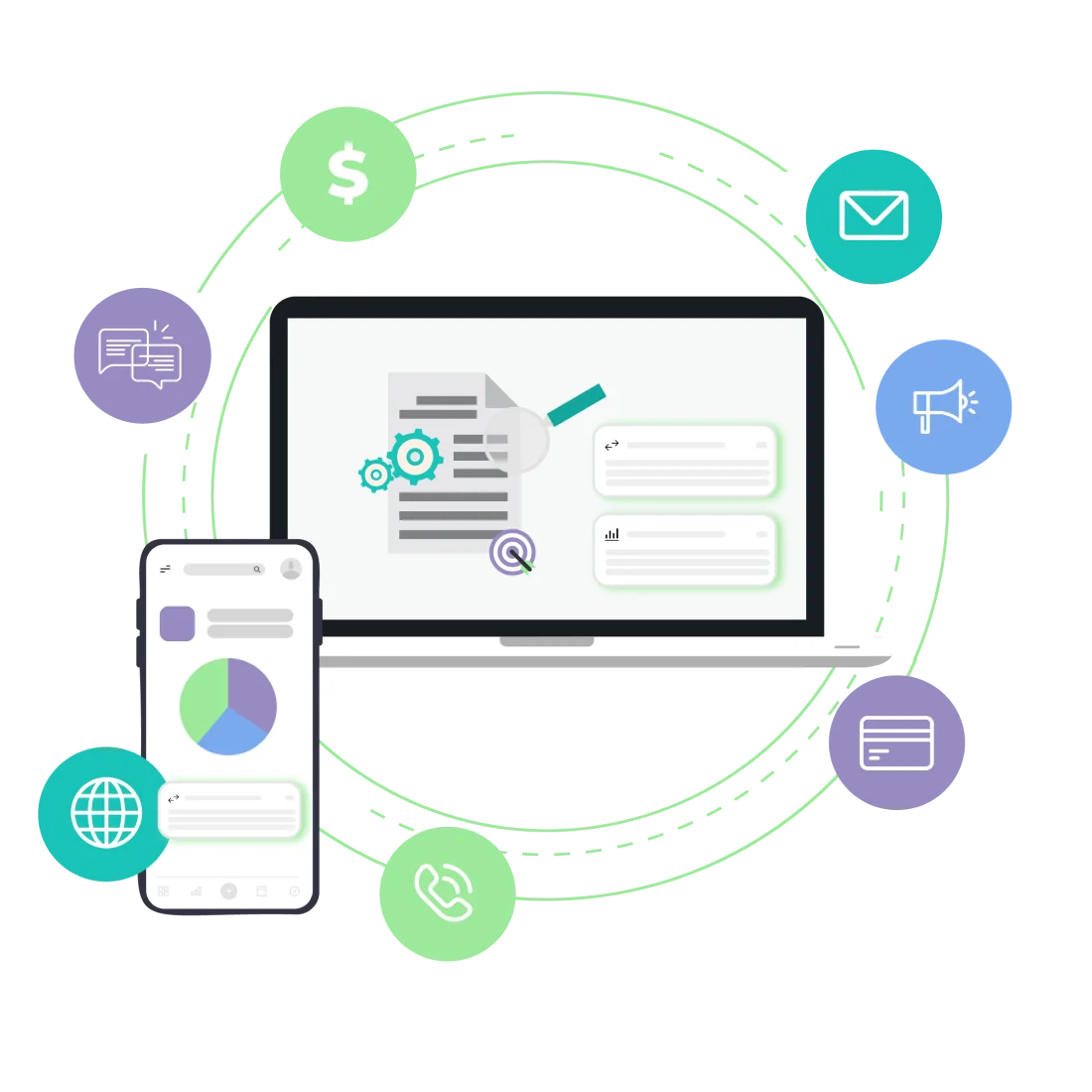

Enhance customer experience with real-time CRM data integration

Stay ahead of your customer’s behavior changes and provide relevant assistance at the right time.

Strengthen your current CRM system with the integration of enriched and real-time financial data.

Create an optimized and real-time omnichannel experience for all your customers to boost engagement.

Accelerate deposit growth with specialized savings solutions

Empower customers to save effortlessly for specific goals whether it’s an emergency fund, a dream vacation, or a down payment for a home.

