The rapid transformation of financial services is compelling banks and financial institutions to deliver hyper-personalized customer experiences. Today’s customers expect tailored solutions that anticipate their financial needs and offer real-time guidance. Generic banking services are no longer sufficient. By harnessing Open Banking and advanced data analytics, institutions can craft hyper-personalized experiences that significantly boost engagement and build customer loyalty.

At Strands, we see hyper-personalization as a core tenet for the future of banking. By integrating Open Banking capabilities, we enable banks to deliver deeply personalized, adaptive financial journeys that prioritize financial wellness for each customer.

The Role of Open Banking in Delivering Hyper-Personalized Services

Open Banking has become a game-changer in enabling banks to deliver highly personalized customer experiences. It offers a secure gateway to aggregate and analyze third-party data, giving banks access to a comprehensive view of their customers’ financial situations. By analyzing transactional data, spending patterns, and account balances, Open Banking allows institutions to offer tailored, actionable insights that meet customers at the right moment.

Strands leverages Open Banking to integrate customer-consented data into its new Lighthouse solution, transforming how banks engage with their users. The richness of this enriched data enables banks to develop hyper-personalized financial products—whether it’s offering a credit line to a customer based on their cash flow needs and credit scoring or suggesting savings tools aligned with their life specific goals.

Moreover, by analyzing this enriched data, Strands ensures that financial institutions can deliver the right solutions at the right time, improving both the customer experience and operational decision-making.

Driving Engagement Through Adaptive Financial Journeys

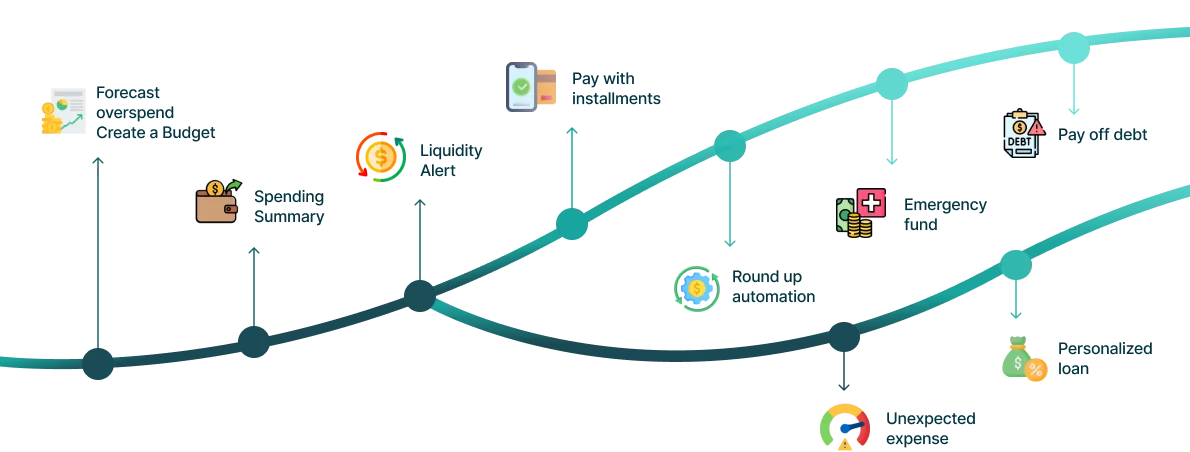

One of the core strengths of Strands’ approach is its ability to create adaptive financial journeys for customers. This means that as a customer’s financial situation changes, the system dynamically adjusts its recommendations and solutions. For example, if a customer’s income suddenly decreases, Strands’ Lighthouse can adapt by updating savings recommendations, adjusting spending alerts, or offering personalized debt management options tailored to the customer’s financial capabilities.

This adaptive approach ensures that banks provide relevant, actionable insights that enhance customer engagement and build trust, becoming a real partner in Financial welness’ journey. Customers feel that their bank understands their evolving needs, fostering deeper loyalty and long-term relationships. Research from The Banker underscores that customers are more likely to engage with institutions that anticipate their needs and offer proactive solutions, driving retention and brand loyalty.

Building Financial Wellness: Strands’ Approach

At the heart of Strands’ hyper-personalization capabilities is the ability to create adaptive financial journeys. These journeys are not static or one-size-fits-all. Instead, they evolve in response to each customer’s unique circumstances. Strands uses data enrichment from Open Banking to continually adjust recommendations and services in real-time, guiding customers through different phases of their financial lives.

For instance, if a customer’s spending patterns indicate potential financial distress, Strands’ platform can automatically suggest a revised budget, recommend savings strategies, or offer relevant loan products to assist with liquidity needs. This personalized, adaptive guidance builds trust by ensuring that the bank is always aligned with the customer’s current situation.

In addition to real-time adaptations, Strands offers features such as automated savings plans, personalized debt management strategies, and proactive spending alerts—all designed to promote long-term financial wellness. The platform’s ability to contextualize and act on customer data in real time not only enhances engagement but also positions the bank as a partner in each customer’s financial journey.

Conclusion: The Future of Hyper-Personalization and Open Banking

As the financial industry moves toward a future driven by data, hyper-personalization and Open Banking are becoming critical tools for banks to differentiate themselves in an increasingly competitive landscape. At Strands, we are leading this shift by empowering financial institutions to offer hyper-personalized, adaptive journeys that promote customer engagement and financial wellness.

Banks that leverage these capabilities will not only meet customer expectations but exceed them—positioning themselves as trusted, innovative partners in their customers’ financial success. Hyper-personalization and Open Banking are no longer optional; they are the foundation of customer-centric banking in the digital age.