CFI

IMPLEMENTATIONS

Flexible Implementation Models for Unmatched Banking Solutions

ON PREMISE

ON SAAS

ON CLOUD

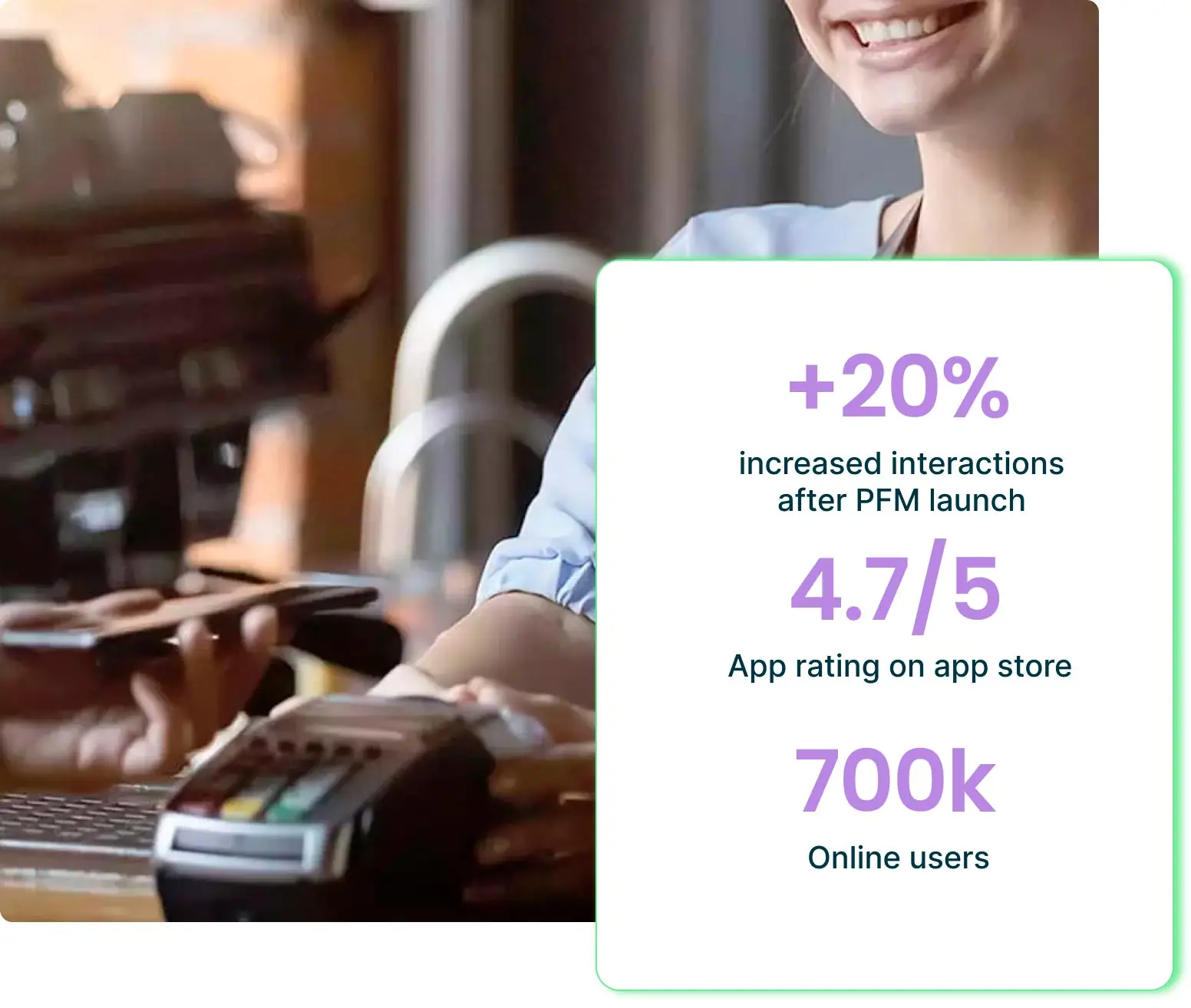

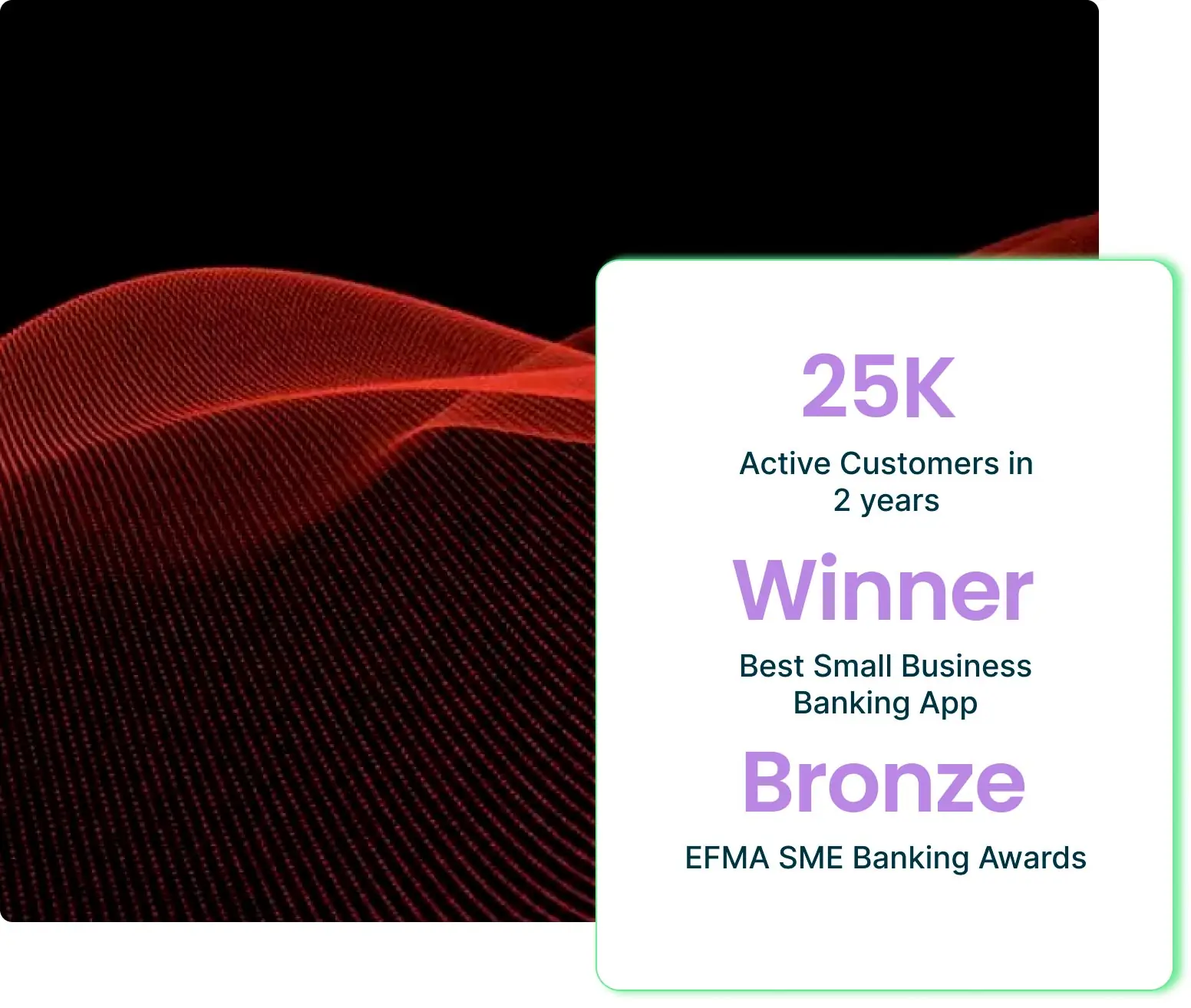

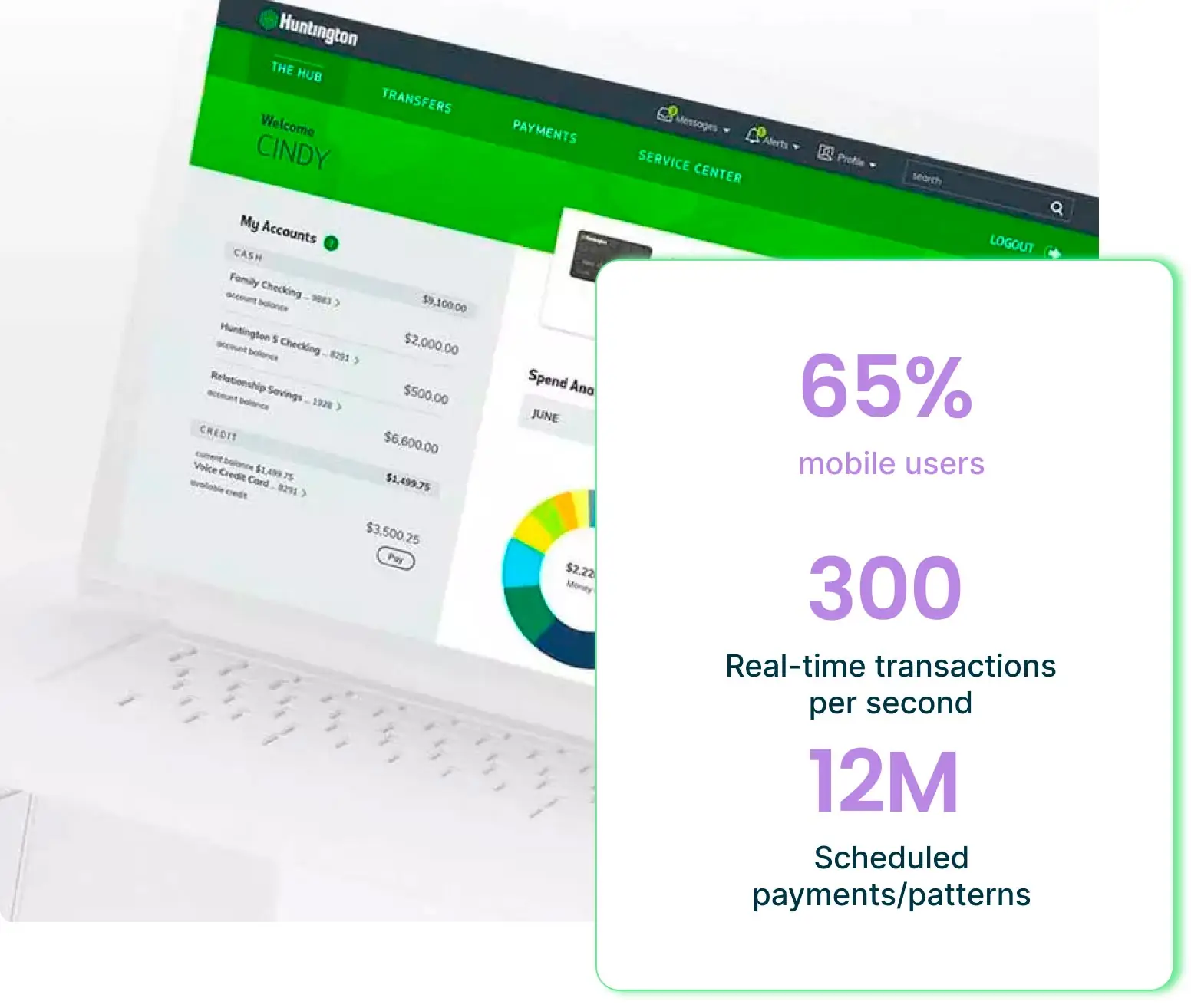

Trusted by top banks worldwide

Top banks worldwide are increasing their digital engagement and growth with Strands solutions.

BENEFITS

Go beyond simple carbon footprint calculation

Use data enrichment to track CO2 emissions and economic parameters, uncover

new sales opportunities and make them effective through carbon insights.

Decrease Funding Costs

Gamified Engagement

Cross-selling opportunities

%

of consumers desire carbon footprint advice

%

reduction of CO2 emissions through carbon insights

%

of customers increase sustainable spending

Sustainability Education

Planet Care

Green Gamification Journey

%

of consumers desire carbon footprint advice

%

reduction of CO2 emissions through carbon insights

%

of customers increase sustainable spending

FEATURES

The green journey to sustainability

Increase environmentally-conscious customer acquisition and engagement through carbon insights while supporting your ESG strategy.

