Open Banking is transforming the way people manage their finances, but there’s still some skepticism on topics like data privacy, security and customer adoption.

As a result of open initiatives, banks are able to access information, creating an open economy where they can interact and collaborate with each other. Having access to new data sources is a great opportunity for banks, but it also requires them to develop data processing skills and adopt technologies to develop services that are more responsive to customer needs.

Users who prioritize security widely accept these technologies. Open Banking services use regulated APIs that comply with the latest legislative requirements, like PSD2 (and PSD3 in the upcoming years) as well as advanced authentication methods, like Strong Customer Authentication (SCA), to ensure data privacy and fraud prevention.

But it’s not only about security. As banks continue to implement these services and focus on user experience, it’s expected that it gains more and more popularity in the upcoming years.

Whether you’re a financial expert or someone willing to solve any concern, we hope to give you the best arguments to not fall into the most heard myths of Open Banking.

1. Data security is at risk with Open Banking

Still not all consumers know that a bank will never ask to share security details. Instead of this, there’s a series of alternative methods such as:

- PINs

- Fingerprint or facial recognition

- SMS verification

- Card-readers

- Passwords

- Etc

In addition, third-party service providers must undergo thorough regulated checks and demonstrate security measures before accessing consumers’ financial data. With regards to security, the use of APIs creates transparency, granting users more control over their data and enabling direct consent.

But when considering security in Open Banking, it’s crucial to focus on the customer perspective. Strong Customer Authentication (SCA) ensures accurate and fraud-proof user authentication, making it safe for them.

In summary, Open Banking prioritizes customer security and empowers users to control their data. It opens up new possibilities for accessing financial services and offers hyper-personalized experiences for users, making it a promising innovation in the financial industry.

2. It complicates financial processes

Nothing could be further from the truth.

Contrary to the misconception, it simplifies banking processes to the maximum. This is one of the reasons that its adoption is growing rapidly, with millions of users around the world, especially in Europe that makes up 49% of worldwide users. But we will see it later in detail.

With open solutions, users no longer need to share card details or login credentials for online payments. It helps to speed processes, reduce fees, and it’s way more secure. On the account information side, Open Banking simplifies personal finance management by allowing users to view all their accounts and cash flow situation in one single platform.

Nowadays, users are more and more seeking advanced financial services. To name a few:

- Account aggregation

- Consolidated views of money

- 24/7 access to bank accounts

- Budgeting and investment advice

- Consent management

- Invoice aggregation

These demands gave rise to personal and business finance manager tools. These technologies are being quickly adopted by banks to help their customers to have a better overview on their finances, and help them to reach a real financial wellness.

But one of the most interesting points of open initiatives is its potential to redefine relationships between banks and customers by offering hyper-personalized experiences.

3. Consumers don’t trust on Open Banking

Contrary to a common myth, its adoption is not affected by a user’s lack of trust. Consumers prioritize usability and security when managing their personal finances, and Open Banking shines in both aspects.

Furthermore, users feel attracted by the efficiency and minimal friction that open solutions offer. These factors impact positively on consumer trust, positioning their finance provider as their reference bank option.

4. It’s having a slow market adoption

Some people have the perception that the market is not adopting open solutions widely. And somehow it could be true depending on the market they focus on.

But let’s be realistic. It’s a relatively new concept, and many consumers are not yet aware of it. However, when they use these services, they quickly understand how they work and find them useful.

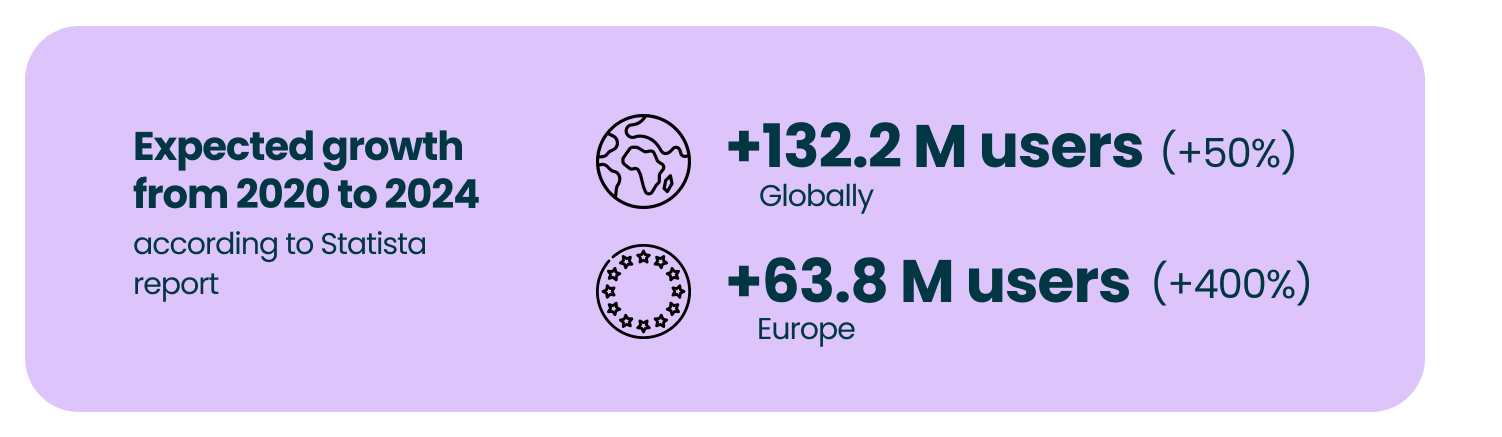

According to a Statista report, in 2020, European Open Banking users accounted for 49% of the global Open Banking users worldwide, with approximately 12.2 million people. And there’s significant growth ahead.

Now, the responsibility lies with banks and financial institutions to integrate these tools into their platforms and mobile apps. Given the signifiant improvements in customer banking engagement and security, among other benefits, it’s only a matter of time before all banks adopt Open Banking on their platforms.

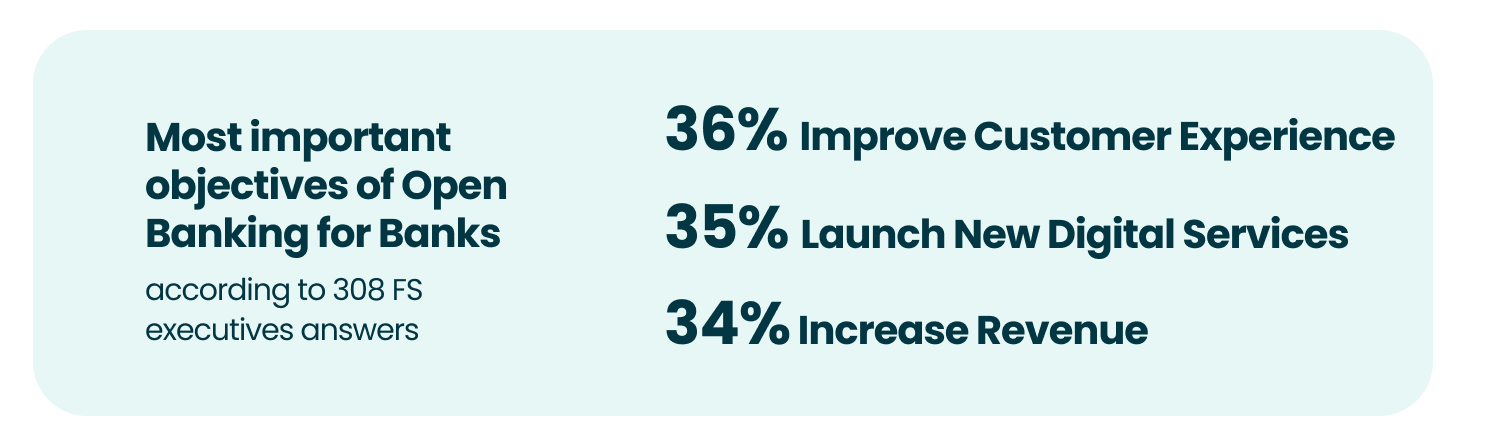

According to a survey conducted by PwC and Strands, these are the top 3 objectives of Open Banking in the near future:

PwC elaboration of market data – survey conducted on 308 FS executives in 12 countries

PwC elaboration of market data – survey conducted on 308 FS executives in 12 countries

Final thoughts

Despite some misconceptions, Open Banking proves to be a safe and convenient way for banks to access users’ data for them to have a better understanding of their customer base, support them in reaching financial wellness and help them when needed for them to manage their finances.

Regarding security, Strong Customer Authentication (SCA) ensures accurate and fraud-proof user authentication. Customer data is always respected, and users always need to approve or deny sharing data with third-parties.

Open Banking simplifies banking processes and makes them more efficient. Users can enjoy these services with just a mobile phone, and banks can offer financial products according to their needs, in a personalized way.

While adoption may be slower in some markets, Open Banking’s benefits and features ensure that more people are embracing it over time. The driving force here are mainly the banks and fintechs, that must offer Open Banking solutions and prioritize user experience to accelerate its adoption.

Overall, Open Banking has the potential to revolutionize the banking industry, redefine customer relationships, and provide secure and convenient financial management options for users. As banks and financial institutions incorporate Open Banking services into their offerings, it will become more accessible and widely adopted, shaping the future of banking for the better.

References:

Open banking users worldwide in 2020 with forecasts to 2024, by region. Published by Statista Research Department, May 17, 2023.