The ongoing climate crisis has highlighted the need for a global transformation that begins with governmental policies, influences business practices and involves every individual in their everyday lives. With consumers willing to understand how they can contribute and take action, we look at why banks can have the upper hand with a carbon manager that reaches the needs of people and the environment. It’s time to establish an approach that values the need for a more robust ESG strategy, and that aims at carbon neutrality.

93% of people from all over the world said the pandemic influenced their views on sustainability.

1 in 2 consumers have increased their spending for sustainable products by 59% in the last year

3 out of 4 consumers report they want to do more to reach their sustainability goals at home

What is carbon footprint

An individual or a company’s carbon footprint is the quantity of greenhouse gas (GHG) emissions that were produced as a result of their consumption behavior. While many consumers are aware of this term, the majority are at the start of becoming aware of the impact of their consumption and taking action. Understanding their carbon footprint with a carbon tracker is the first step of this journey, which they can leverage on with the right educational approach.

Be it refilling the car tank, doing the laundry, or even purchasing new clothes; every day activities generate greenhouse gas emissions. All of which you can think of, can be categorized in three direct and indirect scopes:

- Scope 1: includes direct emissions from owned or controlled sources, such as emissions from use of fossil fuels for vehicles, heating or from industrial processes (for example purchase of fuel).

- Scope 2: includes indirect emissions from the generation of purchased energy. Example: the individual being responsible for direct emissions by the supplier (such as electricity bills).

- Scope 3: includes all other indirect emissions, the most difficult to track, concerned with a broad category ranging from goods to services (business travel, waste disposal, transportation and distribution, investments, use of sold products, and more).

Embracing green banking

Banks nowadays are increasingly aware of the advantages of embracing a sustainable approach, and not just for the environment. Following a green banking model spans from cutting on overuse of resources to working to reduce energy expenditures, but also helping customers be more aware of their emissions and advising them on how to offset them. Banks have an unlimited amount of personal financial data which, combined with the right carbon tracker tools, can encompass the full customer green banking journey.

Green banking involves 3 core initiatives:

- Reducing use of resources: from energy to physical supplies, green banks often commit to reducing both the use and waste of natural resources.

- Funding green projects: green banks will often use part of their funding to attract private investors and other private capital to lend themselves to green projects.

- Supporting customers in tracking and offsetting their emissions.

Why is an ESG strategy for banks important?

Based on recent data, stakeholders themselves are demanding more transparency about banks’ environmental impact, all while shifting their own behavior towards a more sustainable lifestyle. As surveyed and reported by IBM, 1 in 2 customers have increased their spending for sustainable products by 59% in the last year.

This environmentally friendly attitude is even more embraced by the youngest generations. According to the Deloitte Global 2022 Gen Z and Millennial Survey, the vast majority (90%) of Gen Zs and millennials are making an effort to reduce their personal impact on the environment. They don’t believe businesses and governments are as strongly committed, and many are pushing their own employers to take action.

That’s where you can step in, as a bank or financial institution, to turn into a valuable partner in their sustainable journey.

Raising awareness with a carbon tracker

Integrating a carbon tracker in your banking app is the best way to make your customers aware of their spending-related emissions in a seamless interface.