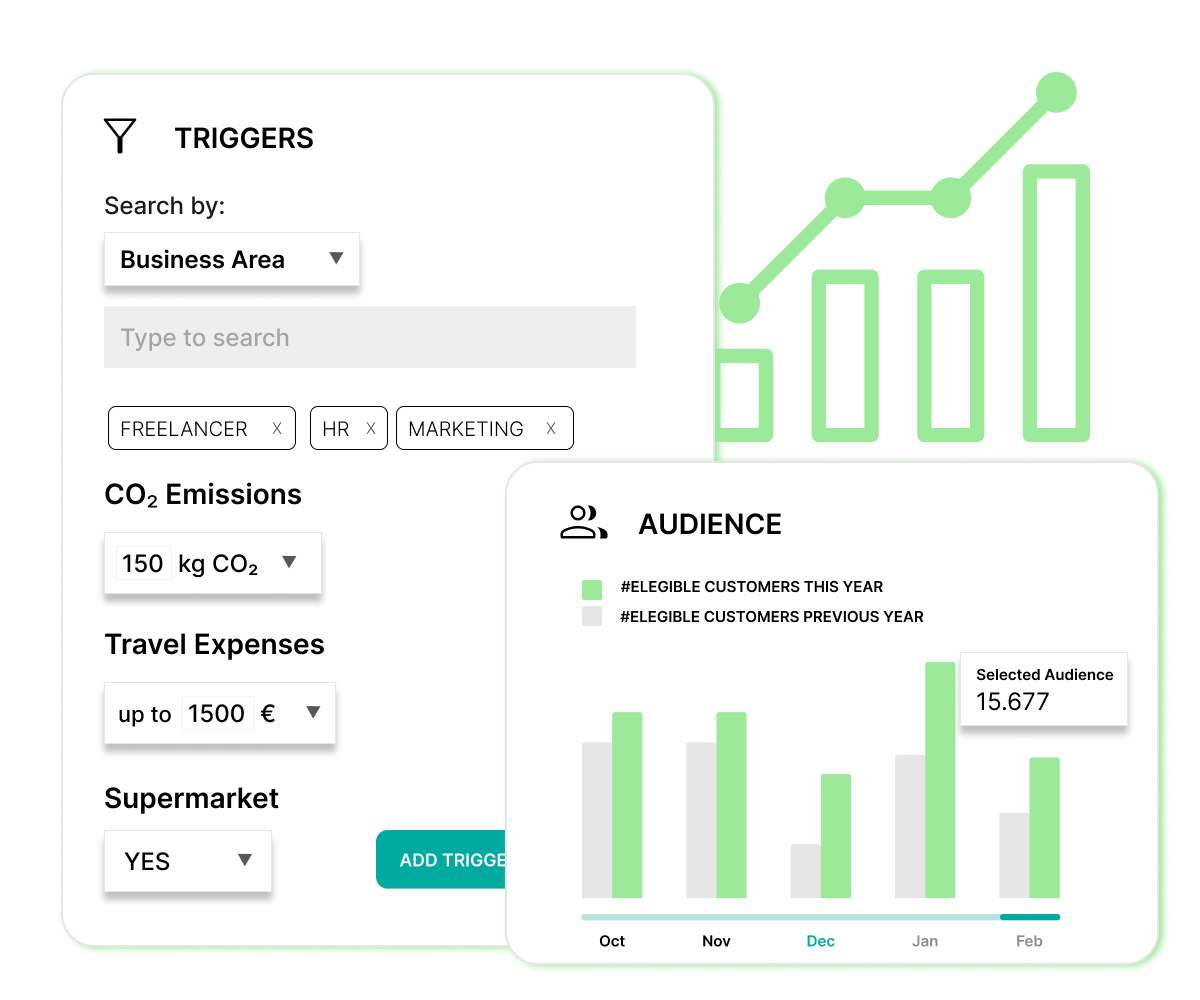

Detect the green propensity and segment your customer base according to specific green attributes

- Make real-time transaction analysis based on CO2 and eocnomic parameters, to help you understand users’ lifestyle habits.

- Gain knowledge of your customer base, identify specific green attributes, and segment it in order to send personalized green offers.

