- Open Banking gained momentum since the implementation of PSD2, which requires banks to share customer data with 3rd-party providers via secure and standardized application programming interfaces (open banking APIs).

- The benefits of Open Banking include broader financial control and freedom for consumers and businesses, thanks to an all-in-one holistic view of their finances

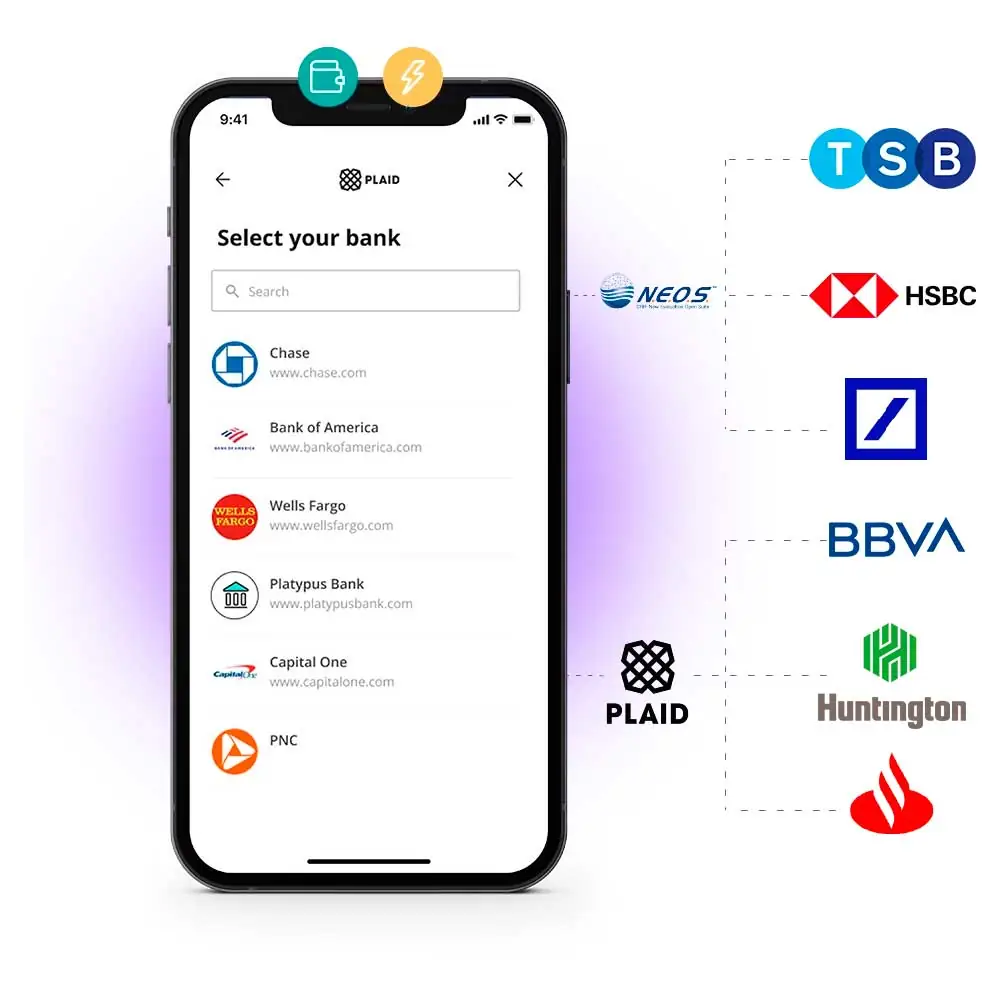

- Strands Open Banking solutions enable banks and financial institutions to seamlessly leverage APIs and aggregation tools to build trust and reliability in their customers’ journey.

With the cost of living increasing, consumers are facing tough economic times. Financial control is crucial in this challenging climate, and fortunately, financial institutions can access new technologies, such as open banking solutions, to effectively back their customers up.

Open finance and open banking solutions show promising potential in helping consumers gain broader financial control and minimize financial burdens. Let’s see how.