Allow for manual or automated contributions or rounding up everyday transactions to bolster savings.

Release funds at their convenience, ensuring that their savings are accessible when needed.

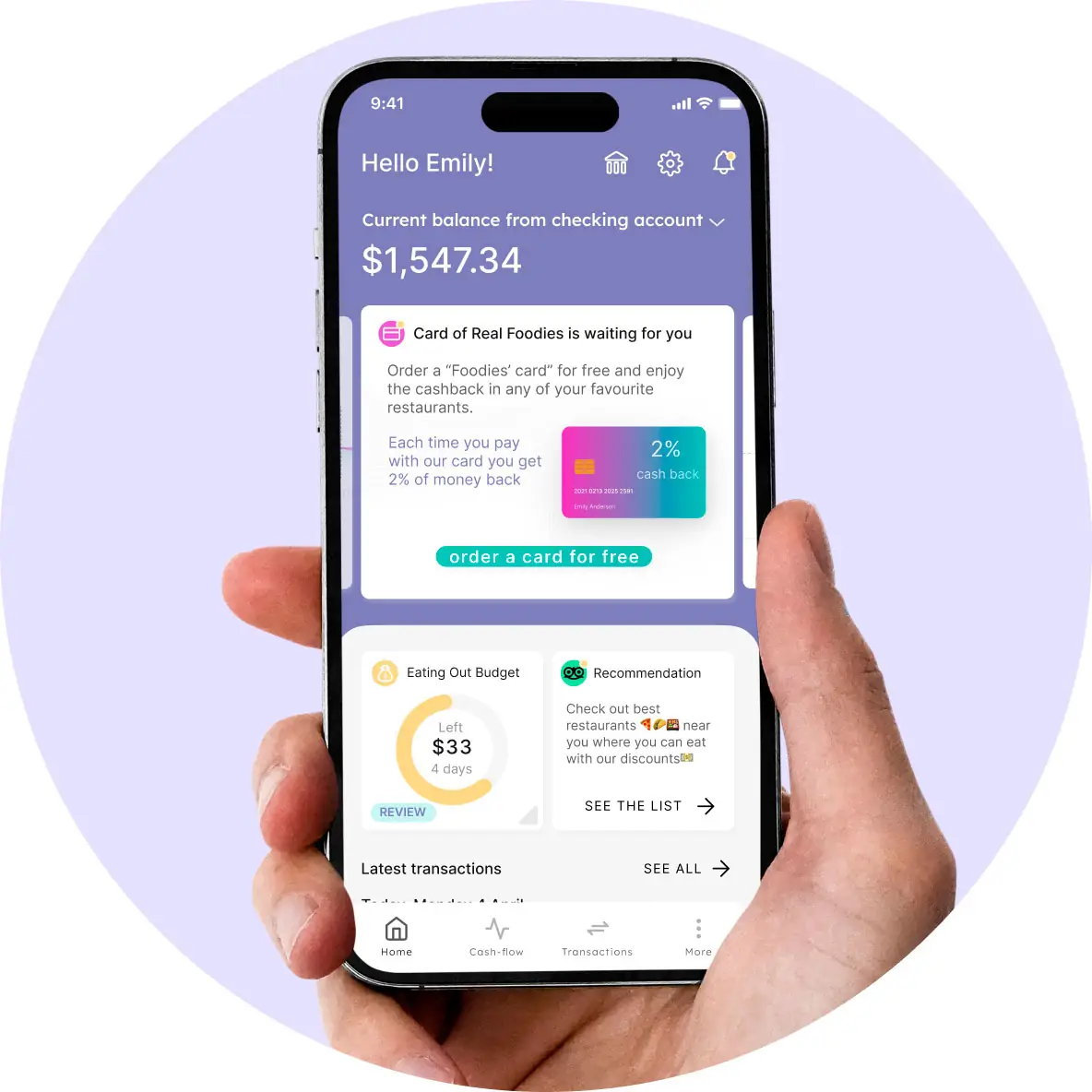

Become your retail customers’ primary bank

Provide a consolidated view of all accounts, empowering customers for to take better decisions

Enhance cross-selling by bringing loans and mortgages to your financial institution with improved terms.

Empower customers for better decisions, preventing potential attrition and promoting improved financial health.

