Redefining Customer Engagement

Credit Agricole Bank Polska (CABP) is a vital part of the globally renowned Credit Agricole Group, a leading European Banking Group operating in 46 countries, serving over 53 million customers daily. In Poland, they have a successful presence of over 20 years and are highly regarded as one of the most recommended banks

The Challenge

Faced with specific challenges, Credit Agricole Bank Polska embarked on a visionary journey to reshape its digital banking strategy. With an existing banking application for individual and corporate customers nearing the end of its life cycle, the bank recognized the need for a complete transformation to meet the evolving demands of the market.

The key challenge was to craft an entirely new mobile app from the ground up, one that would not only alleviate the constraints of the existing application but also align seamlessly with CABP’s ambitious objectives, all of which have been successfully achieved:

- Elevated User Experience: The new app aimed to provide customers with a refreshed and innovative user experience, surpassing industry standards and offering a cutting-edge design.

- Empowered Financial Guidance: Empowering customers with personalized tools and insights to effectively manage their finances, including insights, categorization, savings, and investments.

- Enhanced Conversational banking: Improve customer Interaction by facilitating easy and effective communication between customers and the bank, nurturing robust relationships and enhancing overall customer satisfaction.

- Integrated Beyond Banking experience: Seamlessly integrated non-banking services, enriching the app’s offerings and delivering added value to the customers.

- Established One-Stop Financial Hub: Comprehensive Daily Banking by creating a banking hub within the app, granting users access to an extensive array of banking services, streamlining daily financial management.

- Improved customer-centric selling points: The app was intended to serve as a platform for promoting the bank’s products and services in a user-friendly and engaging manner.

- Leveraged loyalty and reward programs: harnessing the power of the Benefits Club with its expansive discount program, seamlessly embedded in the app to deliver tailor-made offers.

- Enlightened Financial Understanding: Empowering users with knowledge through an innovative financial education program, fostering financial literacy.

- Elevated Security Measures: Ensured the highest level of security for every user interaction within the app, providing a safe and protected environment.

Solution

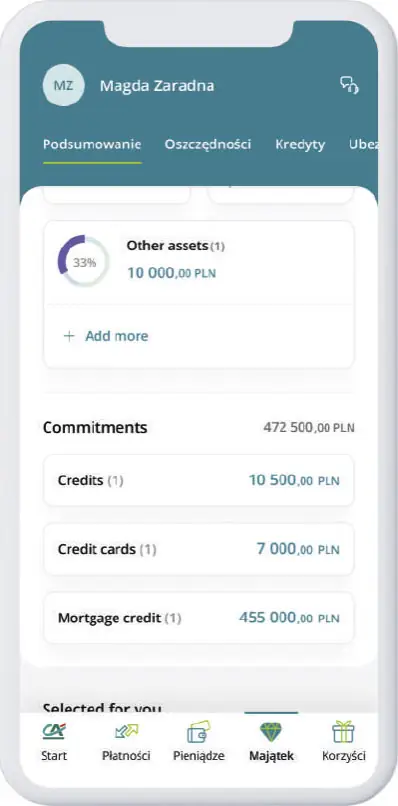

Strands provided solution Credit Agricole Bank Polska needed to meet its goals. The new mobile app, “CA24 Mobile – Full of Benefits,” introduced a unique and innovative user experience. The app’s interface, including elements like accordion cards, a slide-out drawer, and a bottom menu, facilitated quicker and more convenient financial management for customers.

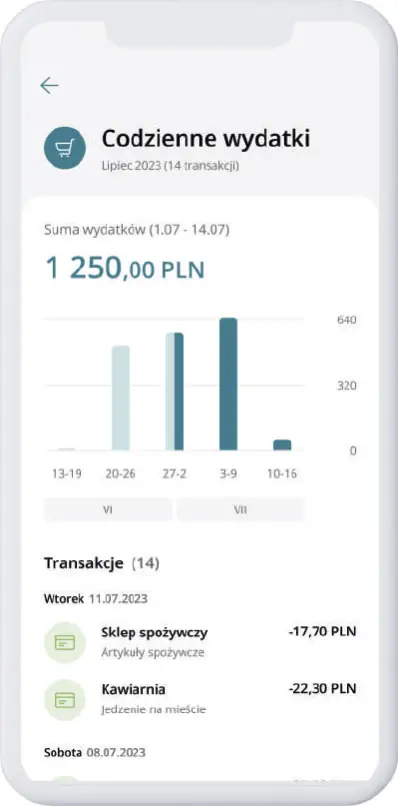

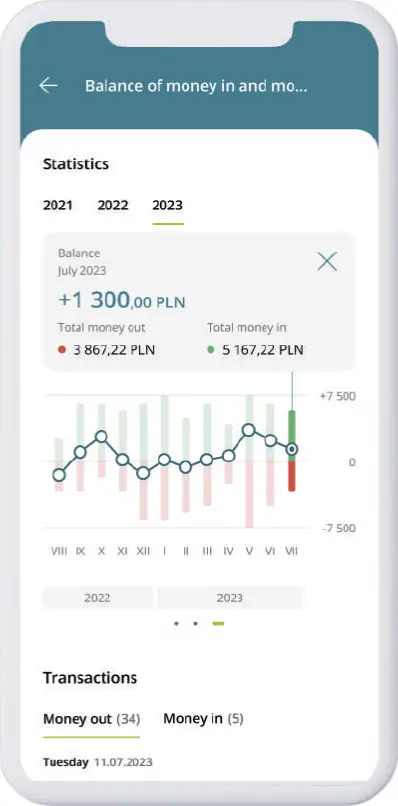

Moreover, the inclusion of a friendly avatar, Dito, and content written in inclusive language enhanced customer engagement. The most significant differentiator of the app was the Benefits Club, offering personalized discounts from top brands at nearly 10,000 locations through a unique “River of Benefits.”In addition, the app featured many PFM functions, enabling users to closely monitor their household budgets and make informed decisions. The app’s search engine enhanced overall usability, making relevant information readily accessible to users.

The Implementation and Results

The implementation of the new mobile app significantly impacted Credit Agricole Bank Polska’s customers, leading to clear improvements in key metrics. The bank observed an impressive 50,000+ increase in annual account openings, cementing its position as the leader in the Customer Relationship Index (CRI) due to exceptional customer relationships. After implementing the app, the account activation rate increased from 60% to 65%. User engagement was robust, with over 436,933 users, 8,439,009 transactions, and 38,020,298 logins (+47% compared to the previous year). The app’s success resulted in an enhanced banking experience for customers, driving increased user engagement, account openings, and improved customer retention.

“Working with Strands and other partners, CABP aimed to achieve these goals and revolutionize the banking experience for its customers, creating a future-ready app that would set new benchmarks in the Polish banking industry”

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.