Increase the adoption of digital channels with green options

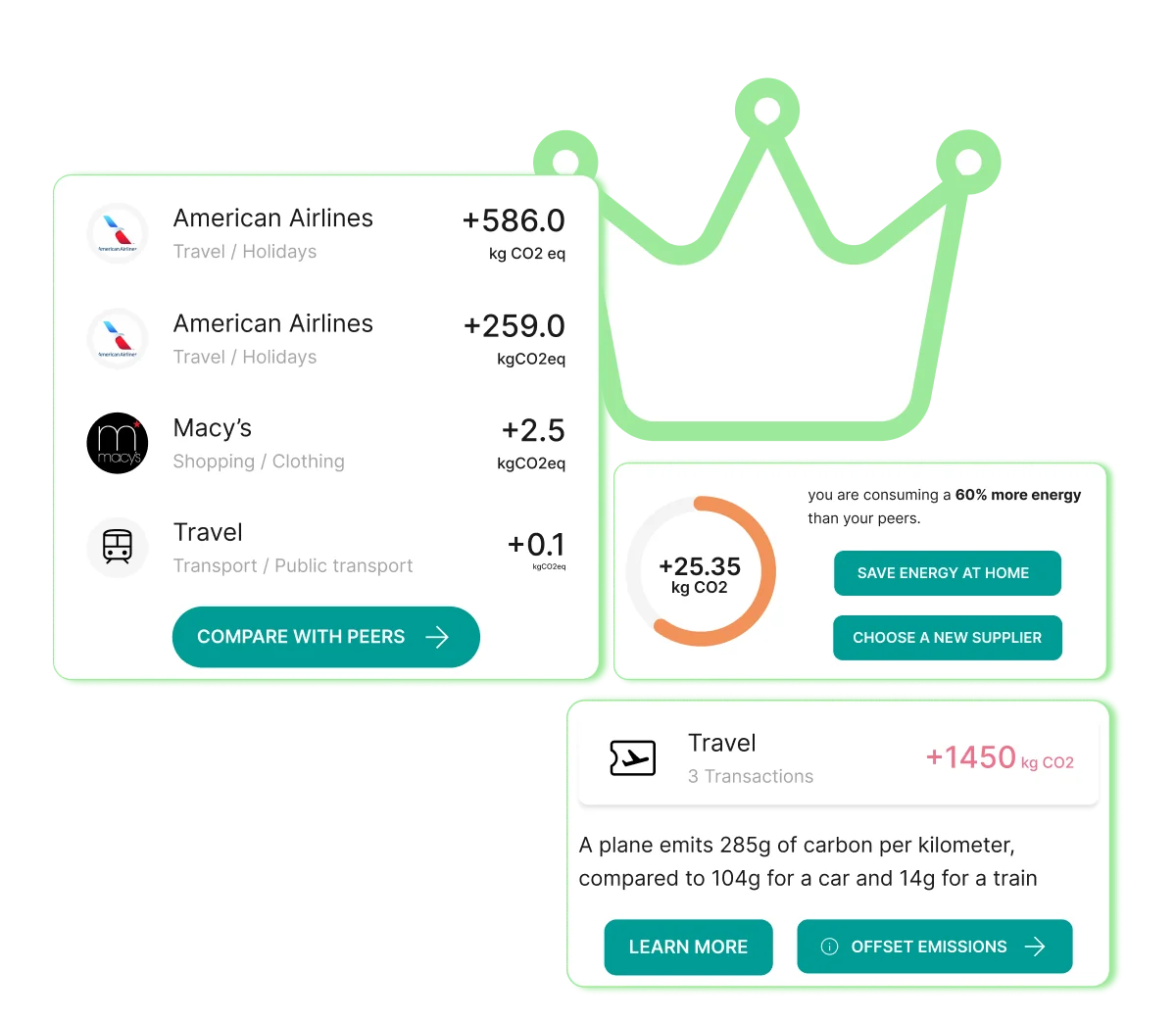

- Show the transaction footprint and a carbon overview within a gamified journey, and allow users to compare them with their peers.

- Display the monthly CO2 amount by category: fuel, transportation, travel, supermarket, etc.

