AI Copilot

IMPLEMENTATIONS

Flexible Implementation Models for Unmatched Banking Solutions

ON PREMISE

ON SAAS

ON CLOUD

Trusted by top banks worldwide

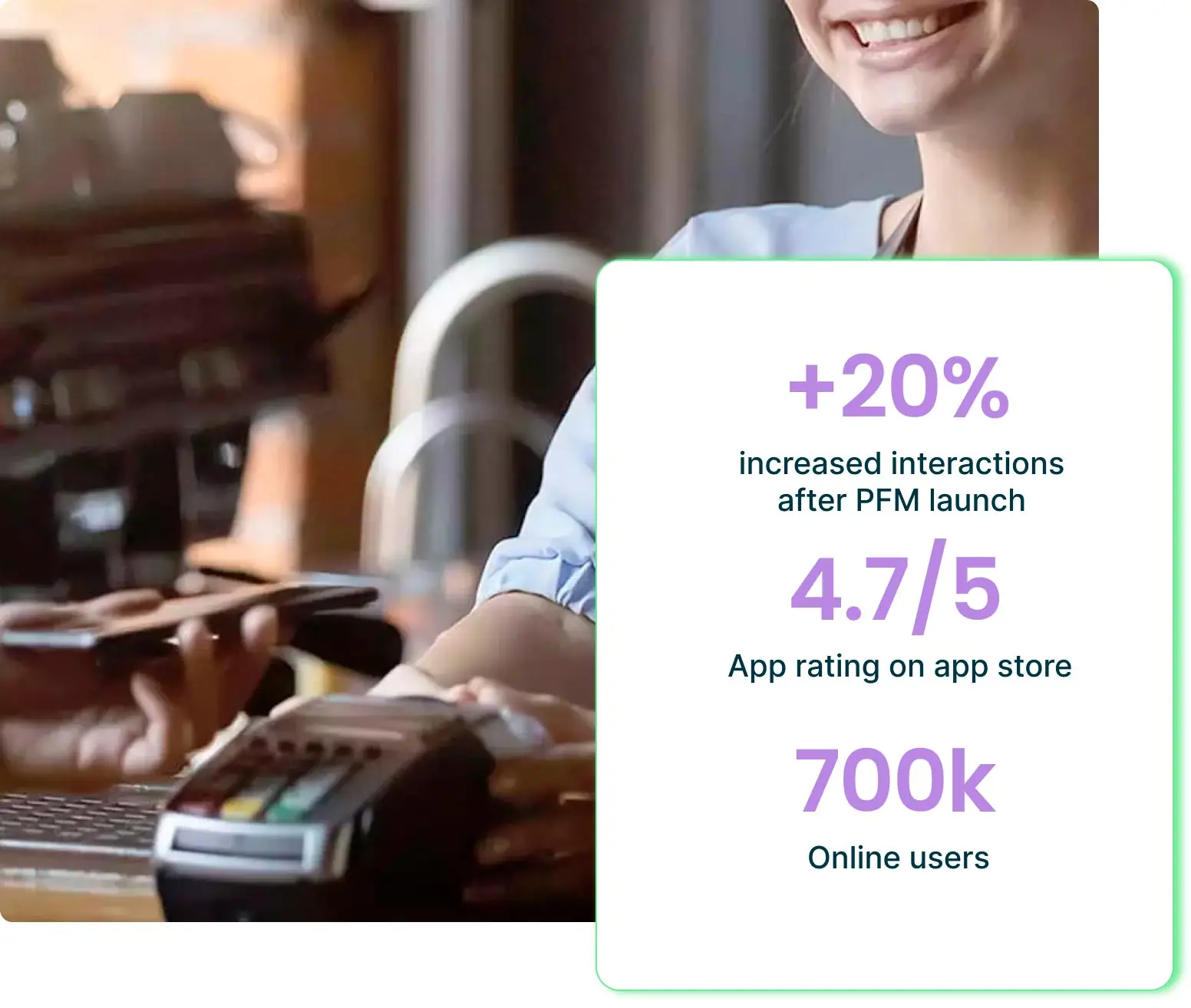

Top banks worldwide are increasing their digital engagement and growth with Strands solutions.

BENEFITS

Harnessing Data Science and AI for Enhanced Customer Profiling

Use our Data Science and AI capabilities to enrich and analyze transactional data, leading to more accurate customer profiling. This helps you to understand your customers, enabling more precise actionable insights, while improving financial literacy and wellness.

Increase cross-sell opportunities to predict customer needs and deliver personalized product recommendations.

