ENGAGER

IMPLEMENTATIONS

Flexible Implementation Models for Unmatched Banking Solutions

ON PREMISE

ON SAAS

ON CLOUD

Trusted by top banks worldwide

Top banks worldwide are increasing their digital engagement and growth with Strands solutions.

BENEFITS

Banks offering personalized banking insights grow faster

Advanced data enrichment is helping financial institutions to create human and hyper-personalized connections. Start using data smartly to increase banking engagement and loyalty.

No Code Insights Creation

Better customers’ knowledge

Revenue Increase

%

of customers expect to receive personalized banking insights

%

think personalizaton is key for brands’ recognition

%

recommend brands that offer personalized solutions

Professional Advice

Better Finance Control

Smarter Decisions

%

of customers expect to receive personalized banking insights

%

think personalizaton is key for brands’ recognition

%

recommend brands that offer personalized solutions

FEATURES

Data-driven insights in just 3 steps

Increase customer engagement and cross-selling opportunities through personalized banking insights.

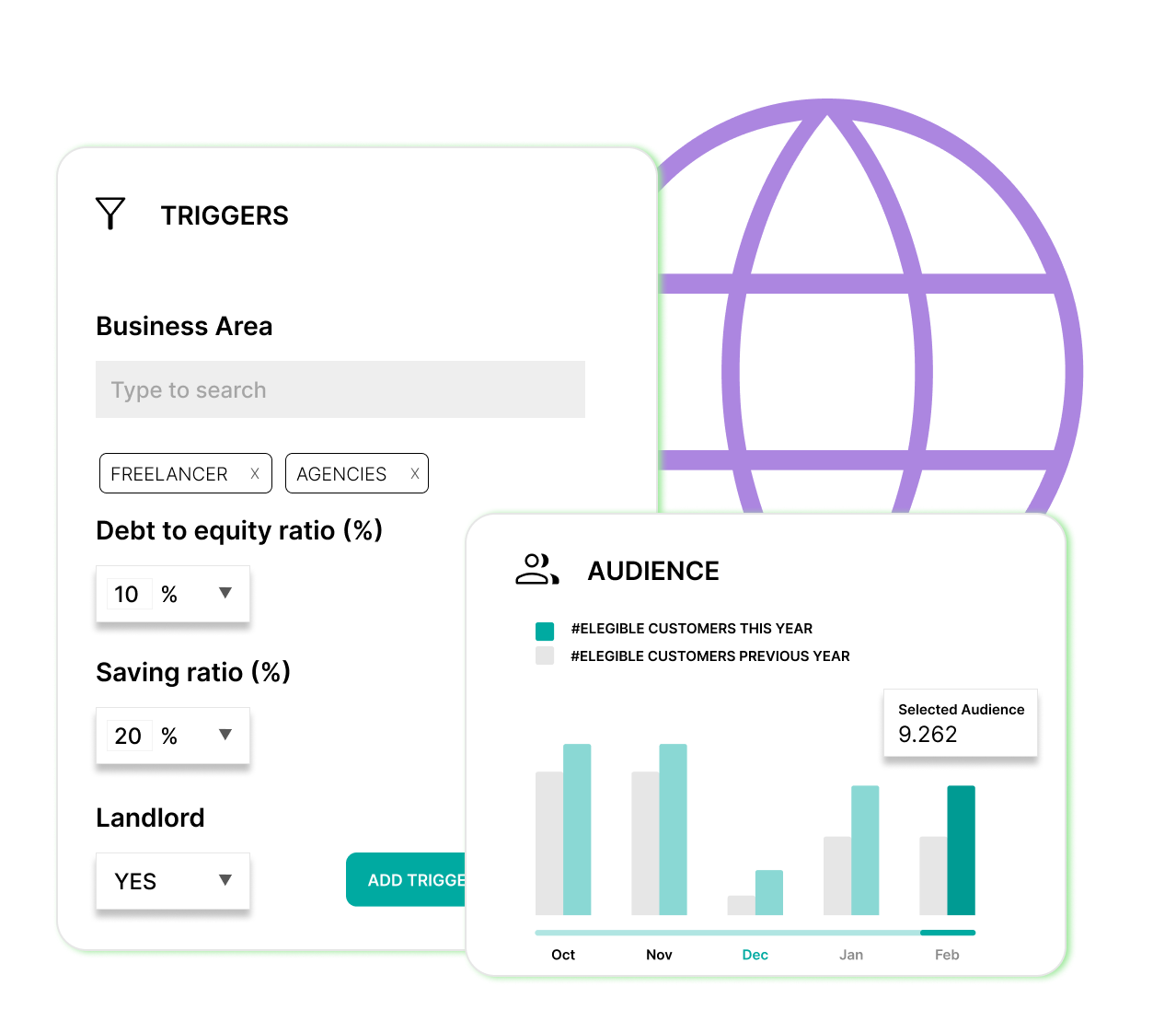

Explore and segment the target audience

Get a deep knowledge of your customers behavior based on their transactional data, that has been previously categorized using different models (Rule Based, ML/Hybrid categorization):

- Leverage a visual tool to understand the customer base through infographics.

