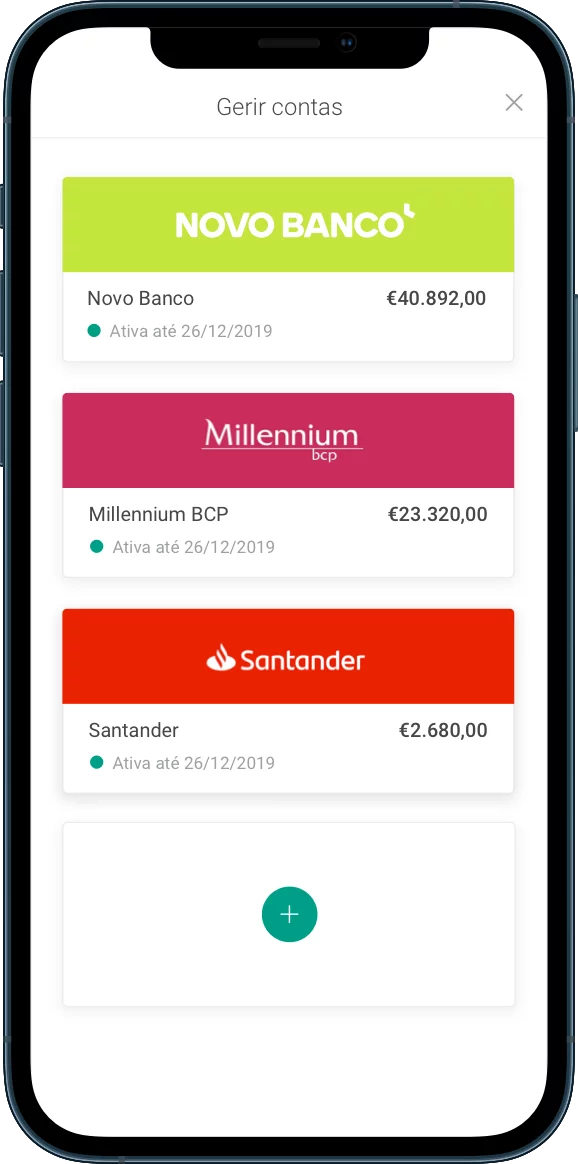

The most up-to-date account information

Novo Banco, one of the most innovative banks in the world, chooses Strands to build its award-winning BFM solution, the first of its kind in Portugal.

The Challenge

Novo Banco was looking for a technological partner able to provide small business owners with the best digital banking experience in Portugal. The bank performed an in-depth analysis of the SME banking landscape in the country, and realized SMEs were being largely underserved by financial institutions.

Novo Banco soon understood that the key to position themselves as leaders in the SME banking segment was building a highly personalized and easy-to-use business financial management platform. And that’s how its partnership with Strands began.

