Creating a Personalized Experience Tailored To Real Needs

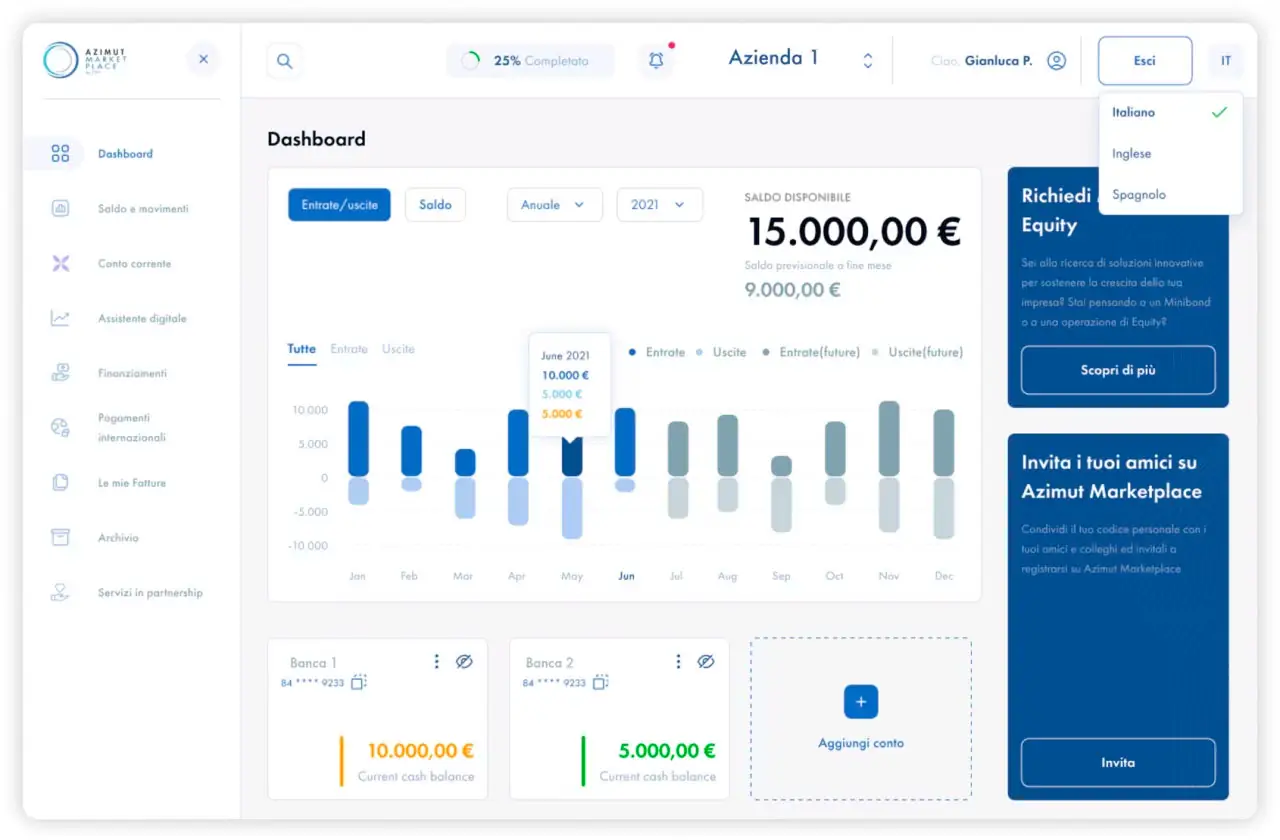

STEP 4 Business is the first fully-fledged digital marketplace of products and services designed for SMEs, in “Amazon Style”. The platform offers a comprehensive one-stop-solution integrating the best financial – and non-financial – services provided by third party providers.

