Trusted by top banks worldwide

STRANDS COMPASS

BENEFITS

Serving as SMEs’ guiding compass, providing the support and direction they need to navigate toward success

By adopting Strands Compass, banks extend their digital banking capabilities by becoming agile, data-driven allies and offering a comprehensive platform to business clients. Simplify financial management, enabling your SME customers to focus on growth, and enhance their engagement.

Financial Institutions

Receive Real-Time Insights

Use real-time data to cover precise cash flow predictions.

Exploit Open Finance

Avoid intermediation

End Users

Unique View On Working Capital

Fast Receivables

Effective Management

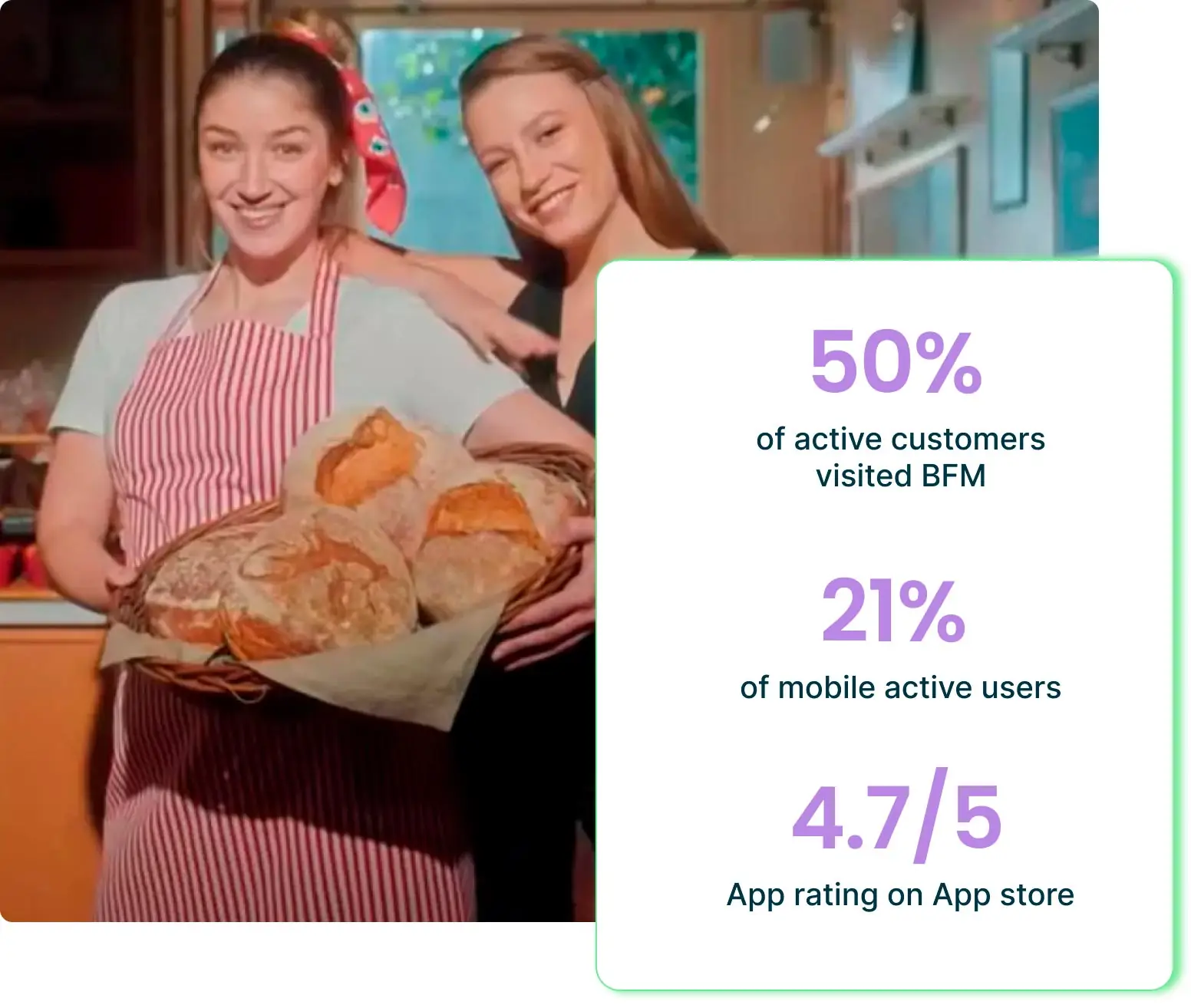

%

Customer engagement rate

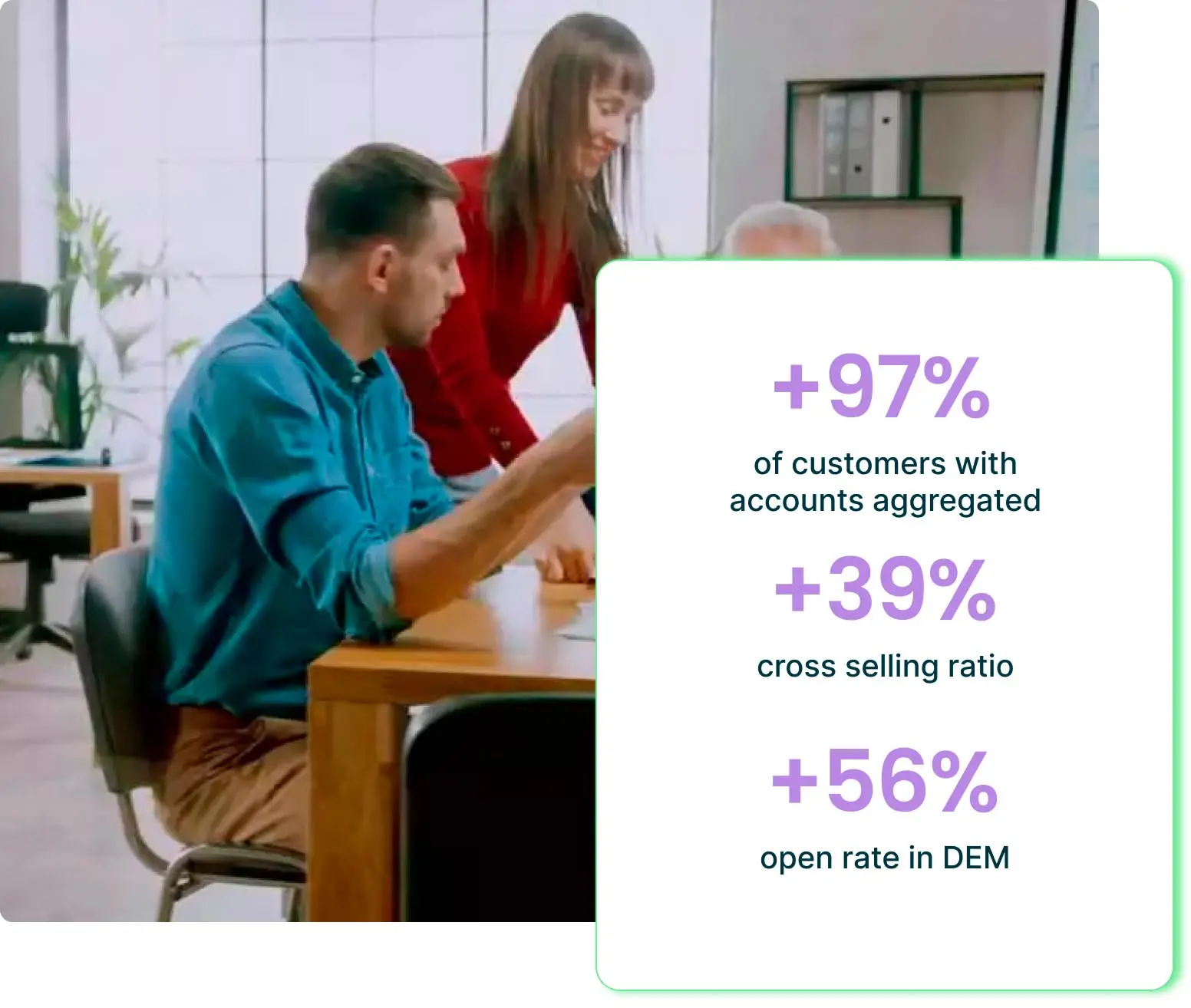

%

Cross selling ratio

%

User interaction with insights

FEATURES

Driving bank KPIs from business clients to a new level

Streamline multi-banking cash flow and forecasting for SME customers

Leverage accounting data for real-time and multibanking insights into cash flow, empowering SMEs to proactively manage their finances.

Utilize AI-driven analytics for advanced forecasting, providing accurate predictions and actionable insights to empower data-driven decisions.

Navigate potential risks with timely alerts and proactive insights, guiding SMEs to address cash flow challenges before they escalate.

Simplify Their Invoicing Management for a Better Efficiency

Integrate with third-party external invoicing providers for a seamless experience, gaining clear direction with real-time insights and better understanding of SME payment statuses.

Navigate transactions and automate invoice reconciliation eliminating manual efforts and streamlining financial processes.

Leverage on AI-based analytics for a better understanding of inflows and outflows to efficiently track debtors and outstanding invoices.

Facilitate Seamless Credit Access to your SME Customers

Gain deeper insights into SMEs' financial health, credit scoring, and risk indicators thanks to enriched data and AI-based analytics.

Get empowered to offer personalized services and tailored solutions, guiding SMEs toward smarter financial decisions.

Break down complex financial information into clear and digestible insights, driving growth and success for SMEs.

FEATURES

Driving bank KPIs from business clients to a new level

WHY CHOOSE US

We are a Global Leader with a proven track record in the Fintech industry

Data analytics at the core with real-time technology

Leverage ML categorization enrichment engine and analytics model to detect real time events based on customers behavior.

Top skilled people sharing their

expertise

Our professionals will support you during solution design, implementation and after go live phase.

Unrivaled service model for all

sizes

Our solutions can be consumed via SaaS on private cloud for EU, on AWS for US, multi-cloud or legacy systems.

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.