PFM

IMPLEMENTATIONS

Flexible Implementation Models for Unmatched Banking Solutions

ON PREMISE

ON SAAS

ON CLOUD

Trusted by top banks worldwide

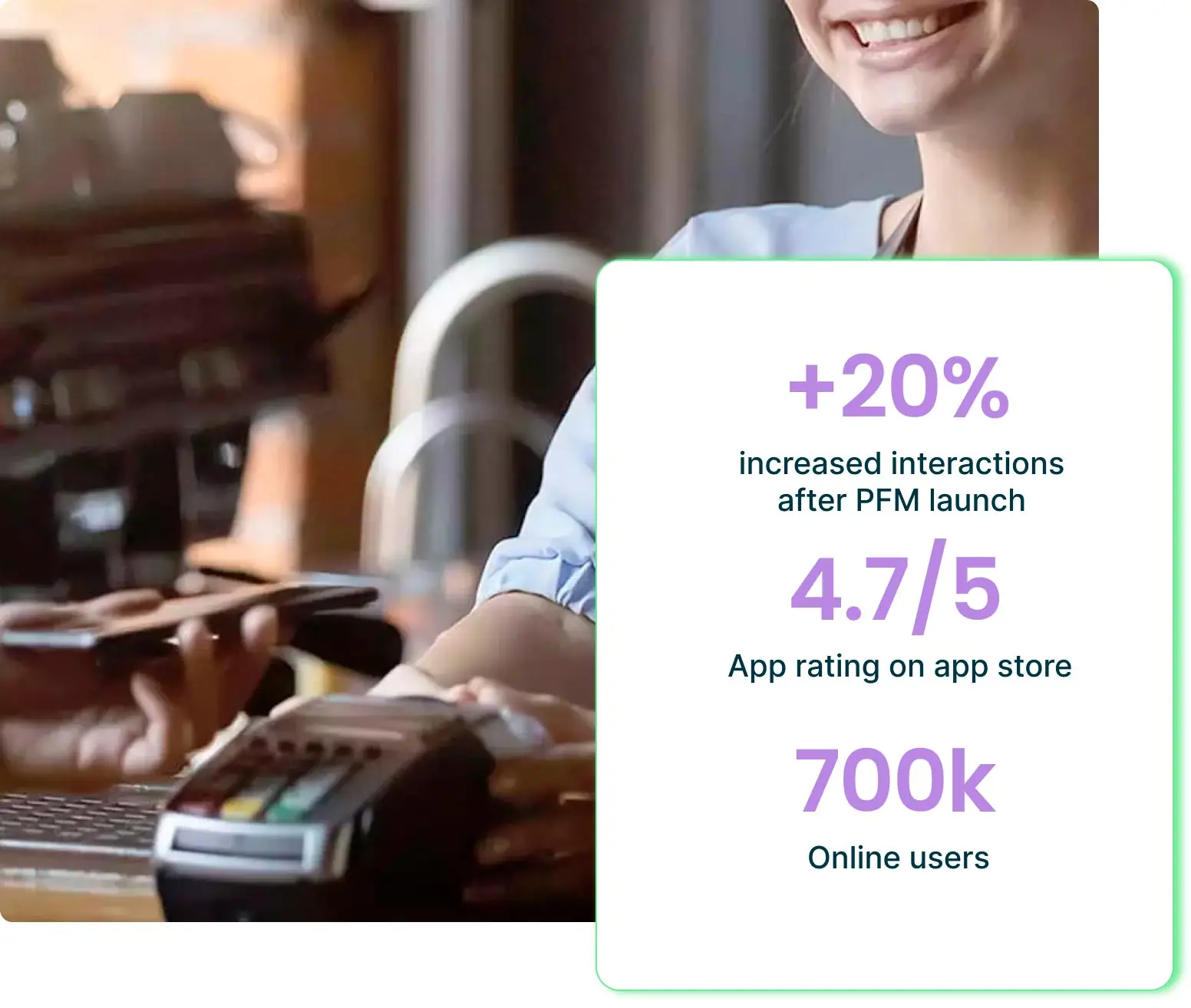

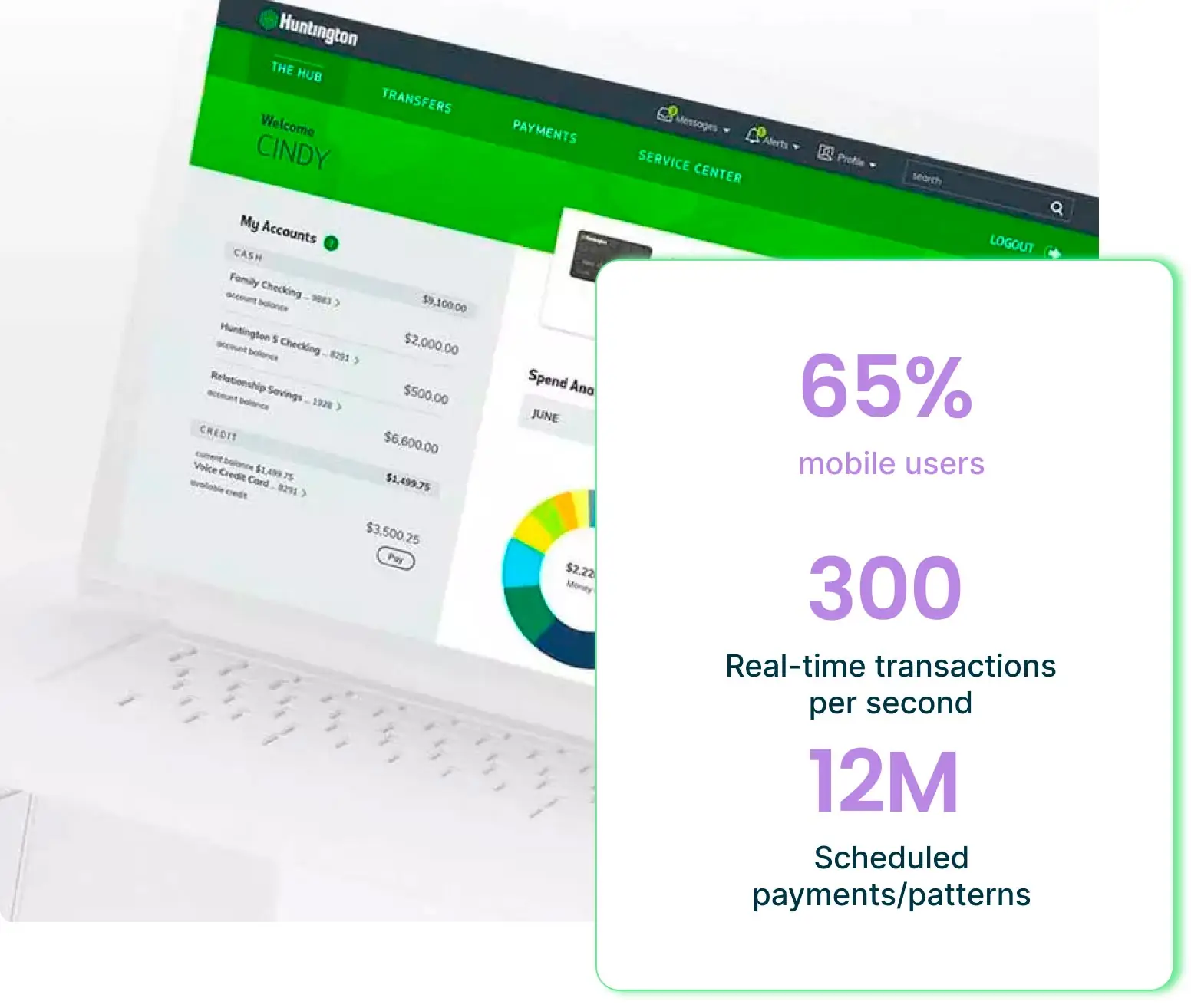

Top banks worldwide are increasing their digital engagement and growth with Strands solutions.

BENEFITS

Building stronger relationships through PFM

Engage your clients into an easy-to-use digital platform and grow cross-selling opportunities and deposits.

Furthermore, offer personalized banking experiences and help your retail customers to achieve financial wellness and saving goals while supporting customer acquisition.

