A Leading Universal Bank in Georgia

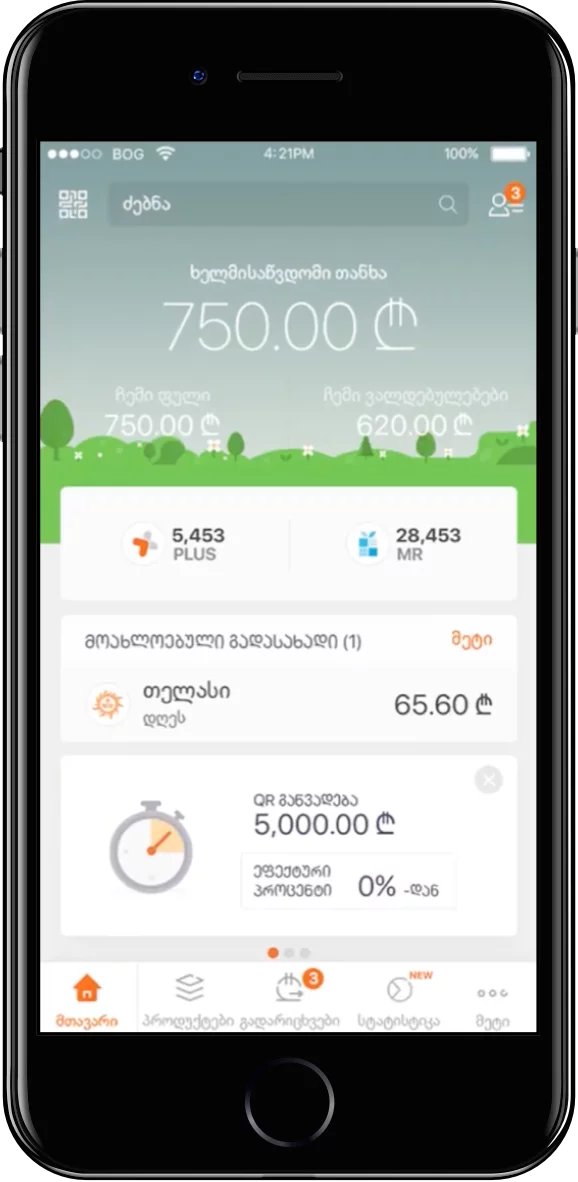

In 2015, Bank of Georgia launched a mobile bank. Ever since, it’s been ramping up its digital transformation program. By all accounts, the bank is on to something – it’s converting customers over to digital channels.

The Challenge

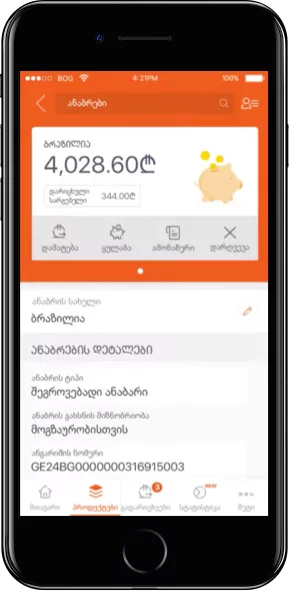

In 2018, Bank of Georgia began its journey toward agile development. The first year of the bank’s digital transformation program concentrated on converting transactional activities, like payments, remittances and money transfers, to digital. Year two and part of the third year targeted digitizing product sales, like consumer loans and mortgages.

Next, Bank of Georgia focused on moving business banking to digital. They were developing parts of the project themselves so they weren’t interested in working with an inflexible provider – they wanted a partner they could collaborate with. That’s when the bank turned to Strands to help power its PFM app.

Solution

Bank of Georgia and Strands created a single team to work on the PFM integration. The timeline was compressed – the companies went from signing a contract to launching a product in six months.

Customers enjoy looking at the data insights, visualizations of different statistics on their transactional history. This allows them to make a lot of decisions based on how they want to manage their finances.

Strands PFM’s charts help Bank of Georgia clients understand their main spending categories and, with a newly integrated function, create a monthly budget. On the retail side, the bank received an 86 customer satisfaction score, a strong number compared to the industry average.

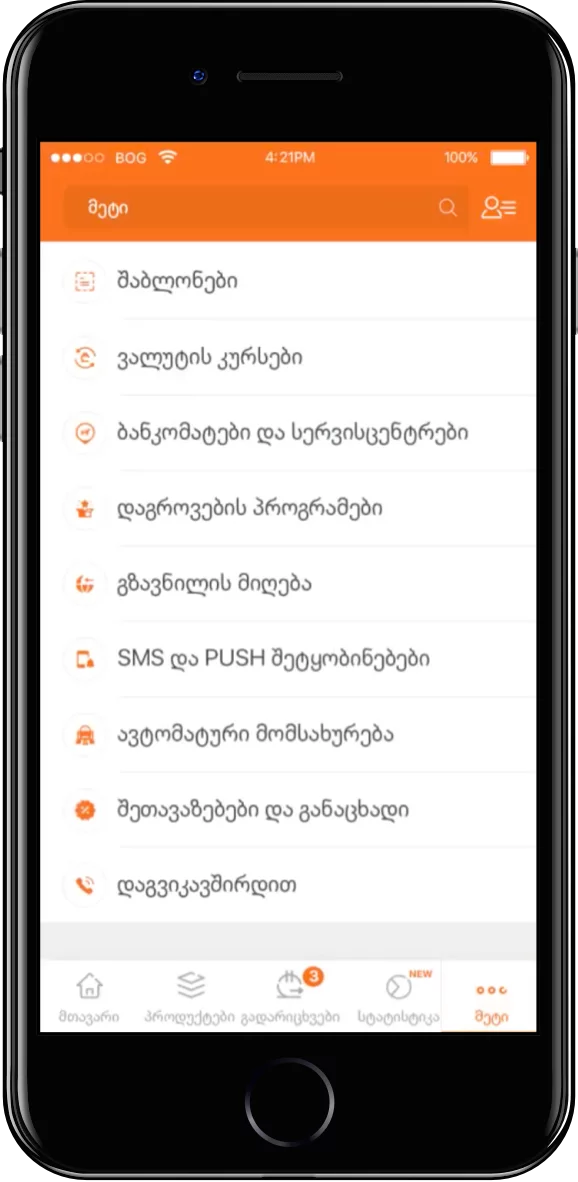

Bank of Georgia has more plans for its PFM. Its digital strategy extends beyond just banking and into broader financial services, including wealth management, insurance, and eventually, lifestyle.

Story Overview

Client:

Bank Of Georgia

Country:

Georgia

Solutions:

Quick Insights:

Customer Satisfaction Score (Points)

Daily engagement

Rating on App Store

Deployment:

On Premise

Launched:

2019

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.