- With Data Filtering, you can explore demographic statistics that exists on your database.

- Predict user behavior and propensity through advanced analytics: new house, growing family, liquidity issues...

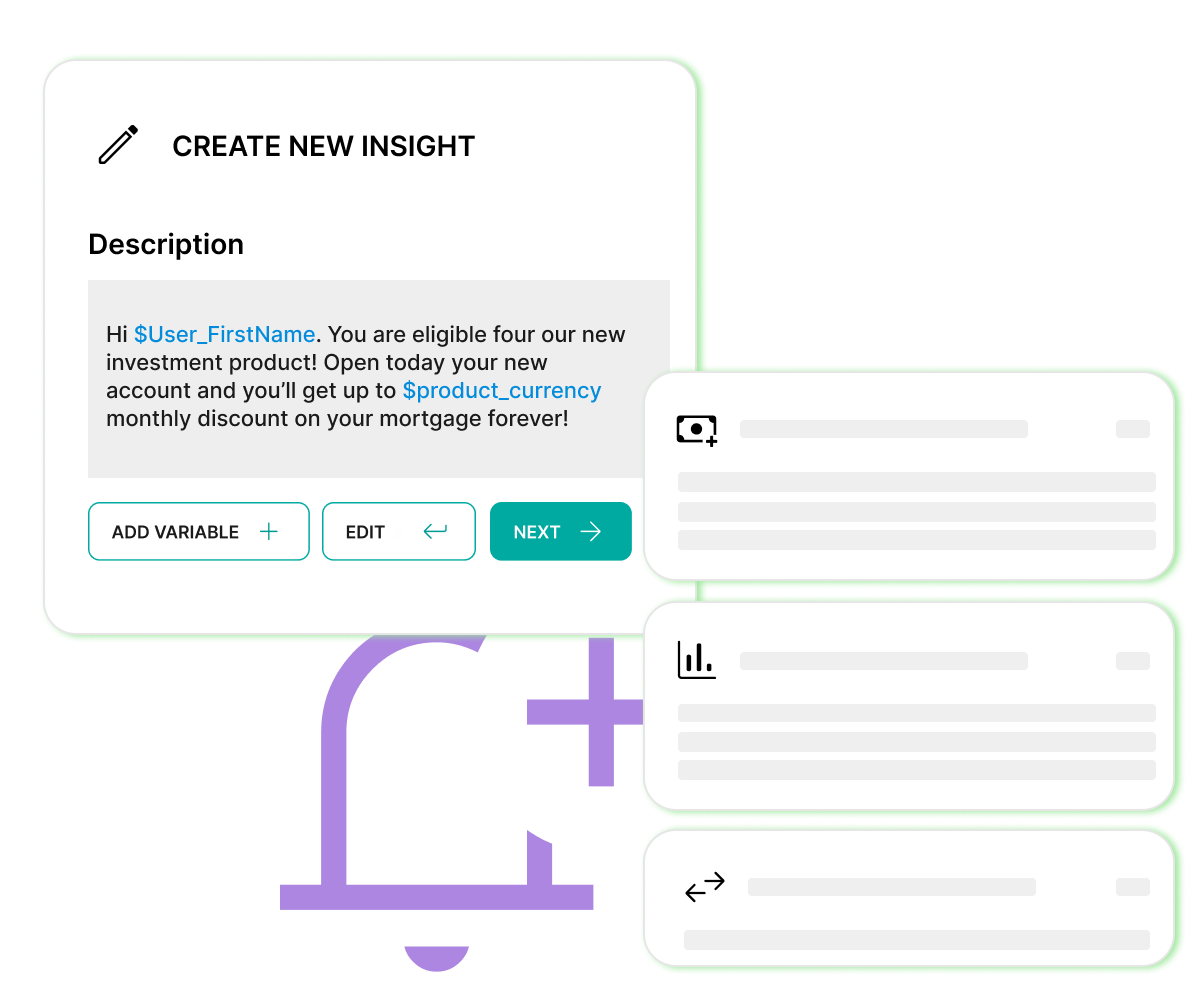

Say the right thing at the right time

Get full autonomy in creating no-code actionable insights from scratch or using our templates catalog, with faster time to market, and let your customers interact with your actionable insights:

- Real-time customized notifications.