Increase Engagement

Personalized Journey

Enhance Turnover

%

Customer engagement rate

%

Cross selling ratio

%

User interaction with insights

Enhance Financial Wellness

Improve Financial Understanding

Jumpstart Mobile Banking

%

Customer engagement rate

%

Cross selling ratio

%

User interaction with insights

FEATURES

Revolutionizing the customer experience

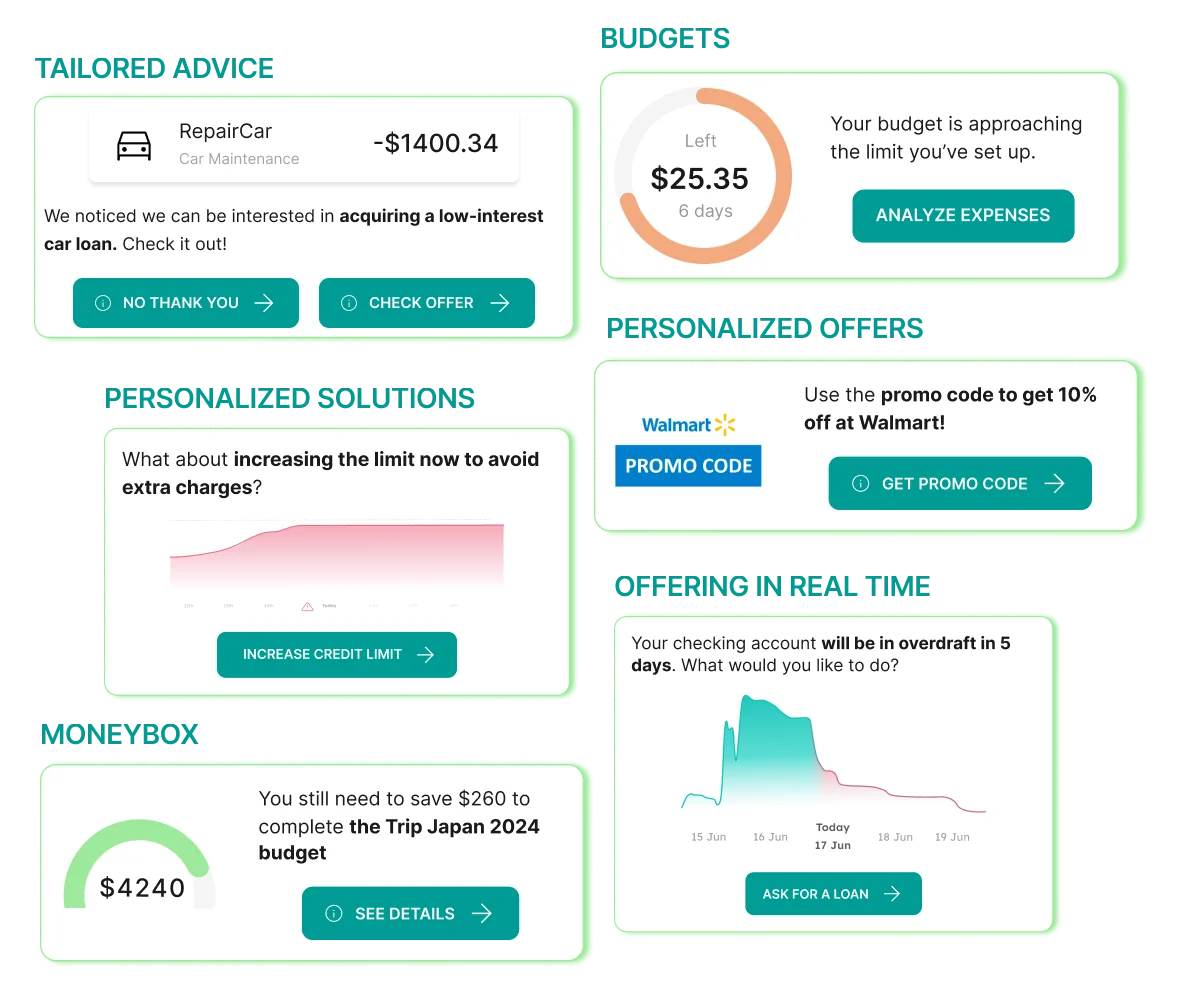

