Across the retail banking industry, the battle for core deposits has reached unprecedented levels, commanding the attention of leadership teams. With funding costs on the rise, deposit outflows accelerating, and margins under pressure, financial institutions are compelled to reevaluate their priorities, elevating deposit acquisition to the forefront.

McKinsey’s recent study underscores the urgency of the situation. Over 60% of potential deposits are held in motion by two pivotal customer segments, the young segment with high incomes and middle age segment with high incomes. It emphasizes that banks will attract and retain deposits more effectively if their strategies are tailored to meet the unique needs of each customer segment.

Unveiling Strategies for Deposit Acquisition

In this section, we unveil three pivotal strategies for deposit acquisition, each designed to address the unique challenges of the current banking environment. These strategies form a cohesive framework, empowering banks to not only attract deposits but to do so with precision and agility.

Segmentation Analysis: Navigating Diverse Customer Landscapes

Embark on a journey of meticulous examination as we delve into the first strategy: Segmentation Analysis. Discover how identifying distinct customer groups, understanding their nuanced preferences, and tailoring strategies accordingly can be the cornerstone of effective deposit acquisition. By recognizing the diversity within your customer base, you unlock the potential for targeted and personalized engagement.

Personalized Rate Structures: Beyond Generic Promotions

The second strategy, Personalized Rate Structures, invites you to move beyond generic promotional rates. Explore how developing bespoke rate structures aligned with identified customer segments elevates your approach to deposit acquisition. Tailoring rates to specific preferences ensures a resonance that goes beyond conventional promotions, fostering lasting connections and attracting deposits with precision.

Real-time Adjustments: The Power of Responsiveness

Finally, we explore the dynamics of Real-time by implementing systems that enable instantaneous adjustments based on customer behaviors and financial activities. Uncovering the transformative impact of staying relevant and responsive in a fast-paced banking environment, lies the ability to adapt in real-time and becomes a strategic advantage in the battle for deposits and customer loyalty.

In this dynamic scenario, where traditional approaches fall short, the battle for deposits demands a fresh perspective centered around customer engagement. The shift lies in delivering tailored solutions and experiences based on customer behavior, addressing the unique needs of diverse customer segments—a pivotal factor in attracting and retaining deposits. As the banking landscape undergoes transformation, the keys to victory are tailored experiences and product innovation in this era of heightened competition.

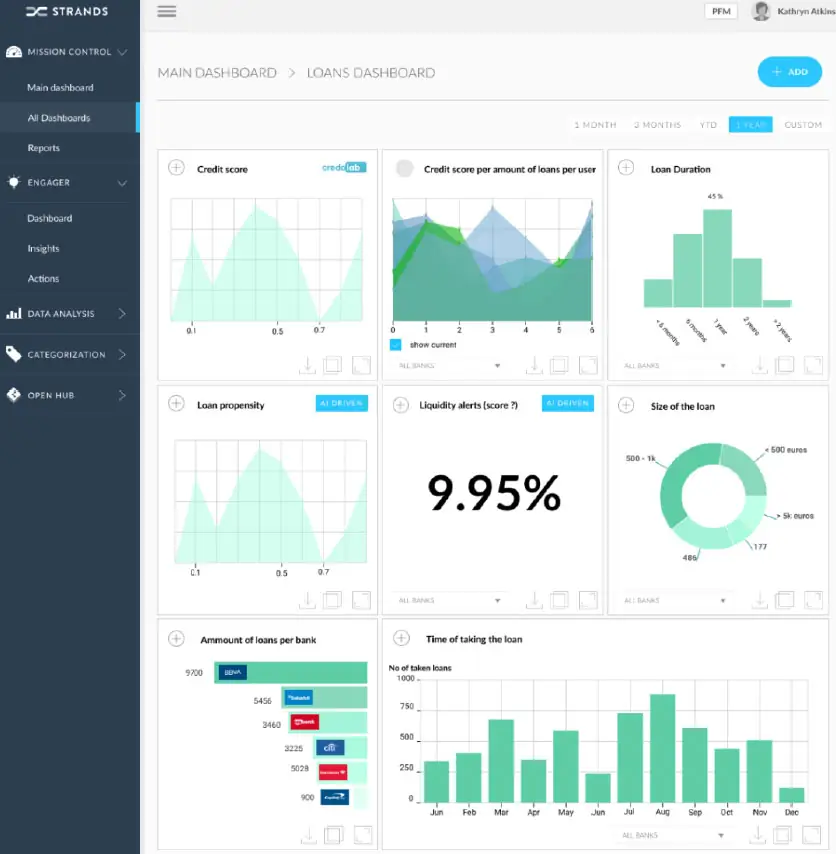

Strands Engager: Hyper-Personalized Insights Solution

Strands Engager stands as the beacon of hyper-personalized engagement, facilitating real-time tailored interactions, essential for building enduring relationships and attracting deposits from these specific customer segments. By analyzing customer behavior and transaction patterns, Strands Engager provides retail banks with actionable, interactive and customizable insights. moving beyond conventional banking services.

Integrated with AI-driven technology, Strands’ Engager empowers banks to offer more than just financial services. With personalized financial advice, customized insights into spending patterns, and real-time proactive alerts, retail banks enhance the customer experience, fortifying the bond between the bank and its clients. Interactive features embedded in mobile apps contribute to a seamless and enjoyable banking experience.

With Engager Back Office Platform “no-code” capabilities, banks can easily and autonomously generate actionable insights without coding skills nor technical expertise. The platform offers a range of pre-built templates that have proven their effectiveness, serving as a quick starting point aligned with banks’ strategies and objectives. Banks can create new insights from scratch using a no-code approach, selecting and triggering elements specific to their strategy, seasonality, and customer segments. This autonomy enables the creation of highly personalized insights that engage customers.

Multi Banking insights: Open Hub

By leveraging multiple sources of data, Strands Open Hub empowers banks to uncover patterns, trends, and correlations, enabling more personalized recommendations and tailored offers. Anticipating customer needs allows banks to proactively address requirements, enhancing satisfaction and loyalty.

Strands supports retail banks in implementing robust and secure API integration, enabling customers to securely access and control their financial data from multiple accounts. This user-friendly experience empowers customers to effortlessly manage their accounts and deposits from various banks while maintaining control from one single platform: yours. Strands’ commitment to staying at the forefront of open banking trends positions retail banks to adapt and thrive in an evolving financial landscape.

Feel free to contact us for further details!

Ask an Expert

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.