- Top performing catalog of insights available.

- Intuitive Back Office Platform and UX omnichannel.

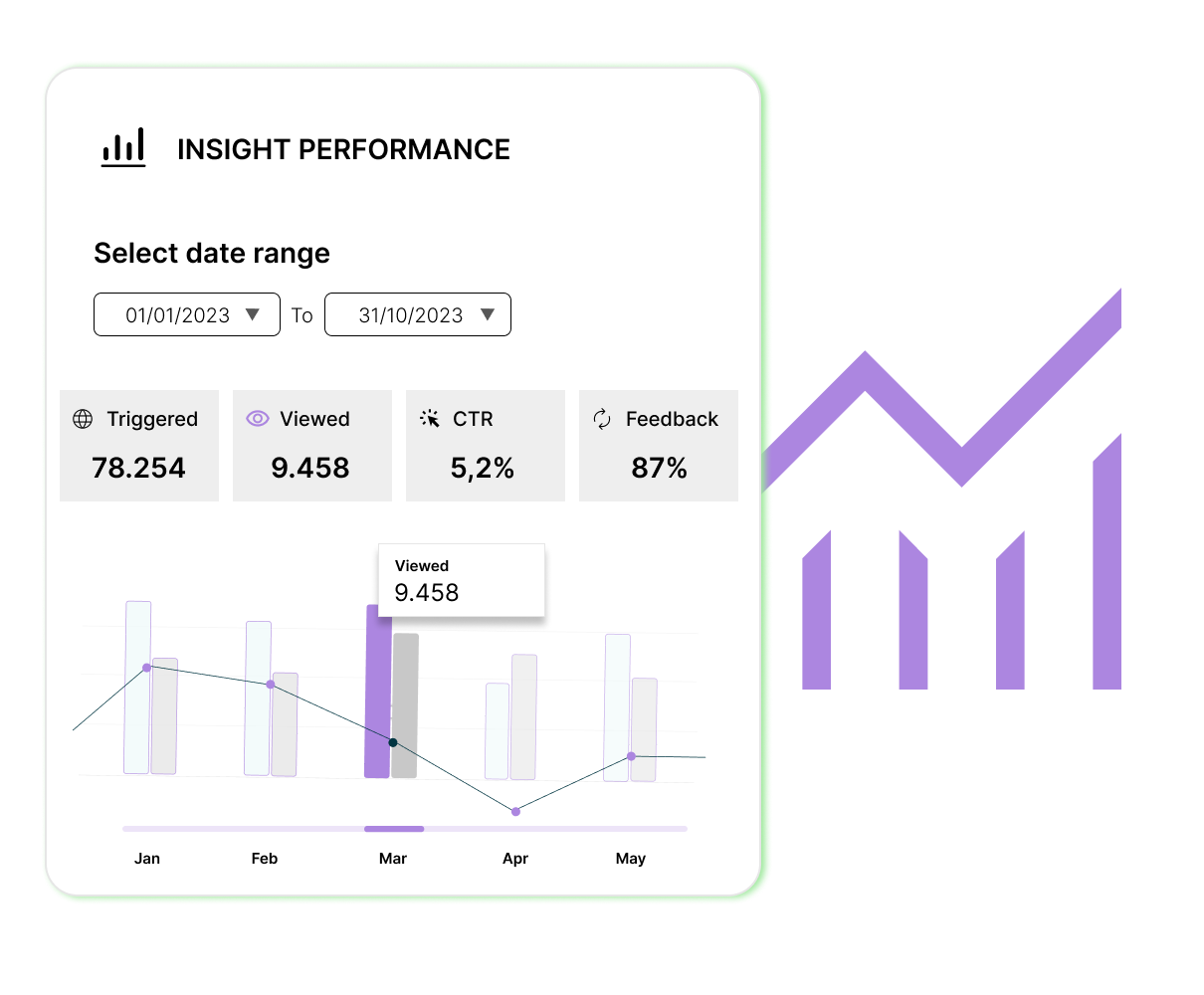

Analyze the effectiveness of your actions

Monitor customer interactions with your insights, and optimize your campaigns to maximize their effectiveness though our intuitive Back Office Platform:

- Through record keeping, all of the recommendations’ touchpoints are saved.

- Our tag system groups similar recommendations into campaigns.

- Access all records and campaigns and analyse their performance.

WHY CHOOSE US

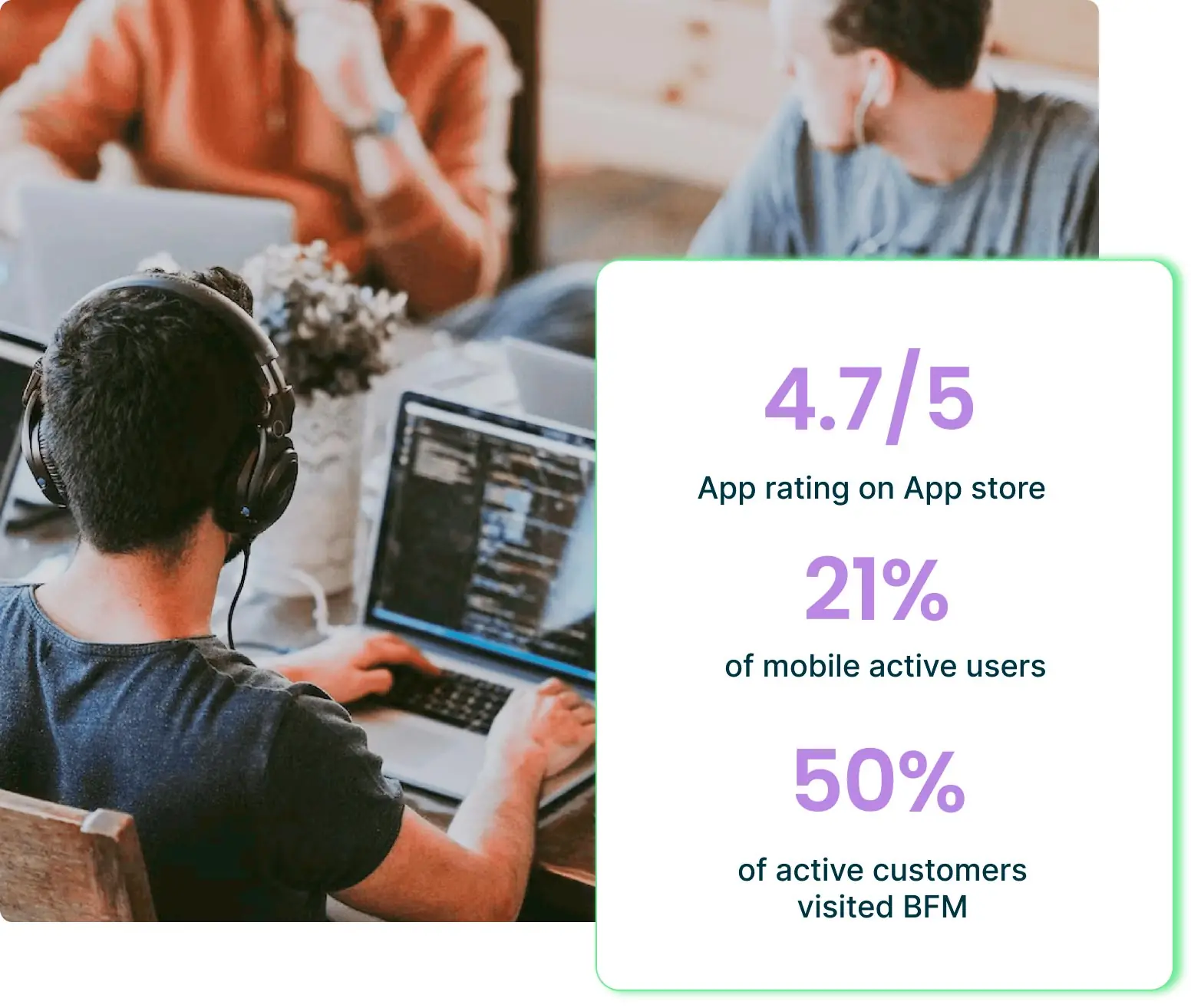

We are a Global Leader with a proven track record in the Fintech industry

Data analytics at the core with real-time technology

Leverage ML categorization enrichment engine and analytics model to detect real time events based on customers behavior.

Top skilled people sharing their

expertise

Our professionals will support you during solution design, implementation and after go live phase.

Unrivaled service model for all

sizes

Our solutions can be consumed via SaaS on private cloud for EU, on AWS for US, multi-cloud or legacy systems.

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.