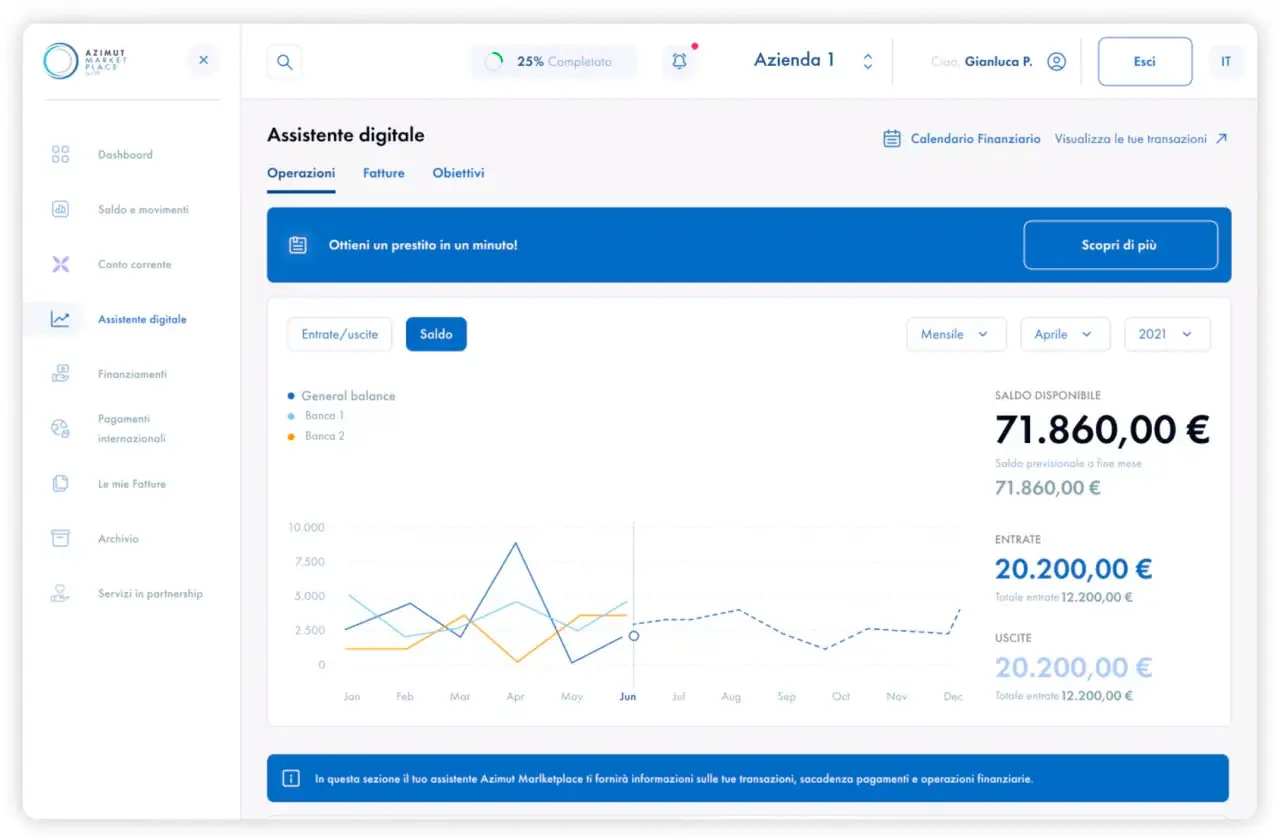

An embedded finance open ecosystem that meets and supports the day-by-day needs of SMEs, by exploiting open banking banking potential and advanced analytics creating a personalized insight driven experience tailored to real needs. For realizing this journey, Strands BFM and Engager capabilities enriched by CRIF account aggregation are natural enablers for building a clear competitive advantage.

The Challenge

Digital disruption in financial services is already a reality for retail customers but it hadn’t happened yet for SMEs and entrepreneurs, who were still seeing their needs and demands pretty much uncovered. SMEs across the world are looking for a beyond-banking ecosystem, covering their needs in a single, easy-to-use service, giving entrepreneurs more time to focus on their core business activities.

The SMEs banking segment is undergoing a deep transformation:

- 79 % of SMEs would change their payment provider if they found a cheaper solution.

- 63 % of SMEs consider speed of settlement to be the most important issue (apart from cost).

- 74 % of SMEs in EMEA plan to expand into another country over the next five years.

Traditional credit scoring models are not sustainable to face SMEs needs during a risk adverse environment (e.g. Covid-19).

Banks will keep seeking efficiency via closing branches in order to reduce costs (e.g. Large European banking players will close 50% of branches in the next 2 years) due to NPL and digital transactions increase.

