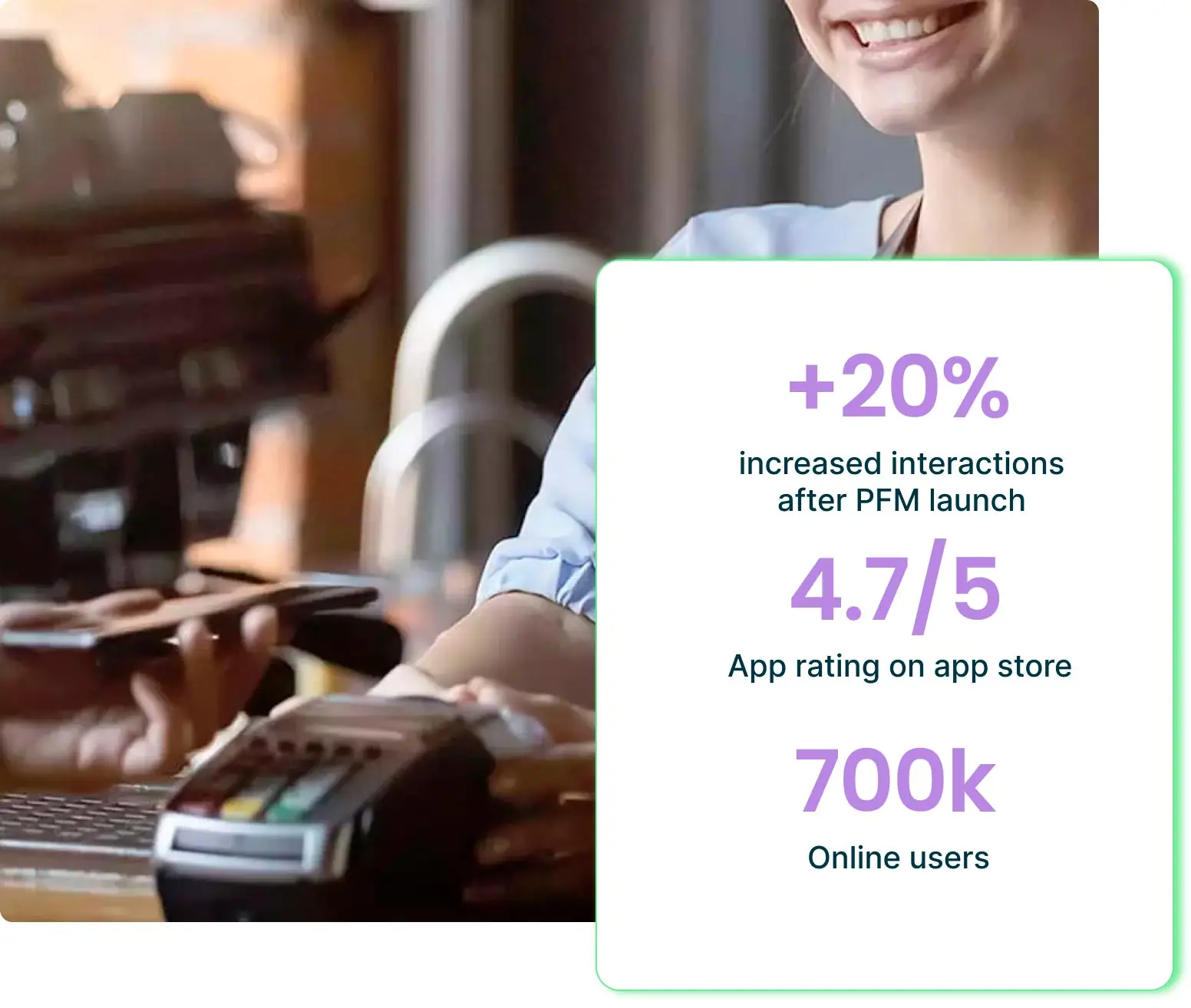

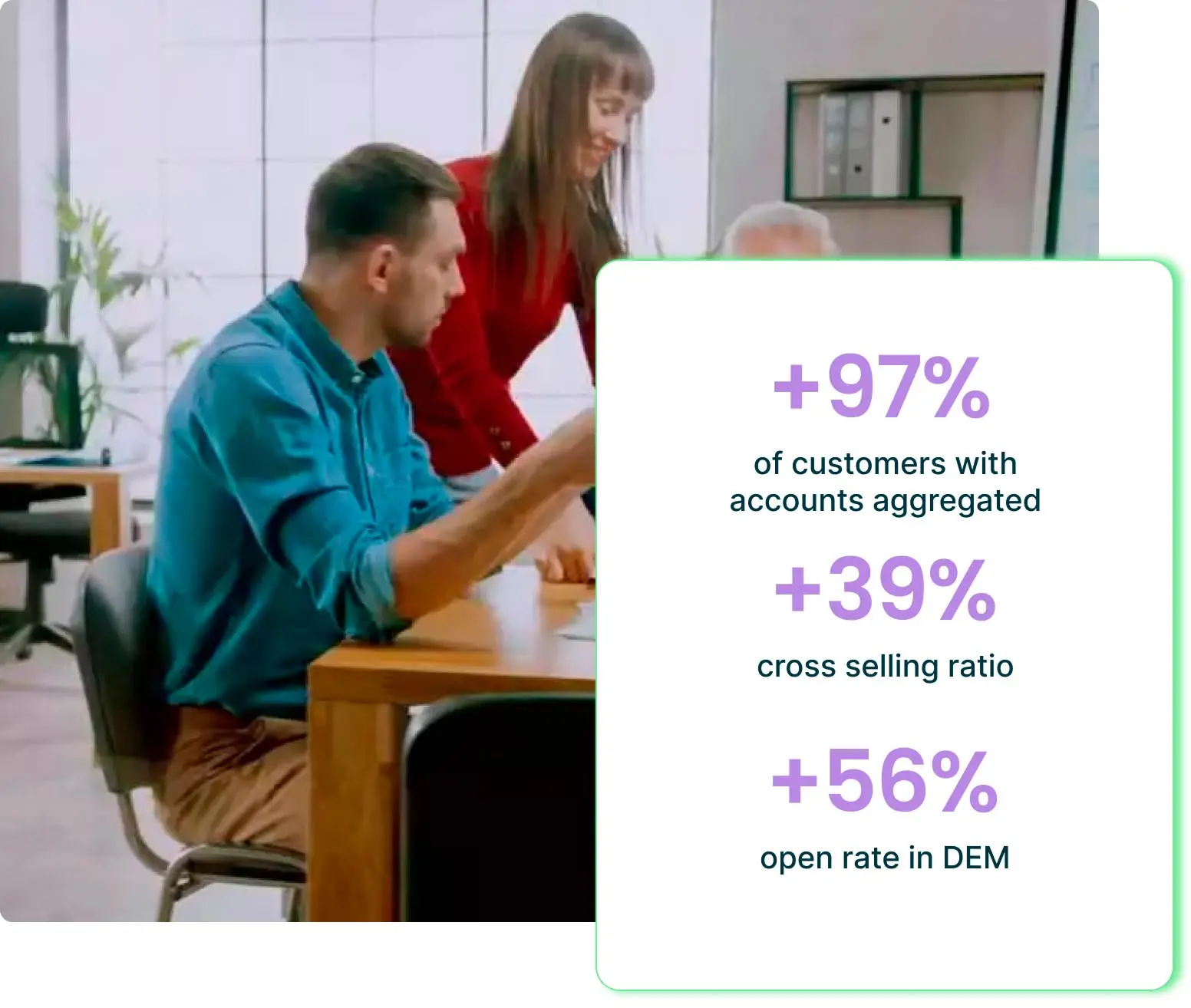

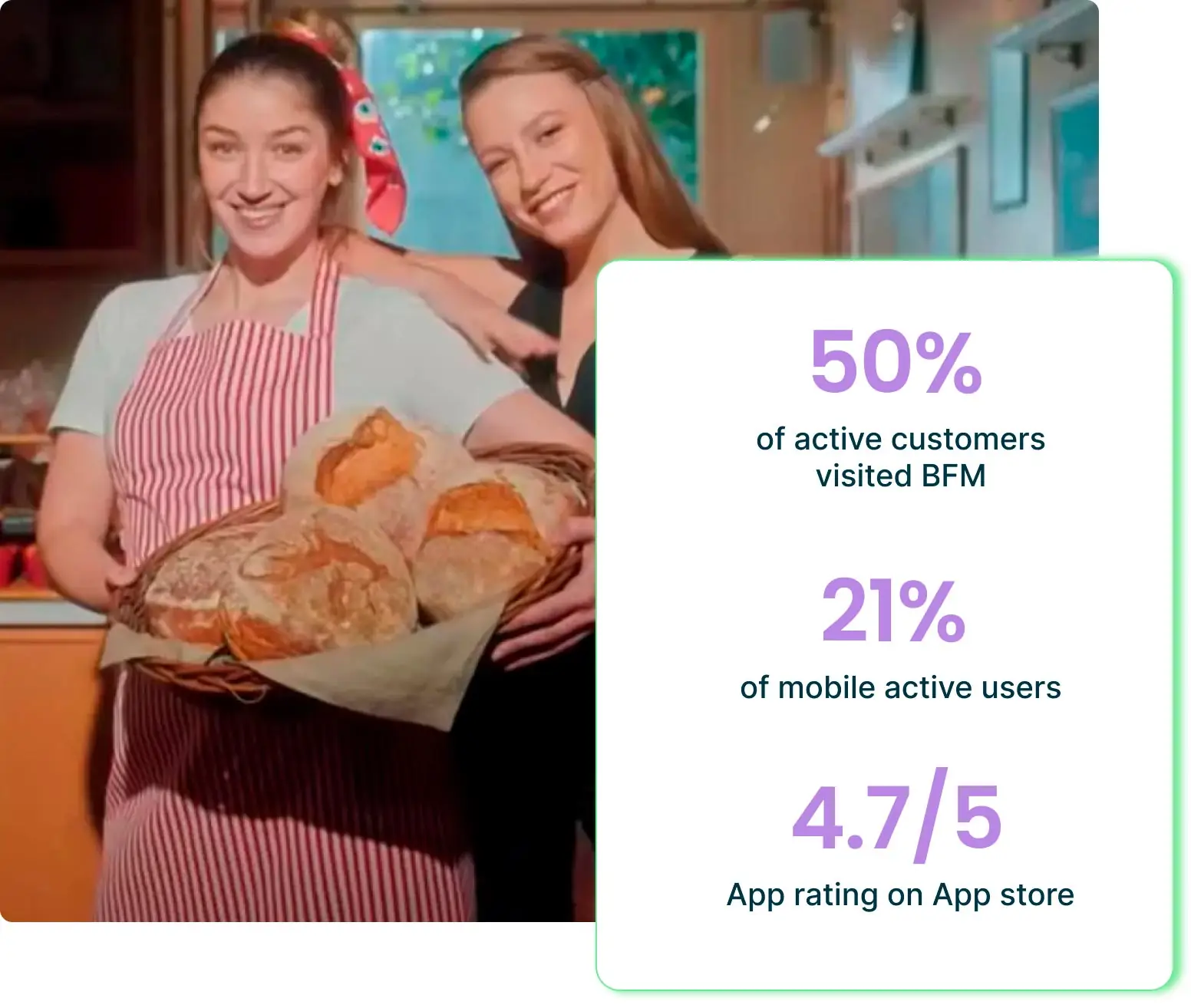

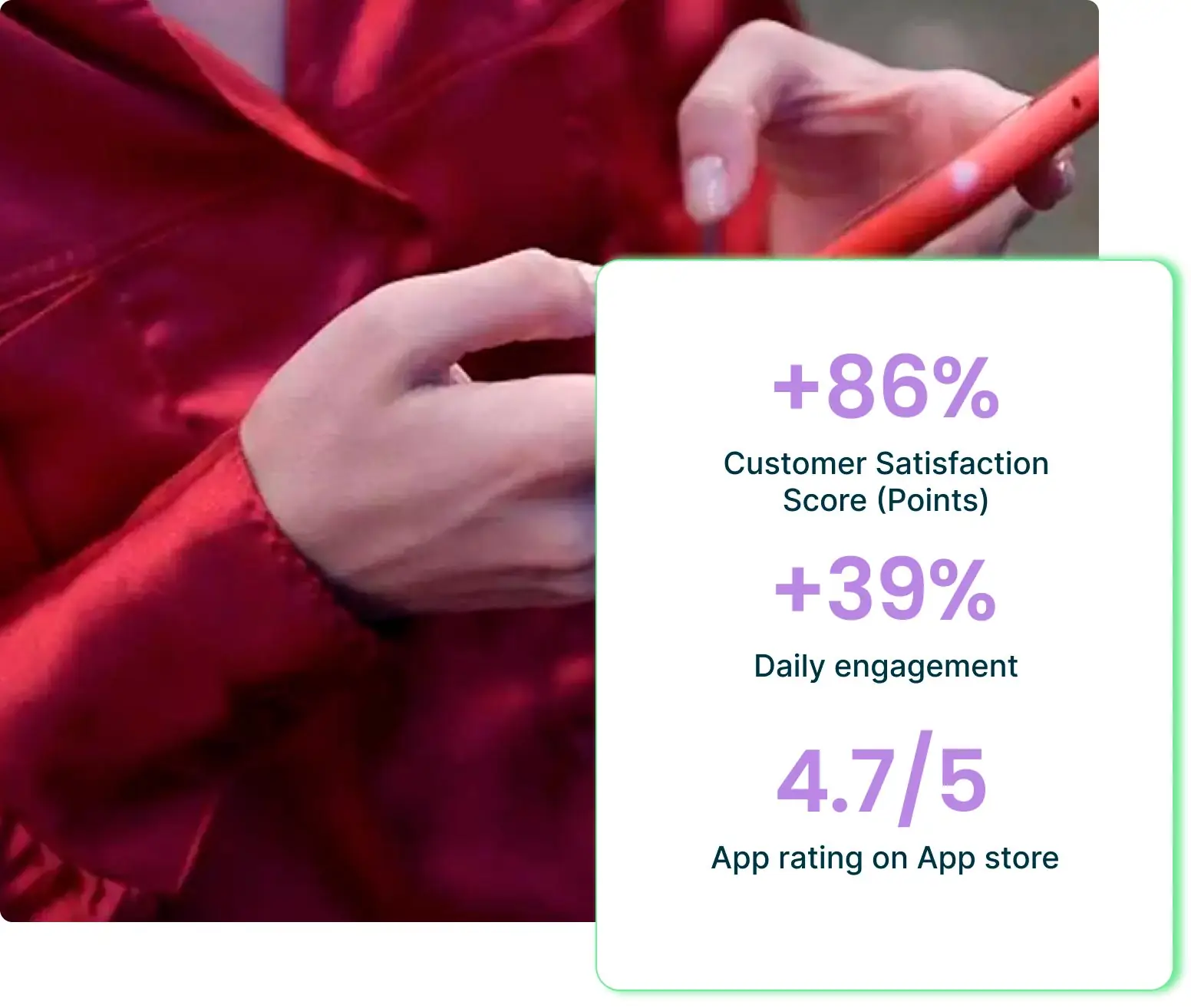

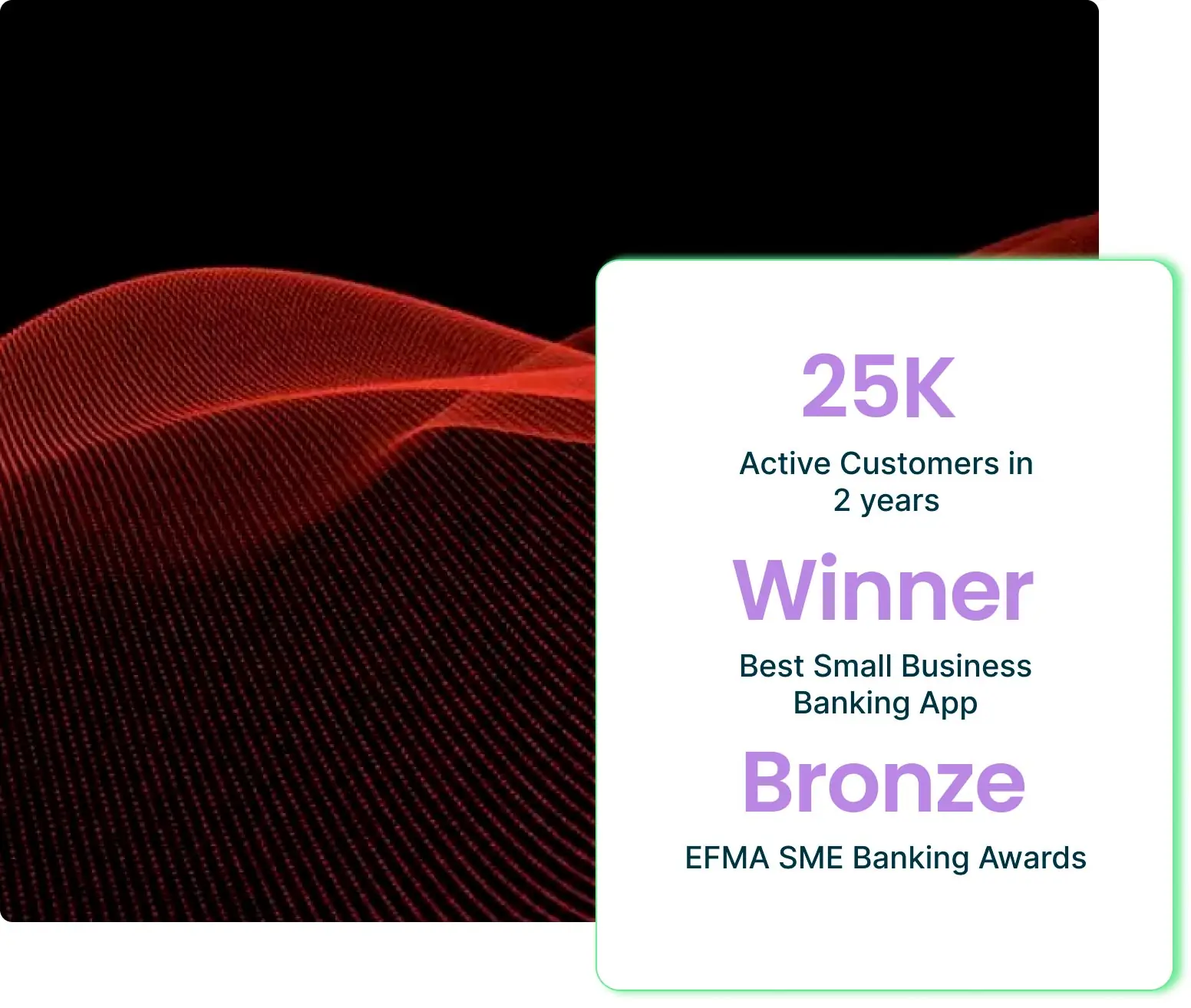