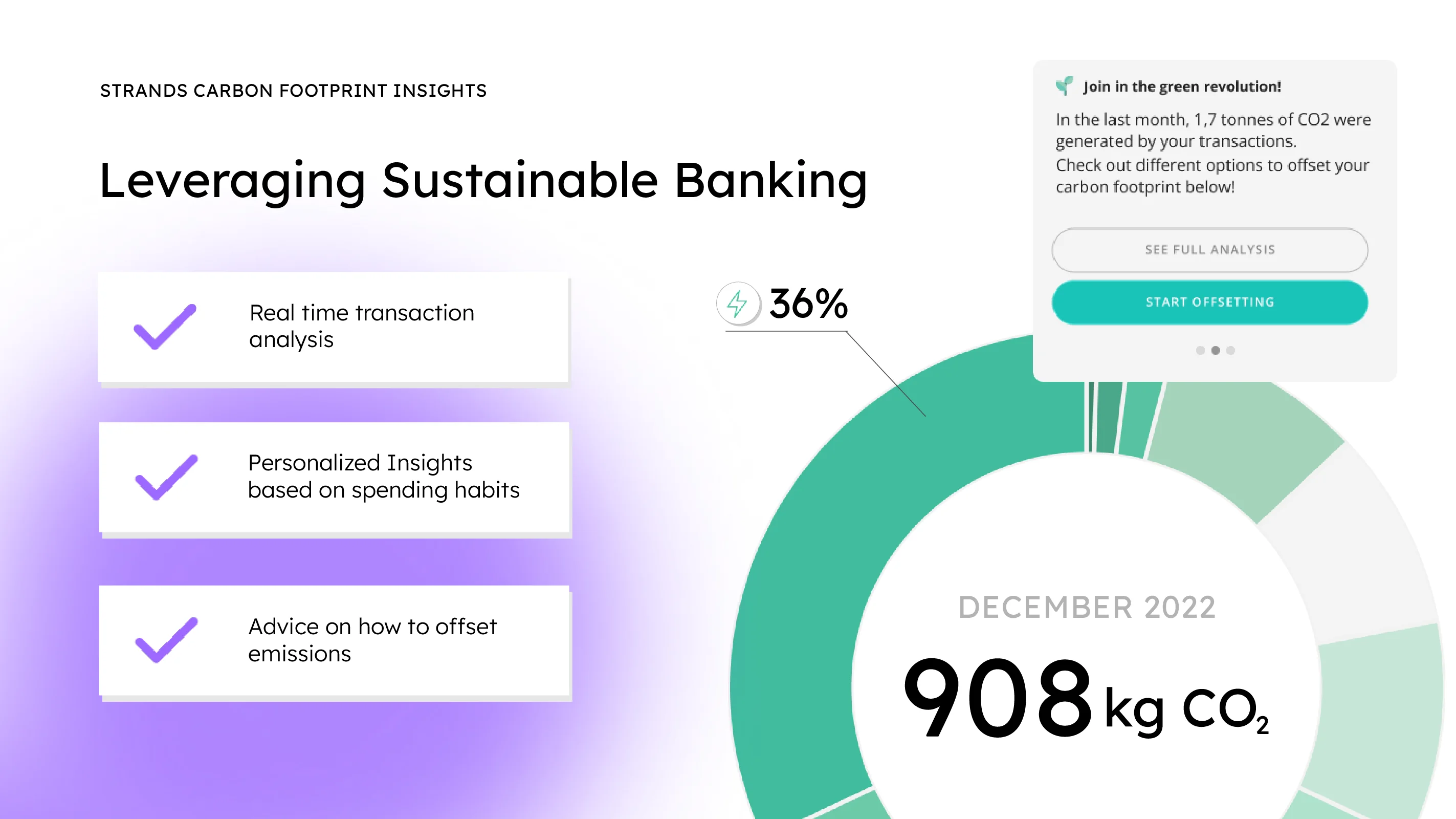

With our newly launched Strands’ Carbon Footprint Insights, bank transaction and open bank’s data get enriched through 3 steps: amount identification, category calculation and co2 scope attribution, in order to provide a complete and intuitive overview of the user’s spending-based emissions. New insights and suggestions are generated according to the user’s behavior, to advise them on the best next choices to take in order to offset their carbon footprint.

Inform your customers about their CO2 impact to promote environmental awareness and encourage them to have a more sustainable lifestyle.

Promoting a more sustainable lifestyle

In the last year, 1 in 2 consumers spent an average of 59% more in sustainable or socially responsible products. Consumers expect more and more from banks. Today, you have a chance to support your retail customers:

- Providing them transaction categorization based on carbon emissions

- Helping them to make informed decisions sharing their monthly summary of emissions or the top carbon spending categories

- Advising them on how to offset their emissions with personalized insights offering environmentally friendly products or promoting green initiatives.

Carbon Tracker with Insights

Boosting customer engagement and loyalty while providing sustainable solutions is part of our mission. We know the offset of carbon emissions is a shared goal among several industries, and even more so among individuals.

That’s why we want to help banks and financial institutions integrate Carbon Footprint Insights into our product suite solutions.

Find out how you can help individuals:

- Track their carbon footprint based on their spending behavior.

- Benefit from better-informed choices by showing them the carbon footprint of different purchases.

- Encourage them to set sustainable goals and recommend actions to offset their footprint.

Turn into a valuable partner for your customers in this sustainable era: