HSBC’s Transformation as a Bank for Small Businesses

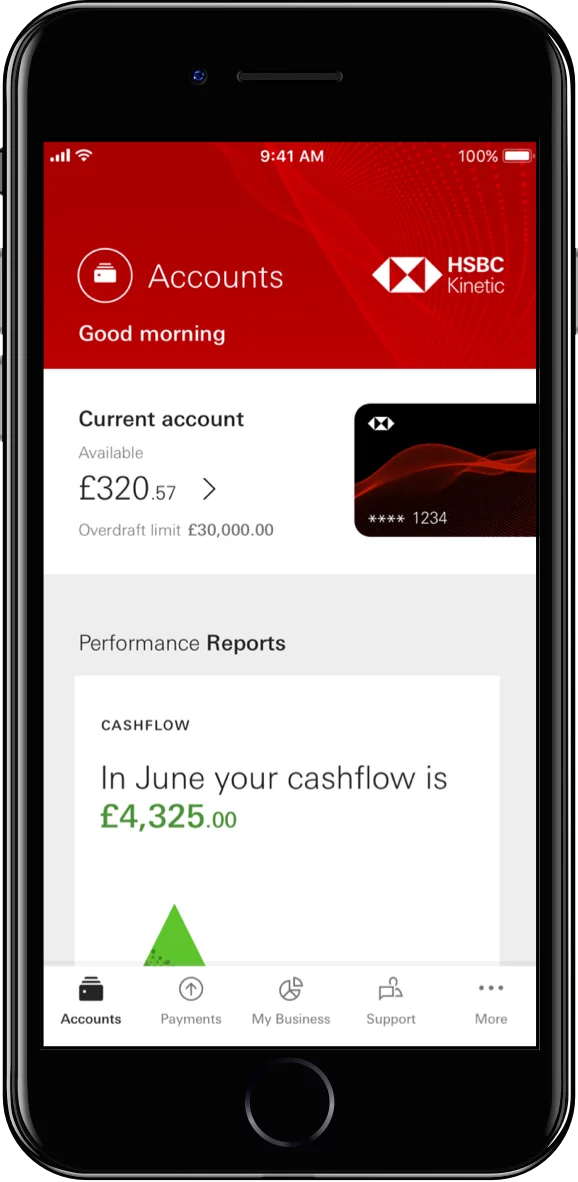

HSBC partnered with Strands to build Kinetic, a machine learning-driven BFM platform that empowers SME owners in the UK to manage their finances properly.

The Challenge

Before building its new business financial management (BFM) platform, HSBC spoke to 3,000 businesses and realized that Kinetic needed to be customer centric to really deliver value. HSBC found that 70 percent of its customers managed their finances manually inside Excel spreadsheets. Small businesses also worked with bookkeepers and accountants to make sense of their business health.

