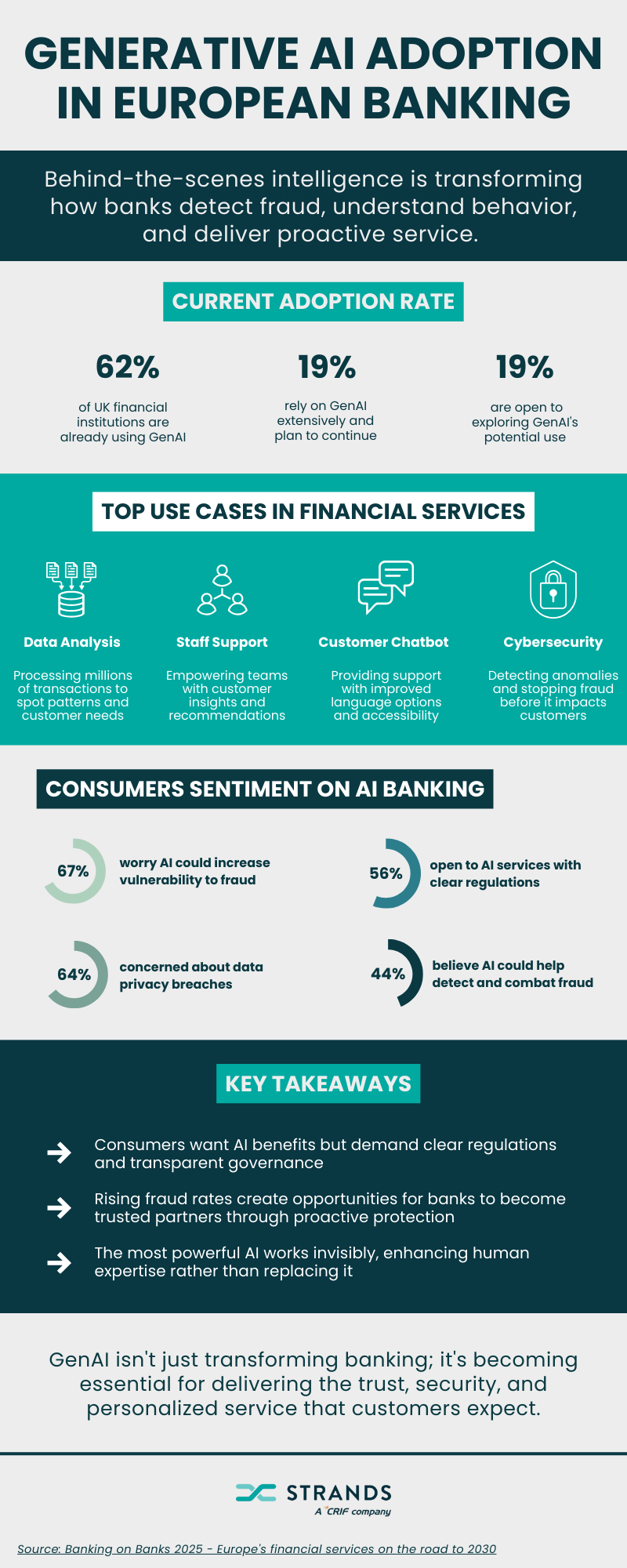

The numbers tell a compelling story: 62% of UK-based financial professionals report their companies are already using GenAI, with nearly one in five relying on it extensively. But it’s how they’re using it that reveals the real transformation coming our way.

How banks are using GenAI

When you examine where financial institutions are actually deploying GenAI, a clear pattern emerges. Data analysis leads at 57%, followed by staff support at 52%, customer chatbot services at 52%, and cybersecurity protection at 47%. This reflects a fundamental understanding: before you can serve customers better, you need to understand them better.

Every financial institution faces the same challenge: Customers generate millions of transactions, interactions, and behavioral signals daily. Buried in that data are patterns that reveal genuine needs. Someone preparing to buy their first home, a small business about to experience cash flow stress, a customer vulnerable to credit fraud…

No team, regardless of size or expertise, can process this volume of data at scale. That’s where AI changes the game. It spots patterns that would take teams months to identify. It flags anomalies that signal fraud before customers are affected. It identifies segments with similar needs, enabling more relevant, timely service.

What do customers really think about AI in banking?

There’s a critical tension for decision-makers: consumers are skeptical about AI they can’t see, but they want the benefits it enables. The research shows 67% of Europeans worry about increased vulnerability to fraud, while 64% are concerned about data privacy breaches. Yet, 44% believe AI could help banks better detect and combat fraud, with even higher confidence among younger generations, and 51% are open to engaging with an AI assistant.

This creates both a challenge and an opportunity for institutions that can demonstrate responsible AI implementation.

The strategic insight for banks? Lead with value, not technology. As the research clearly states: “Efficiency gains alone will not win over the public on AI; instead, it must be earned through clear communication, safeguards, and governance.”

The strategic advantage of behind-the-scenes intelligence

Leading financial institutions understand that the most powerful AI often operates invisibly. It’s the intelligence layer that processes information, identifies patterns, and surfaces insights, enabling better service without requiring customers to interact with algorithms directly.

When a bank proactively reaches out to a customer to offer support during a difficult financial period, the customer experiences care. For example, when credit fraud or unauthorized transactions are detected and stopped before generating a negative impact, customers experience security. The AI that enabled it remains behind the scenes, exactly where it should be.

This protection is incredibly important, especially in a scenario where fraud is increasing year after year. Recent reports show that payment fraud in the European Economic Area reached €4.2bn in 2024, up from €3.5bn in 2023 and €3.4 billion in 2022.

This shift represents the evolution of financial services. Technology is amplifying human expertise, making services more timely and more relevant, but it is also generating new risks for customers. The institutions succeeding with GenAI use it to truly understand customer needs at scale, then deliver that understanding through human touchpoints, seamless digital experiences, and proactive service.

The path forward

Europe’s financial landscape is experiencing significant turbulence from economic shocks, geopolitical instability, and rapid technological change, with GenAI becoming a big player in how financial institutions become more efficient, agile, and proactive.

Successful GenAI implementation for banking requires focus on high-value use cases, a commitment to transparency and governance, and recognition that AI’s role is to enhance human judgment, not replace it.