Boost customer retention with tailored financial solutions and real-time insights, improving customer satisfaction and long-term loyalty.

Boost customer retention with tailored financial solutions and real-time insights, improving customer satisfaction and long-term loyalty.

Transactions categorized daily

%

Accuracy

Categories for a better profiling

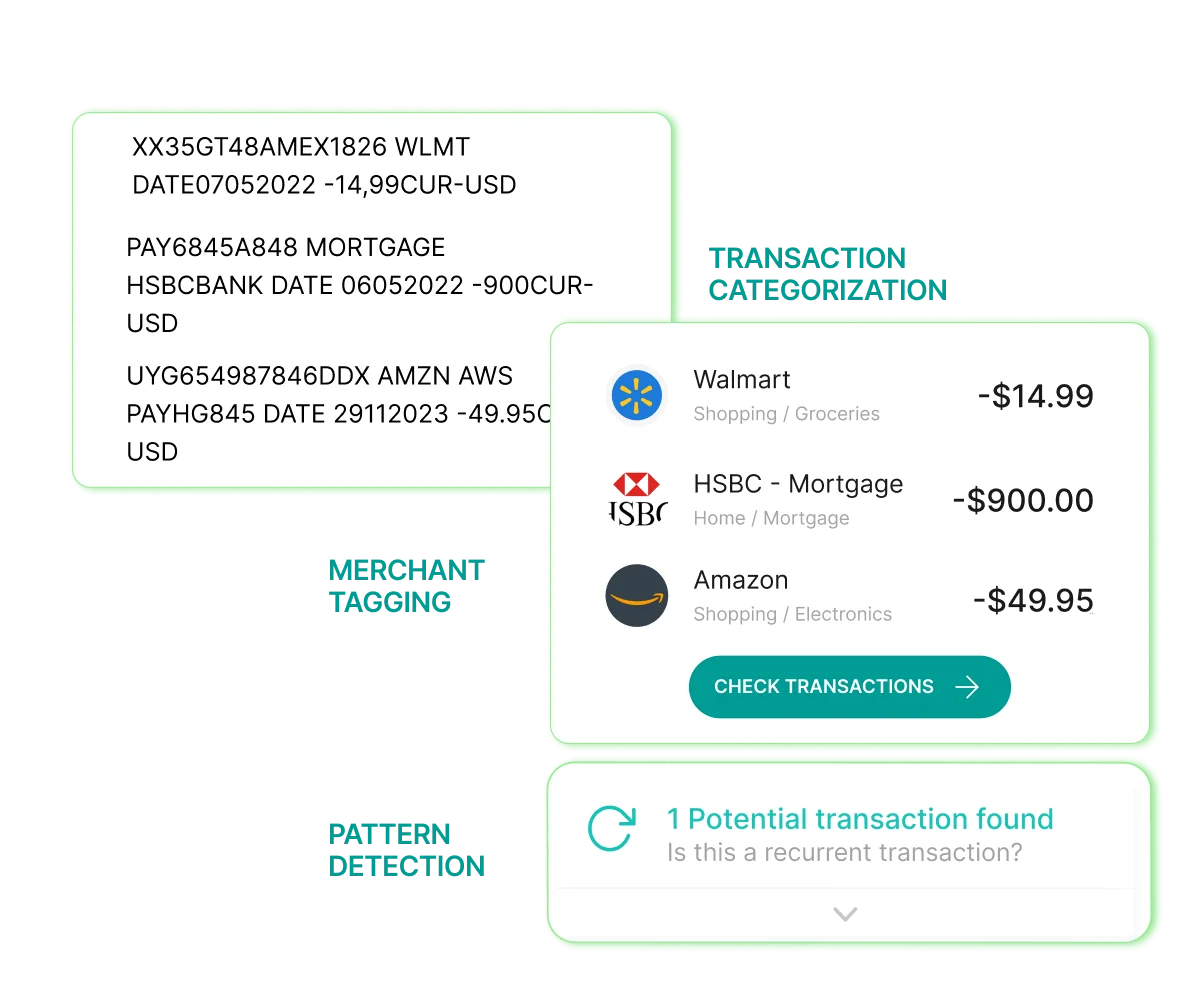

Gain more clarity on spending habits through enhanced transaction categorization and merchant tagging, helping users make more informed financial decisions.

Improve financial health by receiving personalized, AI-powered financial advice and wellness scores, guiding users toward better money management.

Save time on managing finances by automating saving processes and getting tailored recommendations that simplify everyday financial tasks and planning.

Transactions categorized daily

%

Accuracy

Categories for a better profiling

FEATURES

A unique data-driven journey:

Geet a deep understanding of your customers through data enrichment and use it to boost your CRM capabilities.