Interact with your customers through personalized carbon insights and boost cross-selling opportunities

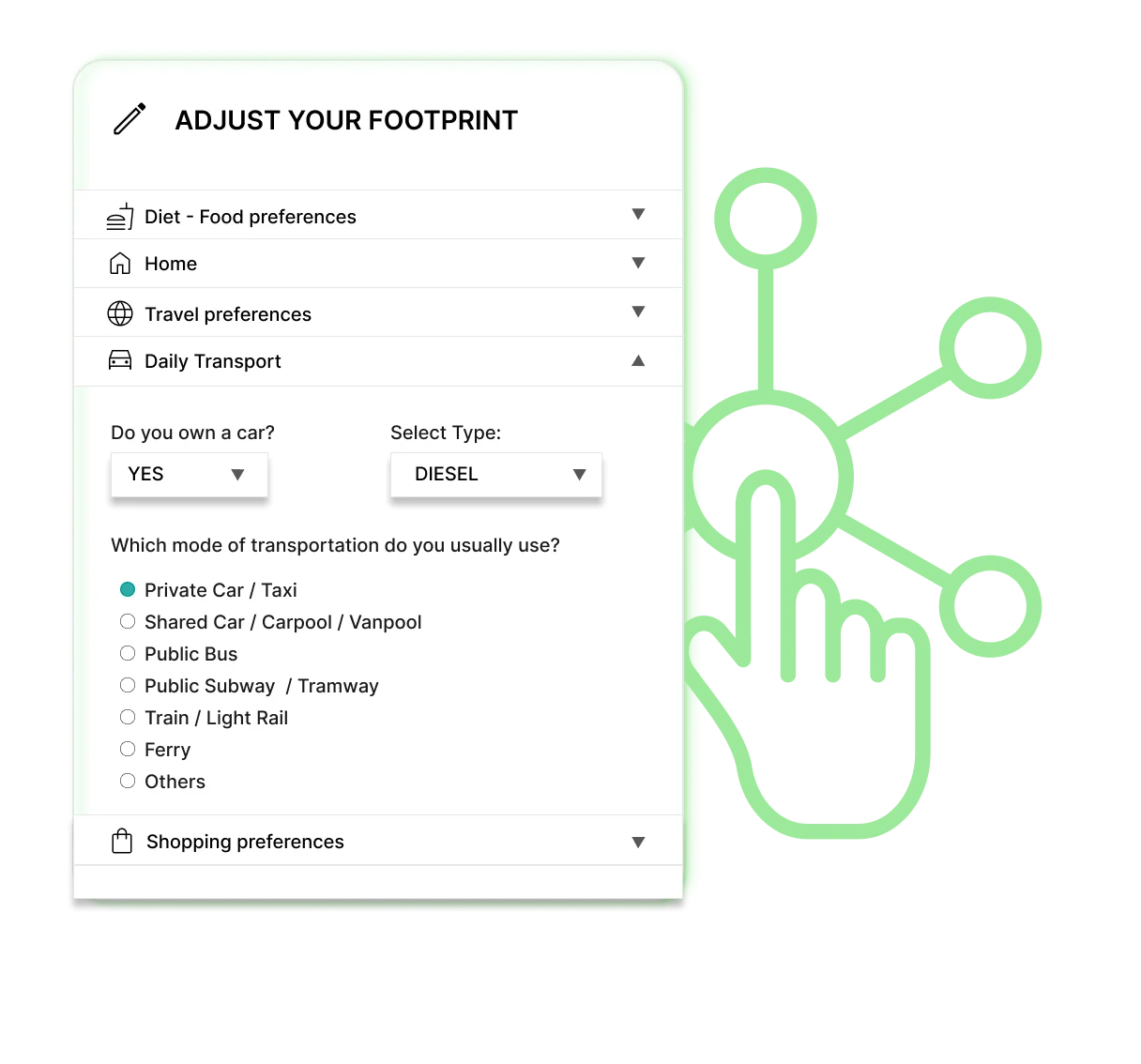

- Allow users to adjust behavior by providing direct inputs into the model, such as diet, transportation, heating, travel, and more.

- Increase cross-selling opportunities by promoting environmentally friendly products.

- Encourage green investments while you guide your customers to make environmentally responsible financial choices.

WHY CHOOSE US

We are a Global Leader with a proven track record in the Fintech industry

Data analytics at the core with real-time technology

Leverage ML categorization enrichment engine and analytics model to detect real time events based on customers behavior.

Top skilled people sharing their

expertise

Our professionals will support you during solution design, implementation and after go live phase.

Unrivaled service model for all

sizes

Our solutions can be consumed via SaaS on private cloud for EU, on AWS for US, multi-cloud or legacy systems.

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.