Solution

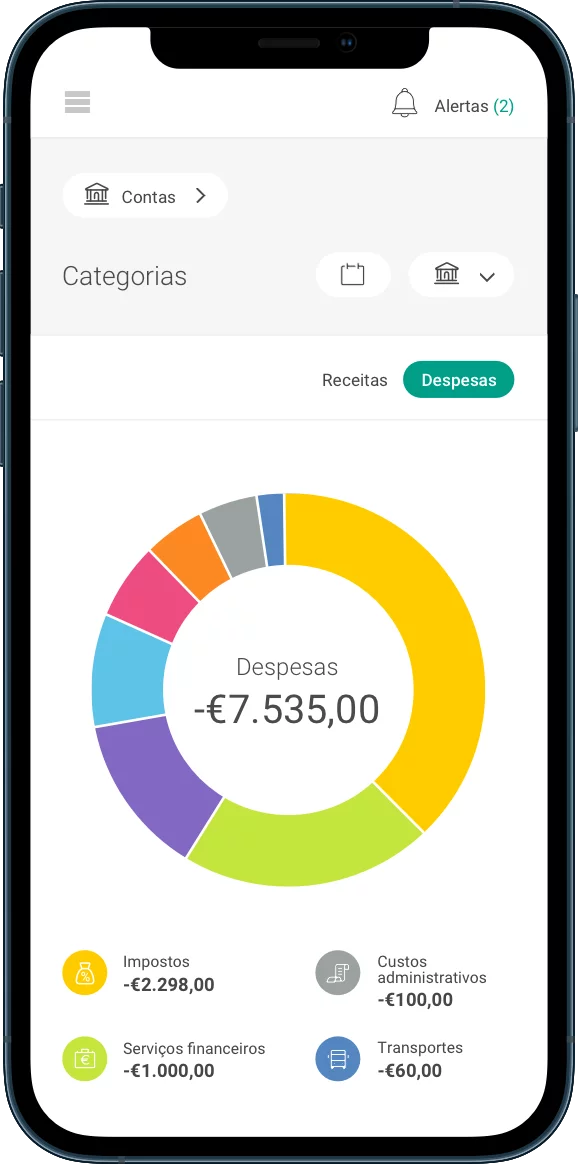

Novo Banco’s strategy was based on a thorough assessment of the issues affecting small businesses. These banking customers need a tool that takes the uncertainty out of money management and allows a 360º vision of all bank accounts, aggregating their entire financial picture on one platform.

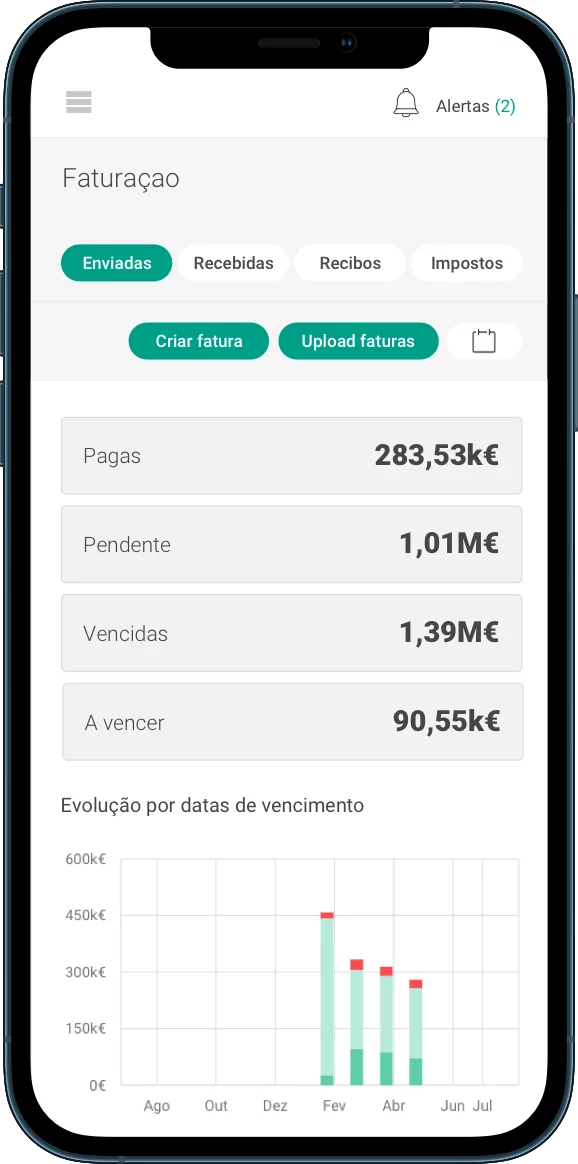

Strands’ business financial management (BFM) solution was embedded into Novo Banco’s digital banking system Nbnetwork+. The implementation process was highly collaborative and Strands provided end to end support: from configuring the back end to designing the user interface. With this solution, which includes invoicing features and a categorization engine, Novo Banco allows its SME customers to keep track of their financial situation.

A real-time engine was also one of the bank’s top priorities. Novo Banco’s customers’ accounts are automatically updated whenever a transaction is processed. By offering the most up-to-date account information available in one single platform, this feature empowers SMEs to stay on top of their accounts and also helps further protect users from potential fraud.

Result

A real-time engine was also one of the bank’s top priorities. Novo Banco’s customers’ accounts are automatically updated whenever a transaction is processed. By offering the most up-to-date account information available in one single platform, this feature empowers SMEs to stay on top of their accounts and also helps further protect users from potential fraud.

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.