Allow SME banking customers create a business control Hub

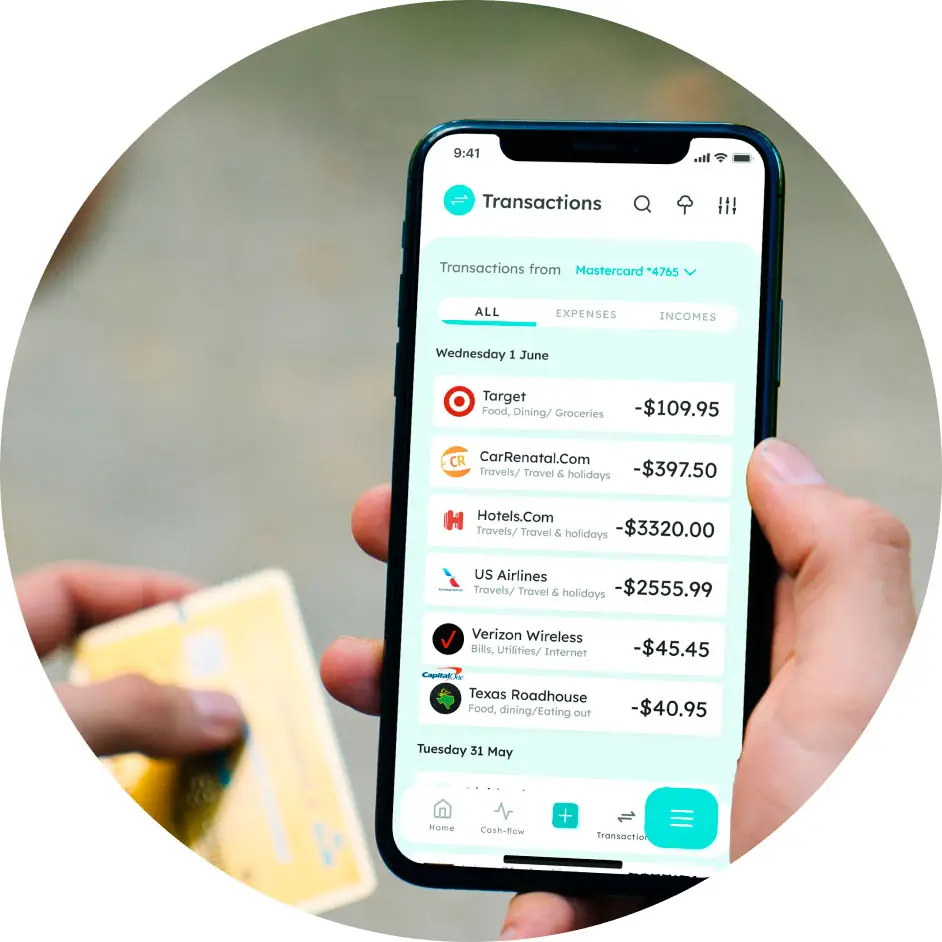

Empower business customers with comprehensive financial control thanks to a seamless view of financial transactions.

Provide a complete insight into financial and non-financial status.

Enhance your understanding of customer needs and Increase revenues via expanded services and new cross-selling opportunities.

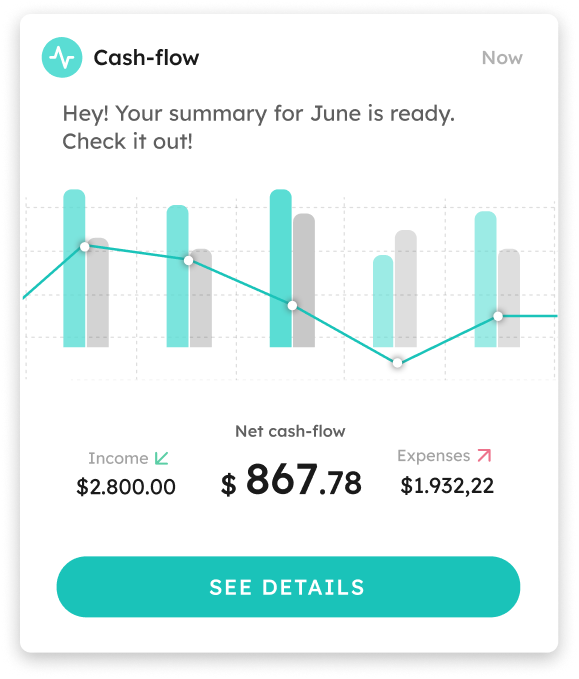

AI-powered cash flow insights for better SME banking decision-making

Anticipate financial needs and position your financial institution as an innovative leader in financial technology.

Inflow and outflow patterns, empowering customers to understand their cash flow and make informed financial decisions.

Future cash flow, to proactively manage liquidity risks and respond to financial challenges effectively.

Elevate financial control of your SME banking customers

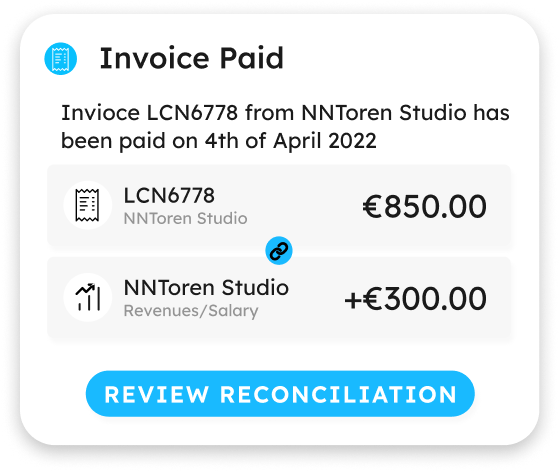

Enable effortless reconciliation by syncing invoices to empower SMEs in managing payments and securing daily financial operations.

Offer a clear payment status by integrating AP/AR overview for better financial control, preventing surprises.

Deliver real-time solutions and insights to prevent late payments from disrupting business operations.

Optimizing tax provisioning to boost business growth and loyalty

Enable customizable thresholds to provide a tailored approach that meets financial goals, ensuring that resources are allocated efficiently.

Monitor tax handling over a selected period and offers valuable insights.

Recommend tax adjustments and position your financial institution as a trusted growth partner.

Craft tailored products to boost cross-selling opportunities

Provide business customers with customized services that meet their specific needs by leveraging transactional data.

Suggest tailored products such as a credit card with a convenient charge back agreement when an unexpected purchase is needed.

Encourage cross selling opportunities and increase your revenue streams.

RESOURCES

Keep updated with our related digital banking resources

Beyond SME Banking Experience

How are banks and financial institutions able to address the pain points of these business owners?

Banking on banks

Inflation and rising prices are wreaking havoc on the finances of millions of beleaguered households across Europe today…

Digital Banking and Beyond: The Value of Personalization

Elevate customer engagement by leveraging Open Finance for data-driven interactions…

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.