The state of Open Banking

Also referred to as “open bank data”, open banking offers consumers and businesses more convenient and flexible access to financial services. It gained momentum in Europe in January 2018, with the implementation of the Revised Payment Services Directive (PSD2), which requires banks to share customer data with 3rd-party providers, with the customer’s consent, via secure and standardized application programming interfaces (open banking APIs).

- Europe, and specifically the UK, have led the way. Based on a report by the Open Banking Implementation Entity (OBIE), 10-11% of digital banking consumers in the UK were using at least one open banking service.

- As interest in open banking solutions is so high, a report by Forrester forecasts a doubling of their adoption between 2022 and 2027 in Europe.

- In the US, the Consumer Financial Protection Bureau (CFPB) will allow consumers to seamlessly switch financial services providers by requiring banks and fintechs to share their data with other providers when consumers request it.

Benefits of Open Banking

The benefits of Open banking point to markedly improved financial freedom and control. Open banking APIs can facilitate data sharing, remove friction in financial processes, like account validation, fraud detection and payment authorization. The perks apply both to individuals in their personal finance and to SMEs in their business management.

Among the benefits of Open Banking for individuals, we can list:

- Convenience: open banking solutions allow customers to access all their financial information in one place, through a single application. No need to switch between multiple bank accounts to manage their finances.

- Control: open banking enables customers to share their financial data with 3rd-party providers, who can then offer financial products and services tailored to their real-time needs. This enables customers to feel more valued and in a position to make better informed decisions.

- Lower costs: several open banking providers, such as certain neobanks and new financial players, are gaining a competitive edge by offering lower fees and better exchange rates than traditional banks

Open banking solutions for businesses

More and more organizations are adopting open banking solutions to meet their financial and administrative needs, from powering their investor experience to managing their payments infrastructure. As one of Europe’s most promising technologies, open banking is providing more control and flexibility in small and medium business processes.

The best part? We’re just scratching the surface of its potential. Here are a few ways businesses can leverage open banking to drive growth and innovation:

- Faster settlement: many business owners have to deal with the waiting times of funds settling, and open banking solves this problem by offering instant settlements. Companies are now empowered to receive their money the way they need it, when they need it.

- No chargebacks: chargebacks can impose a reputational risk on companies by affecting their future payment processing rates. By not offering chargebacks, open banking preserves businesses while protecting customers.

- APIs: Open Banking APIs give access to more information about their users’ finances and habits, enabling companies and financial institutions to offer tailored, individualized services. A pivotal element, considering how much business owners are looking for personalization in financial services.

Strands Open Banking solutions

Data is indisputable nowadays, and banks need to think about the best ways to collect it, analyze it and transform it to reach new heights in their customers’ financial awareness and control.

With our Open Finance solution, banks and financial institutions can leverage APIs and aggregation tools to build trust and reliability in their customers’ journey.

Individuals can merge multiple bank accounts in one location, and get a holistic view of their finances thanks to our third-party aggregation partners. Business owners, whether small or medium entrepreneurs, can incorporate their invoicing provider to have all their invoices and bills automatically synchronized. We select the best aggregators in every geographic region to provide the best possible experience.

Gain a competitive edge by offering better products and services to your customers, and become their primary touchpoint. Find out how we can help you create an open finance ecosystem.

Takeaways

Open banking is undoubtedly a powerful driver of innovation in digital banking. Personalization of products and services, smoother decision-making, convenience and control are not even all the benefits that it can offer to retail and business customers.

Some may point to a certain distrust regarding safety, however, through substantial authentication requirements, strict protocols are enabling an increasingly safe experience. Enabling this process doesn’t mean putting one’s data at risk, but rather gaining a whole new power to manage personal and business funds.

And it’s not just consumers and businesses benefitting from Open Banking solutions. These technologies also bring endless opportunities within the financial market and other industries. They can seamlessly help banks, financial institutions and fintech companies simplify and automate processes, from identity verification, through account aggregation, personal financial management, lending services and credit reporting, allowing them to upscale their manual tasks and input.

Interested in how we can help you?