Personalized journeys for a better personal financial management

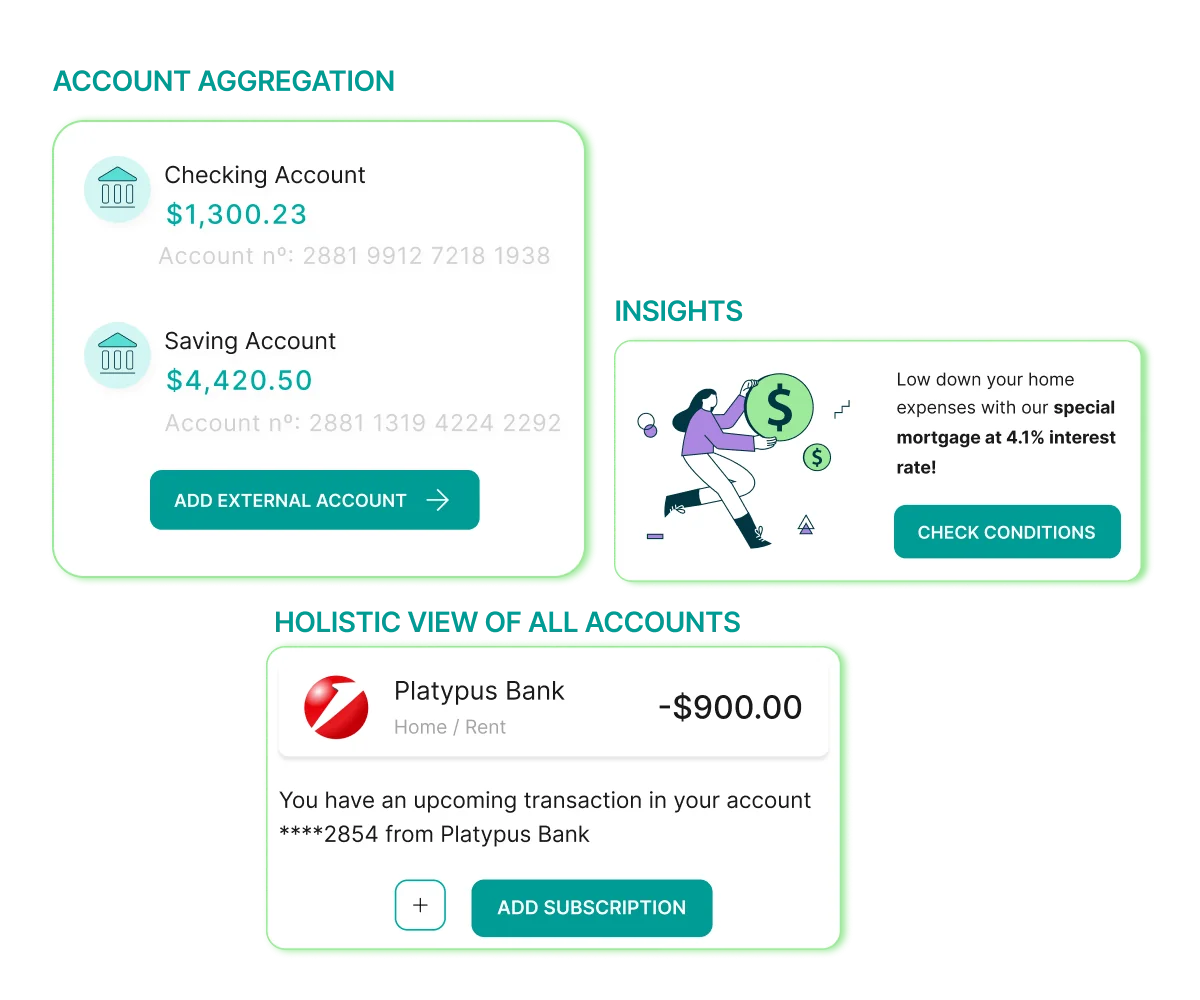

Aggregate multiple accounts in one place

Use aggregated data to deliver a personalized financial wellness experience leveraging Open Banking:

- Enable customers to instantly link multiple bank accounts in one place to get a holistic view of their finances.

- Identify opportunities to shift loans and mortgages from other institutions.