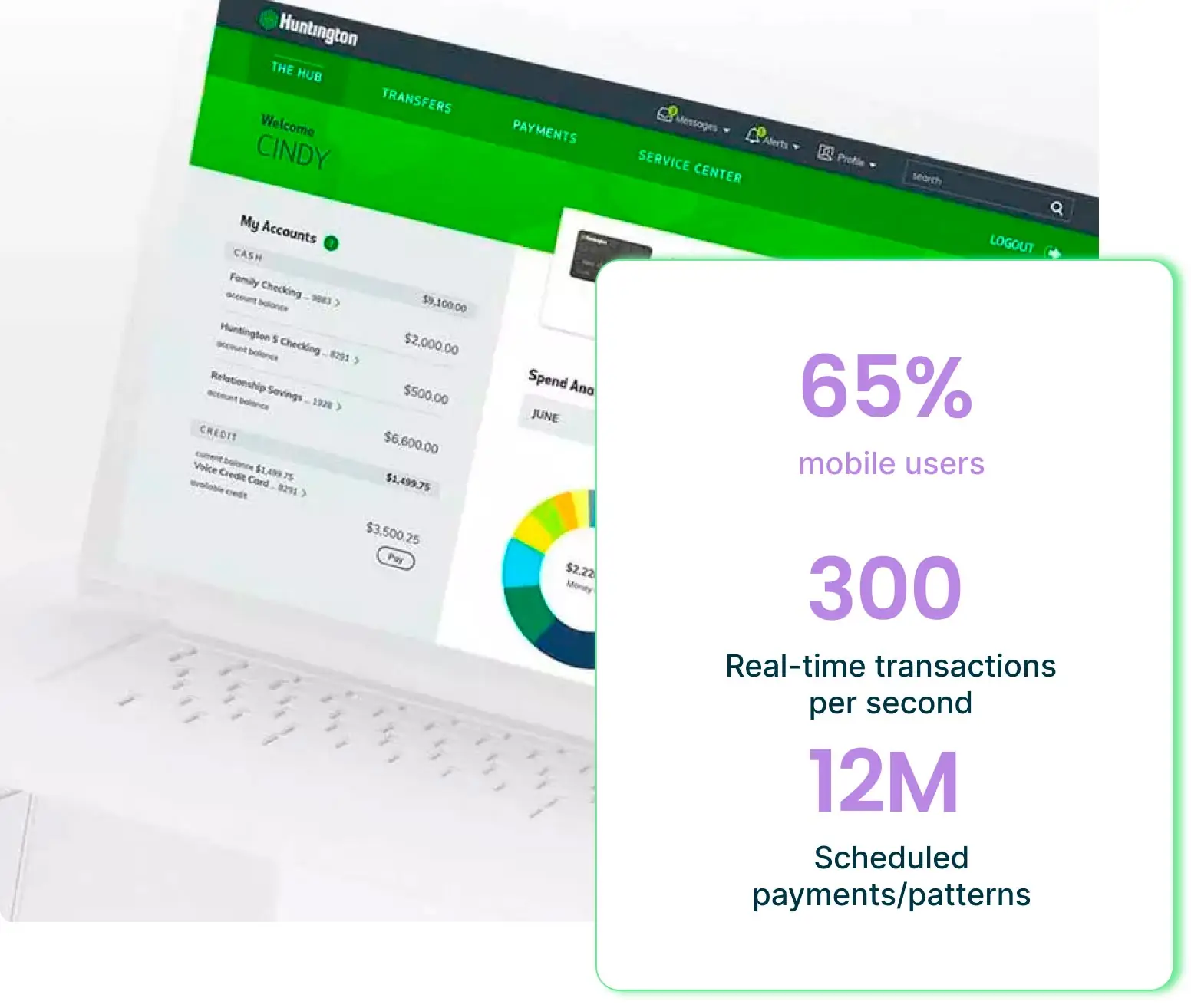

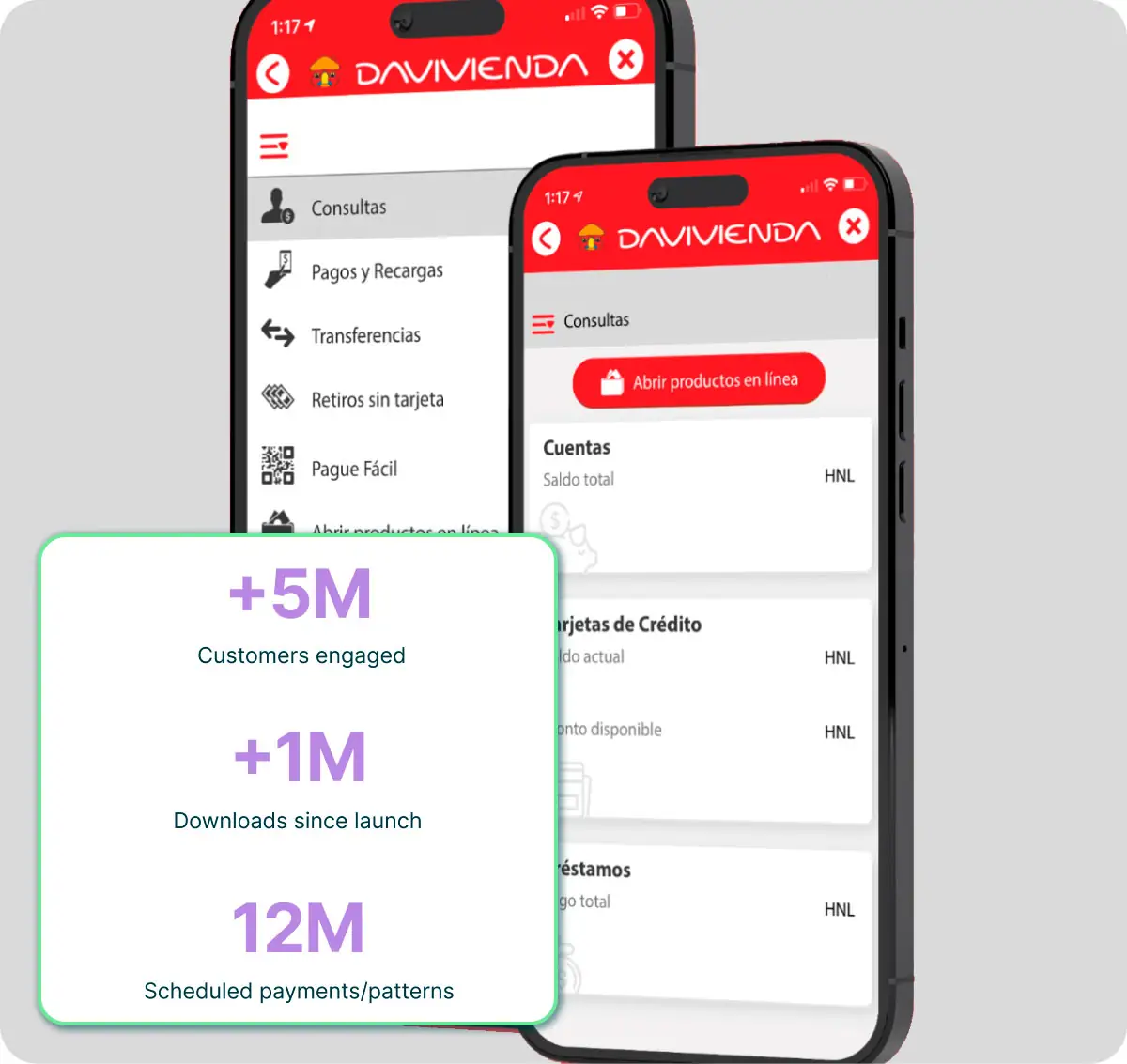

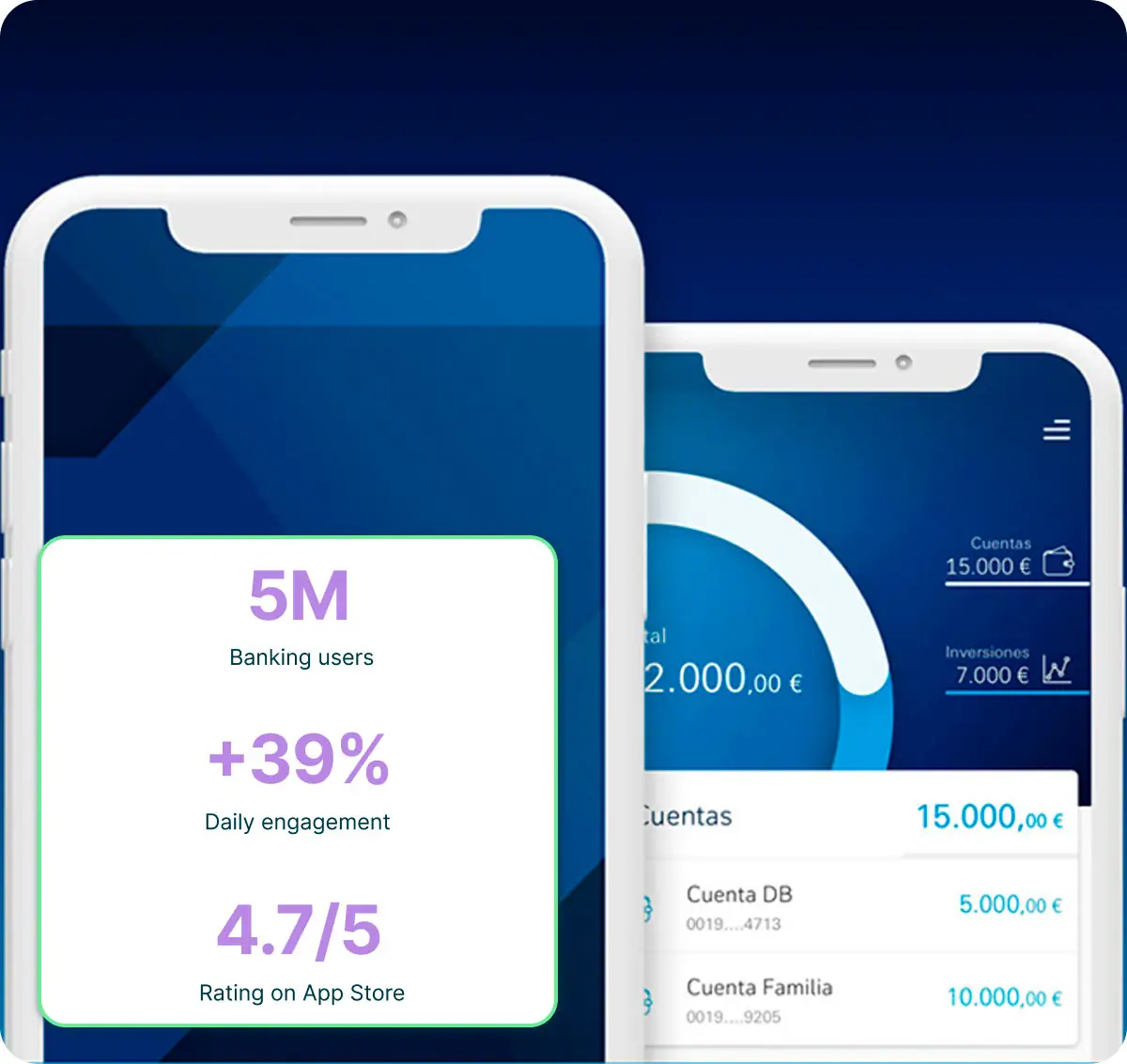

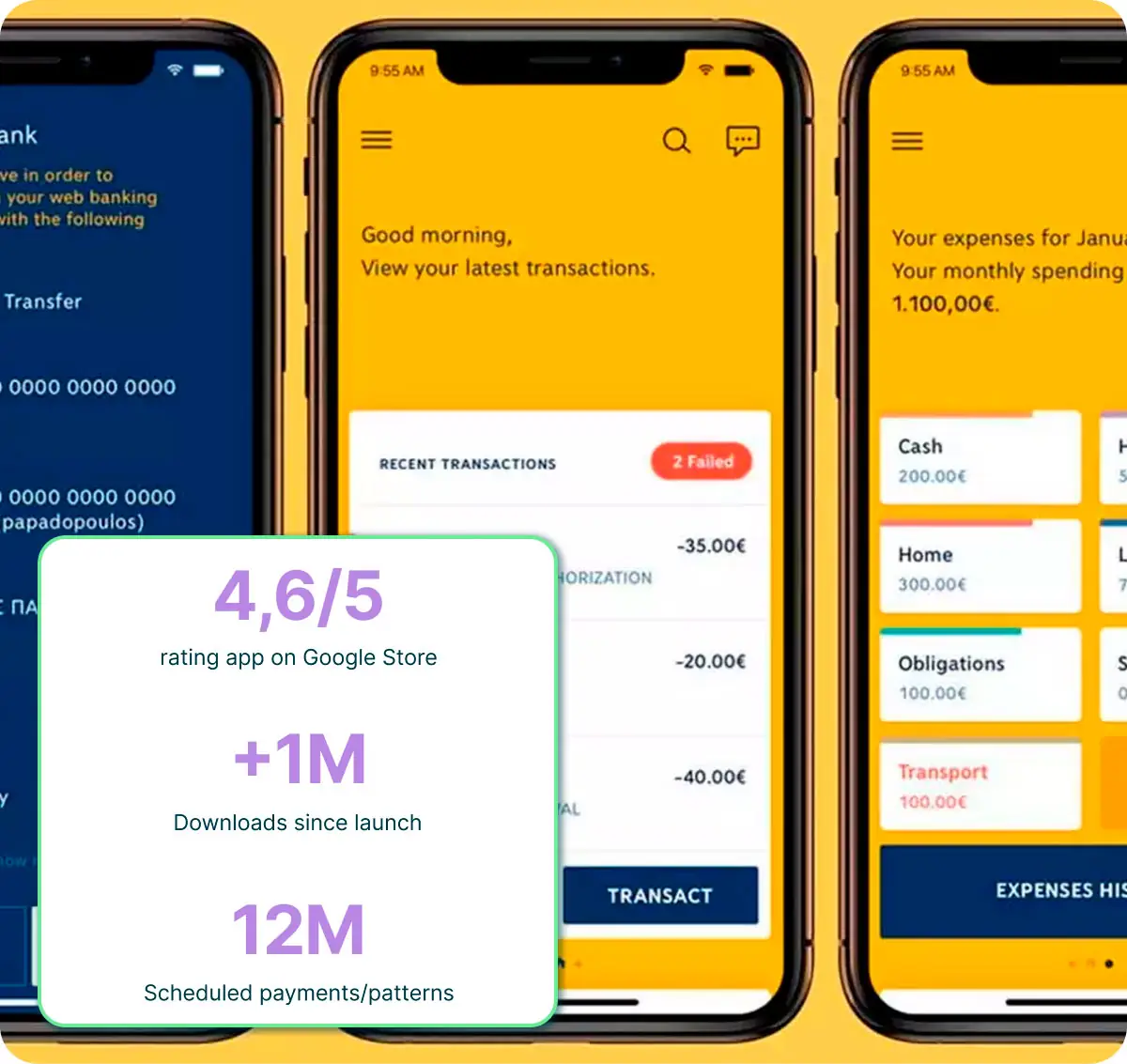

Top banks worldwide are increasing their digital engagement and growth with Strands solutions.

How we do it?

A customer centric journey based on data-driven personalization

Make the most out of digital banking with our modular solutions, dedicated to boost customer adoption, engagement and retention. Increase cross-selling opportunities and revenues through personalized actionable insights.

A UNIQUE OFFERING

Addresing the digital banking needs of financial institutions

Increase your revenue by building tailored and data-driven money management experiences for retail and business customers.

ATTRACT

Enhance digital channels adoption by improving digital banking proposition.

RETAIN

Create real-time experiences to anticipate and meet customer needs and expectations.

ENGAGE

Improve customer experiences with AI-based personalization.

Learn from our resources

Feel the FinTech pulse

How European Financial Institutions Are Using GenAI To Understand Cust …

The conversation around AI in financial services often focuses on customer-facing applications:...

2030: Will Your Bank Still Exist?

The financial landscape is shifting beneath our feet. While most personal finance is already...

The Future of Family Banking in the Middle East: Why Advisory Relation …

The Middle Eastern family banking landscape is undergoing a big transformation, one that presents...