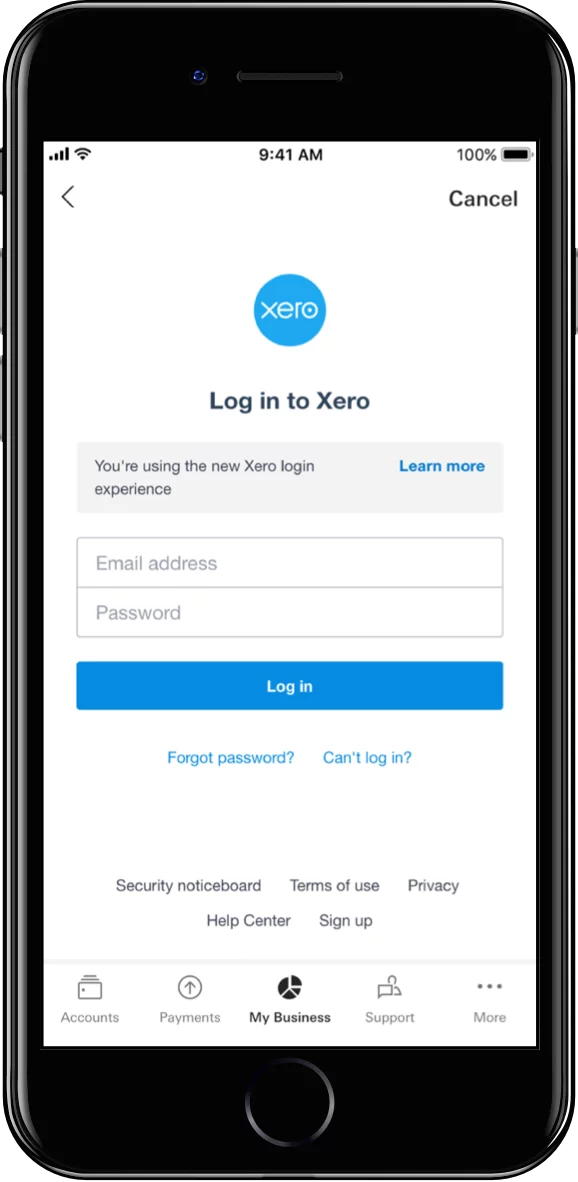

As their bank, HSBC had access to all of a business’ incoming and outgoing transactions. The bank realized that it had a huge opportunity to leverage its knowledge and data and become a trusted financial advisor to its customers. However, to do so, HSBC needed to put all the pieces together and collect all of their customers’ financial data in one place.

Solution

Working with Strands, HSBC was able to secure strong partnerships that allowed them to bring external, accounting data into Kinetic, an app-only digital bank servicing small businesses.

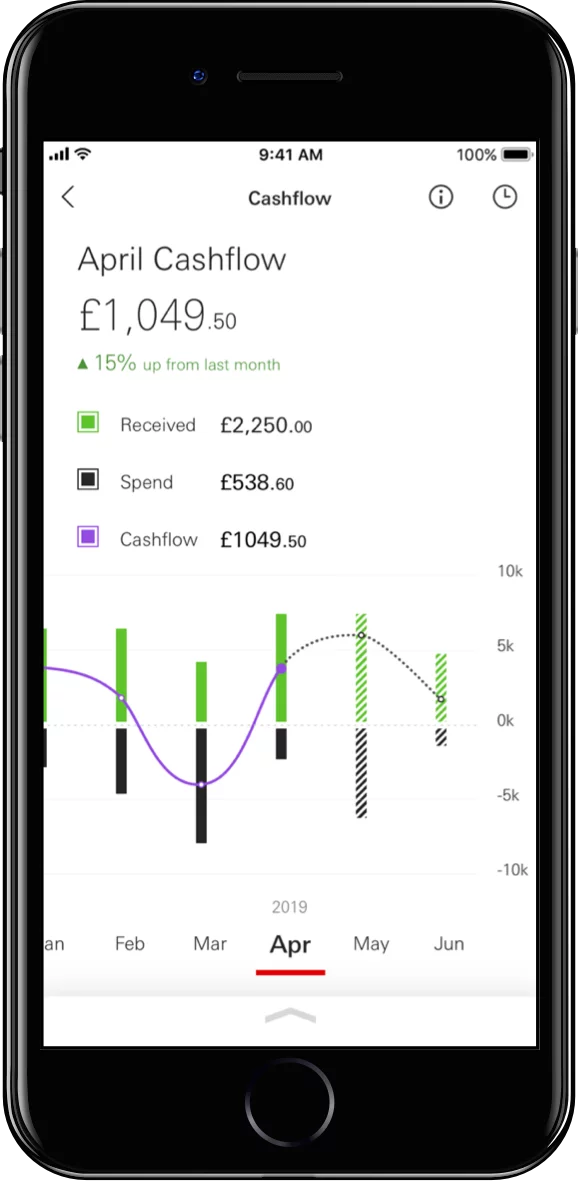

With Kinetic, HSBC is building experience in agile development environments, in the cloud, and with a branchless app that offers automated onboarding, in-app overdrafts, a controllable debit card and a range of personal financial management budgeting and cashflow tools.

Working with Strands, Kinetic has a powerful transaction categorization engine within HSBC that is aligned to HMRC, the UK’s tax office. By categorizing those transactions, the business bank saves its customers days every month trying to manually reconcile what category spending should fall under. Customers get a cleaner view of where they spend their money. And with some additional analytics, Kinetic gives customers a monthly breakdown of the changes in their spending per category.

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.