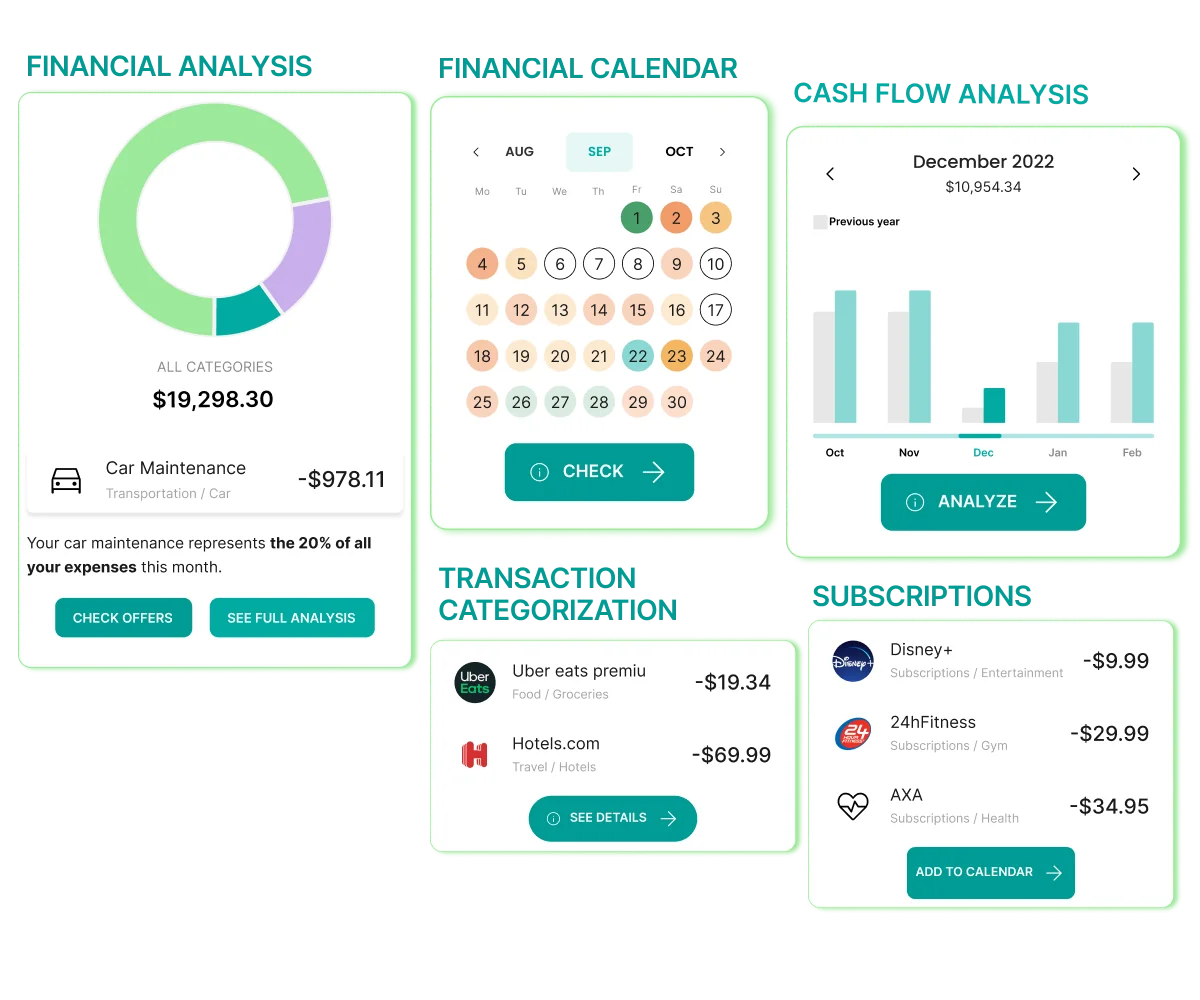

Boost customers’ experience and control

Enriching transactional data allows a better categorization, forecasting, predictions and Carbon Footprint impact information:

- Harvest the potential of predictive models to detect and organize payment patterns.

- Inform your customer upfront about their recurring payments or possible deviations.

- Trigger personalized offers and insights using data analytics and pattern recognition.

Turn into a personal advisor

Turn into a personal advisor by building personalized banking insights and experiences that drive engagement and growth:

- Offer tailored real-time insights, maximizing cross selling opportunities.

- Send specific advice for better money management by weighing all their accounts.

- Offer customized investment plans, maximizing multi-channel engagement.

WHY CHOOSE US

We are a Global Leader with a proven track record in the Fintech industry

Data analytics at the core with real-time technology

Leverage ML categorization enrichment engine and analytics model to detect real time events based on customers behavior.

Top skilled people sharing their

expertise

Our professionals will support you during solution design, implementation and after go live phase.

Unrivaled service model for all

sizes

Our solutions can be consumed via SaaS on private cloud for EU, on AWS for US, multi-cloud or legacy systems.

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.