Solution

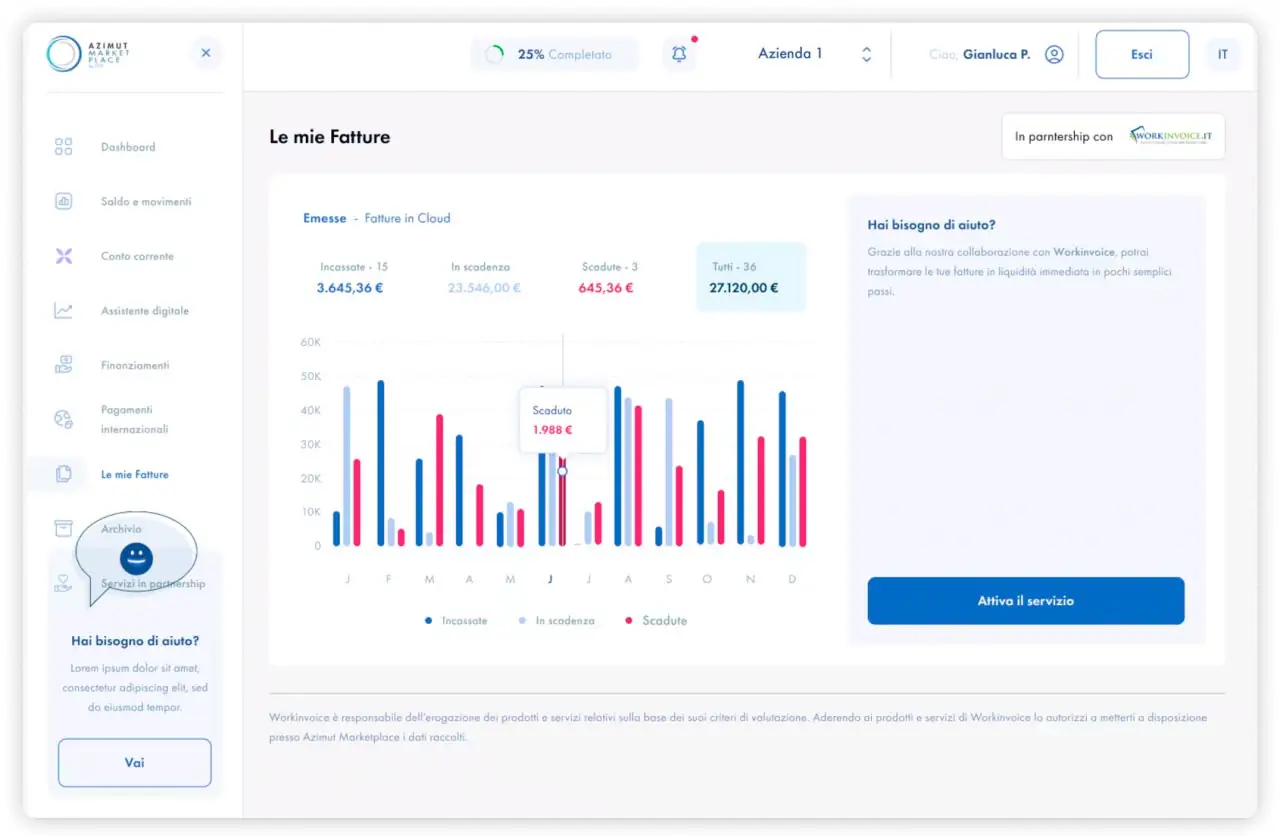

STEP wants to offer a People-Centric Customer Service that can offer a one-stop-shop following state-of-the-art in digitalization. Open platform and ecosystem, marketplace fully-fledged SMEs solution able to leverage PSD2, integrating product factories (fintechs) through APIs, in order to deliver the excellence in every product/service to small and medium enterprises and corporate customers. Account aggregation – first platform to offer it for free to SMEs on European scale – and BFM are key elements of the STEP value proposition, in order to offer a holistic financial view to SMEs customers as well as business insights and predictive analytics, and big data in order to target customers in an effective and dynamic way based on current account transactions and big data. Third party products integrated in the platform with a best in class user experience then allow SMEs to apply for an instant loan, discount their invoices, manage their international payments and FX transactions, acquire payments from customers, ask for an ESG rating, subsidized finance, among others, all in a single marketplace or super-app platform.

Result

Since the market launch in October 2021, more than 1,350 SMEs have chosen the STEP platform in two different markets: Italy (Azimut Marketplace by STEP) and Spain. 97% of SMEs have aggregated their accounts using CRIF Account Aggregation capabilities (AISP), in order to always keep their financial position under control. Moreover, they are using Strands’ Business Financial Manager (BFM) to generate predictive analytics, business insights, transactions categorization, potential liquidity issues, payables and receivables monitoring, along with others. This customer loyalty and big data – aggregated transactional data and business insights – has led to a 23,4% cross selling ratio of customers engaged with Amazon-like next-best-offer CRM engine, and a pipeline of more than 40 million euros loan and working capital operations already requested.

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.