The Middle Eastern family banking landscape is undergoing a big transformation, one that presents both challenges and opportunities for financial institutions seeking to deepen client relationships.

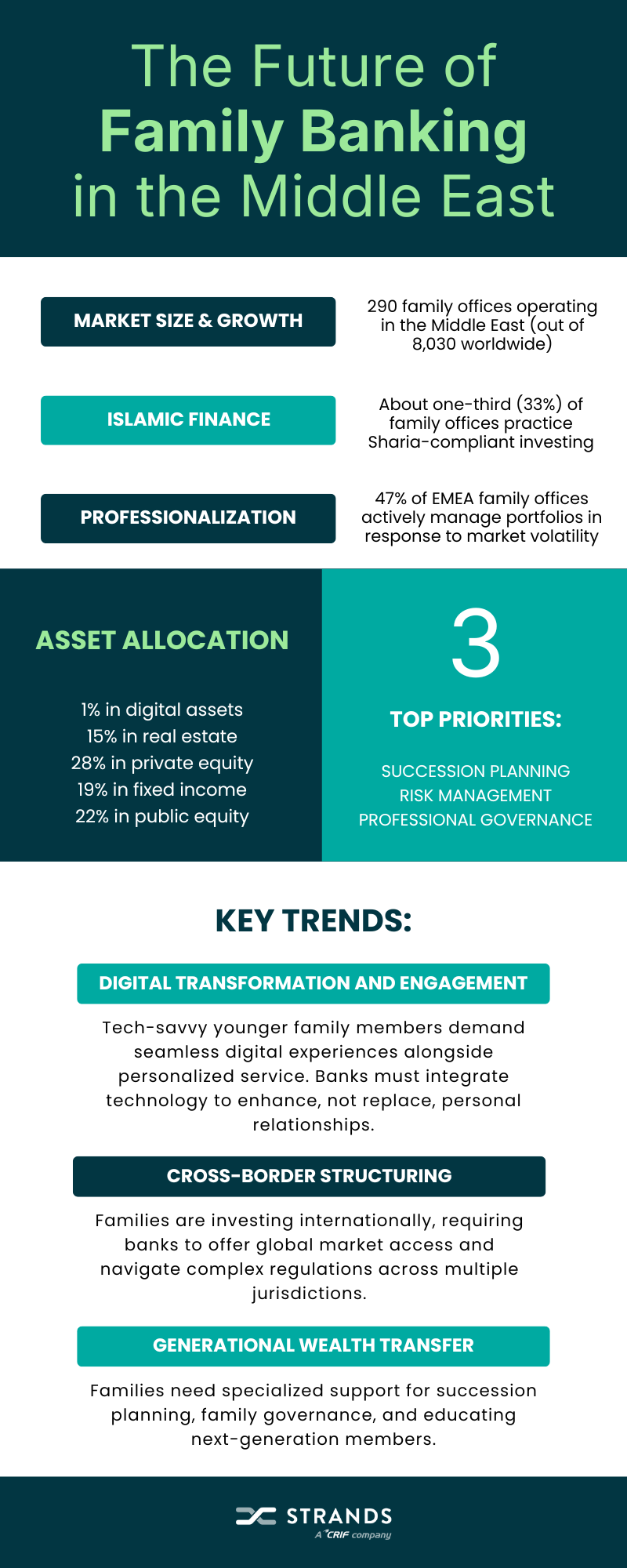

With approximately 290 family offices now operating in the region and wealth quickly transferring between generations, banks face a critical question: Will they remain transactional service providers, or will they evolve into trusted financial advisors?

A Market Shaped by Heritage and Innovation

What sets Middle Eastern family banking apart is its deep connection to cultural values and religious principles. About one-third of family offices practice Sharia-compliant investing, and families view their banking relationships as more than financial; they’re partnerships that protect legacy and shape economic futures.

But the landscape is changing:

- Succession planning, risk management, and professional governance have become top priorities.

- Meanwhile, younger generations are pushing for modernization, technology adoption, and portfolio diversification beyond traditional holdings.

Key Shifts Reshaping the Sector

Several trends are transforming how family offices operate and what they expect from their banking partners:

- Professionalization is accelerating: 47% of EMEA family offices actively manage portfolios in response to market volatility, hiring global talent, and adopting institutional best practices. This means families now expect sophisticated analytics, expert guidance on complex scenarios, and strategic advisory, not just account management.

- Investment strategies are evolving: While conservative in some areas (just 1% in digital assets), families in this Region are increasingly investing in technology, renewable energy, healthcare, and cross-border opportunities, requiring banks to offer access to alternative investments and global markets.

- Digital expectations are rising: The sector is experiencing a major shift toward digital engagement, with tech-savvy younger family members demanding seamless, secure digital experiences on top of personalized services. The challenge for banks is integrating technology in ways that enhance, rather than replace, personal relationships.

- Succession planning has become critical: As wealth moves between generations, customers need specialized support for wealth transition, family governance, and educating next-generation members. This represents one of the most important areas where banks can demonstrate value beyond transactions.

Why This Matters for Banks

Family offices in the Middle East are at a turning point, and banks have a unique opportunity to move beyond transactional services and become strategic partners. Here’s why:

- Generational wealth transfer: As trillions of dollars shift to younger generations, advisory services are essential.

- Digital expectations: financial institutions that integrate platforms and personalized engagement will stand out in a market where trust and convenience are equally expected.

- Diversification: banks offering access to global markets and alternative investments will become an indispensable partner for families.

From Service Provider to Strategic Partner

What does all this mean for banks? Simply put: transactional banking is no longer enough.

The Middle Eastern family banking sector is expanding rapidly, driven by regulatory reforms, economic diversification initiatives like Saudi Arabia’s Vision 2030, and generational wealth transfer. For banks, the opportunity is substantial: families that find genuine advisory partners remain loyal for generations and consolidate assets with institutions they trust.

Families don’t just need someone to execute trades or process payments. They need partners who understand family dynamics, respect cultural and religious values, can coordinate across investments, and think in terms of decades rather than quarters.

This requires banks to develop deeper client intelligence, understanding not just account balances but family structures, goals, and values. It demands proactive engagement, reaching out with relevant insights before clients ask. And it calls for cultural competency, particularly around Islamic finance principles and how religious values shape financial decisions.

The banks that will thrive are those investing in platforms and capabilities that enable relationship managers to truly act as advisors. Technology should free bankers from administrative tasks, allowing them to focus on strategic guidance. Analytics should surface opportunities for timely, personalized advice. And service delivery should feel integrated and coordinated, not fragmented across specialists.