Enrich your banking customer experience and optimize business processes

- Provide a detailed view of each transaction thanks to our hybrid categorization engine.

- Identify merchants and make transactions actionable through search, edit and tagging, and dividable for easier customization.

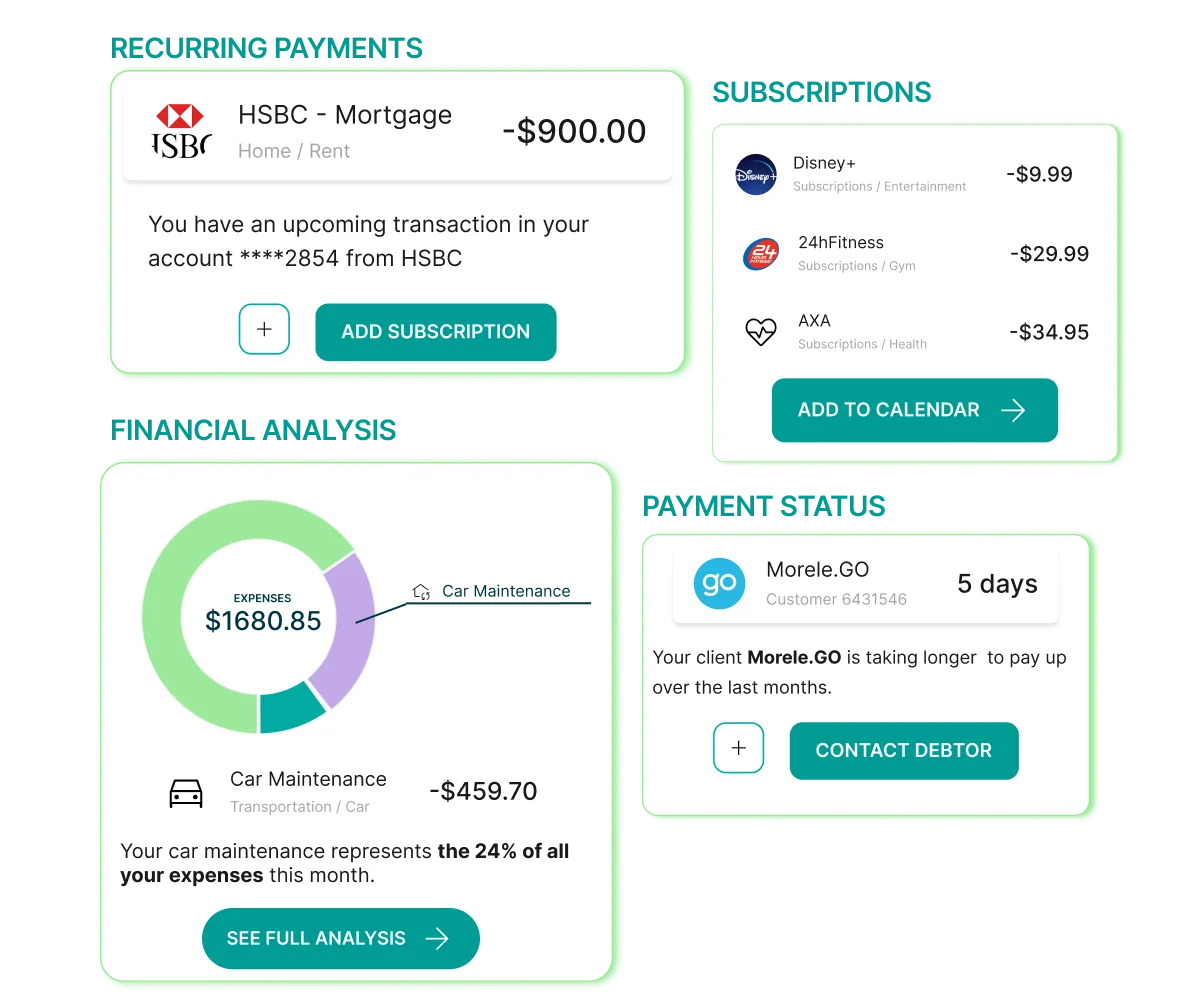

Support financial wellness at all times with our advanced behavior detection capabilities

- Identify patterns instantly within your customers transactions to better know their behavior.

- Uncover growth opportunities and optimize resource allocation with context-rich financial insights.

- Inform customers about recurring payments or potential deviations upfront assisting your customers in financial planning.

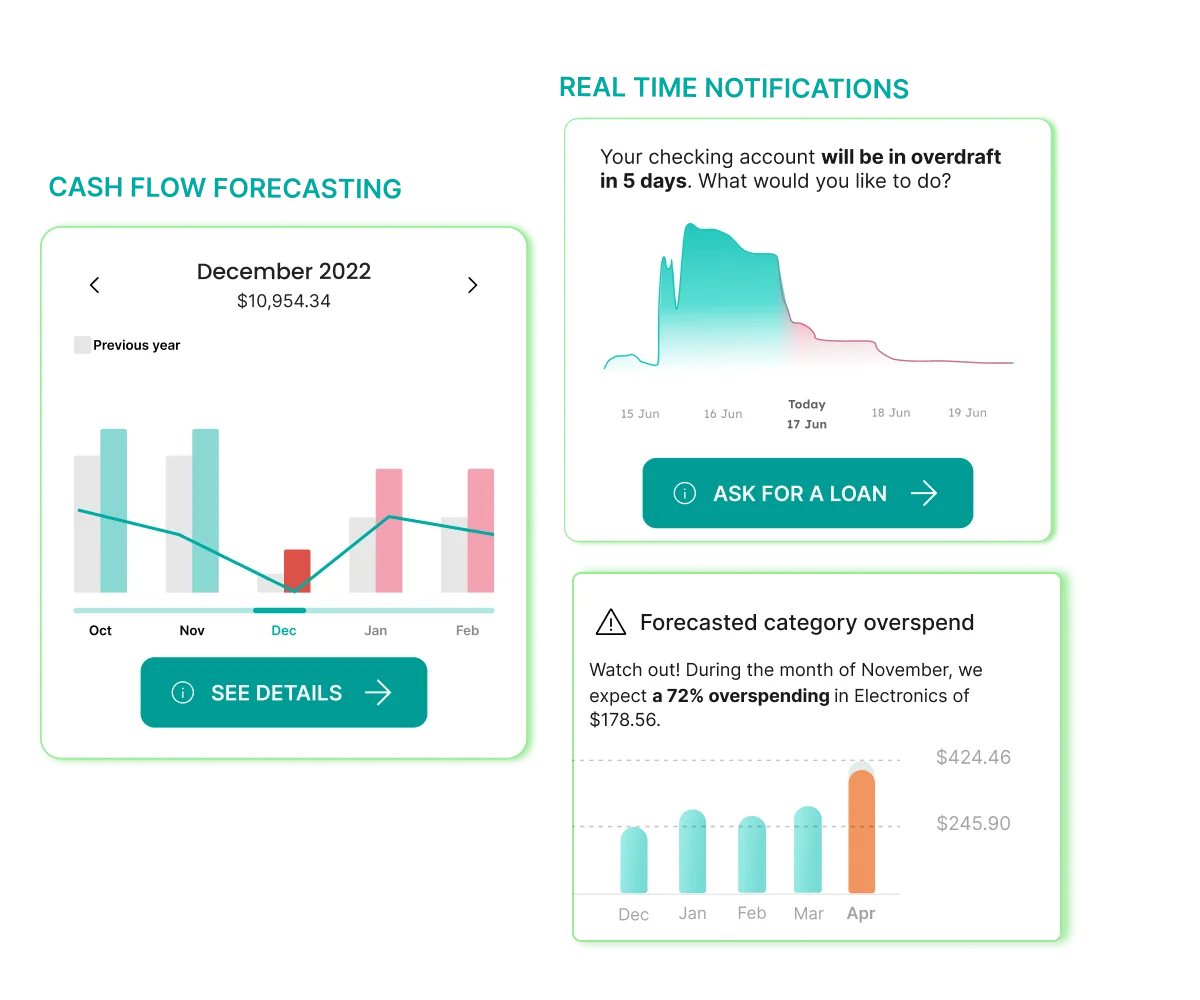

Empower customers to achieve life and financial goals with our predictive analytics

- Identify trends and anomalies in customer spending behavior thanks to predictive models in order to tailor offerings and support.

- Inform proactively your customers about recurring payments or potential deviations, credit scoring, cash-flow predictions, saving goals or fraud detection through an intuitive interface.

WHY CHOOSE US

We are a Global Leader with a proven track record in the Fintech industry

Data analytics at the core with real-time technology

Leverage ML categorization enrichment engine and analytics model to detect real time events based on customers behavior.

Top skilled people sharing their

expertise

Our professionals will support you during solution design, implementation and after go live phase.

Unrivaled service model for all

sizes

Our solutions can be consumed via SaaS on private cloud for EU, on AWS for US, multi-cloud or legacy systems.

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.