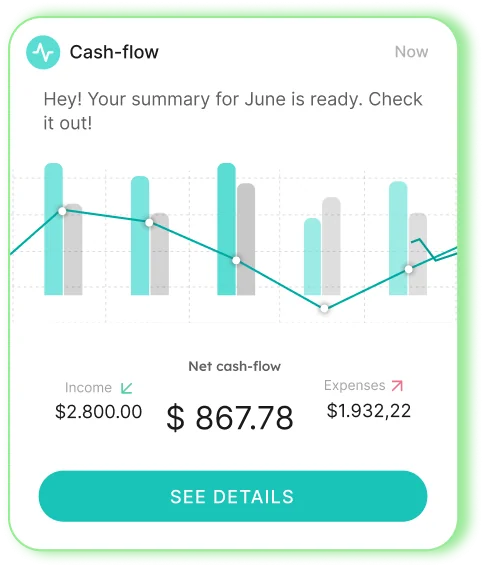

Enhance customer understanding and boost financial well-being

Enable optimal categorization and accurate cash flow forecasts for better decision-making.

Provide an intuitive experience with easy-to-understand dashboards and periodical summaries.

Uncover growth opportunities and optimize resource allocation with context-rich financial insights.

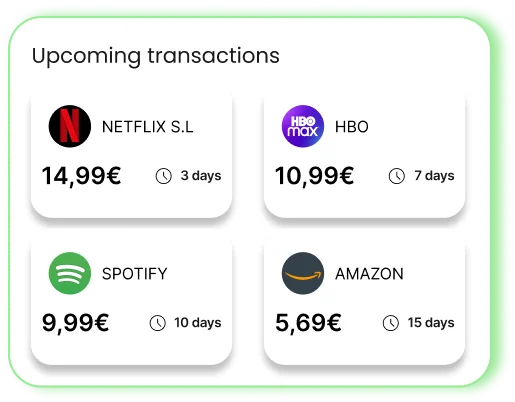

Ensure customer satisfaction by proactively scheduling payments

Streamline financial management by detecting and organizing payment patterns within a calendar.

Identify trends and anomalies in customer spending behavior thanks to predictive models in order to tailor offerings and support.

Proactively inform customers about recurring payments or potential deviations upfront assisting your customers in financial planning.

Help users to make better decisions by improving their financial literacy

Help your customers to stay on top of their finances with monthly summaries to increase spending awareness and financial literacy.

Provide users with easy-to-understand dashboards and an intuitive interface to access and interpret their financial data.

Inform them upfront about their recurring payments or possible deviations to have a better financial control.

Boost customer engagement with real-time personalized financial guidance

Utilize AI and Machine Learning for personalized, real-time financial management tailored to customer needs and behaviors.

Automate tailored solutions for specific financial events, empowering customers with actionable guidance.

Send real-time relevant offers, and personalized recommendations to achieve their financial objectives.

Empower financial wellness with enhanced saving habits

Allow your customer to monitor and track their expenses by setting up budgets in a few clicks.

Enable corrective actions and timely warnings by sending the relevant insights optimizing financial health and savings.

Offer tailored budgeting advice, ensuring that users receive recommendations that align with their unique financial goals and circumstances.

Increase Cross-Selling opportunities with Personalized Investment Solutions

Provide personalized guidance and a user-friendly home screen for effortless wealth tracking.

Calculate available funds for monthly investment, considering all financial commitments.

Alert customers to advantageous investment deals through real-time notifications, enabling them to capitalize on timely opportunities.

Increase customer loyalty and digital adoption through gamification

Reward customers for hitting financial milestones like saving, paying bills promptly, or cutting debt, fostering budgeting and saving awareness.

Collect more insights on customers’ habits and preferences with interactive quizzes or surveys, tailoring the experience for individual needs.

Engage customers with quests or challenges in the mobile app, offering exclusive rewards for task completion while guiding them through specific app features.

RESOURCES

Keep updated with our related digital banking resources

Unleashing the Potential Data-Driven Personalization in the Financial Industry

Leveraging customer journys from other industries to maximize engagement…

Accelerating deposits growth

Revolutionize savings habits, boost customer retention and drive profitability in banking…

Banking on banks

Inflation and rising prices are wreaking havoc on the finances of millions of beleaguered households across Europe today…

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.