The banking industry finds itself at a pivotal juncture amidst rapid shifts in consumer preferences and technological advancements. Within this dynamic landscape, customer experience emerges as a paramount concern, especially with escalating competition. Customers now demand the same level of seamless, convenient service from their financial institutions as they receive from digital providers, reshaping industry expectations.

For traditional banks burdened by legacy systems, keeping pace with agile, cloud-native challengers proves challenging. Fragmented systems and product-centric models hinder their ability to compete effectively. To address this challenge, incumbent banks face critical decisions: transform legacy systems, adopt cloud-based solutions to bridge the gap, or build cloud-native infrastructure from scratch.

Strands’ SaaS solution offers a compelling path forward, delivering the agility, flexibility, and innovation capabilities lacking in legacy systems. By embracing cloud-ready technology, banks can escape the constraints of lengthy release cycles and isolated data silos. Instead, they can harness the power of data categorization and enrichment, and a robust interactive ecosystem to swiftly craft hyper-personalized customer experiences and drive growth through enhanced digital engagement.

Leading banks are already charting a course towards future-proofing through SaaS and cloud adoption, recognizing its potential to reshape their value proposition and realign around customer needs. Those lagging behind risk falling short as competitors redefine consumer expectations. Ultimately, cloud banking stands as a transformative catalyst, enabling incumbent banks to revolutionize their approach and thrive in the evolving banking landscape.

Plug-and-play Customer Centric approach with Strands

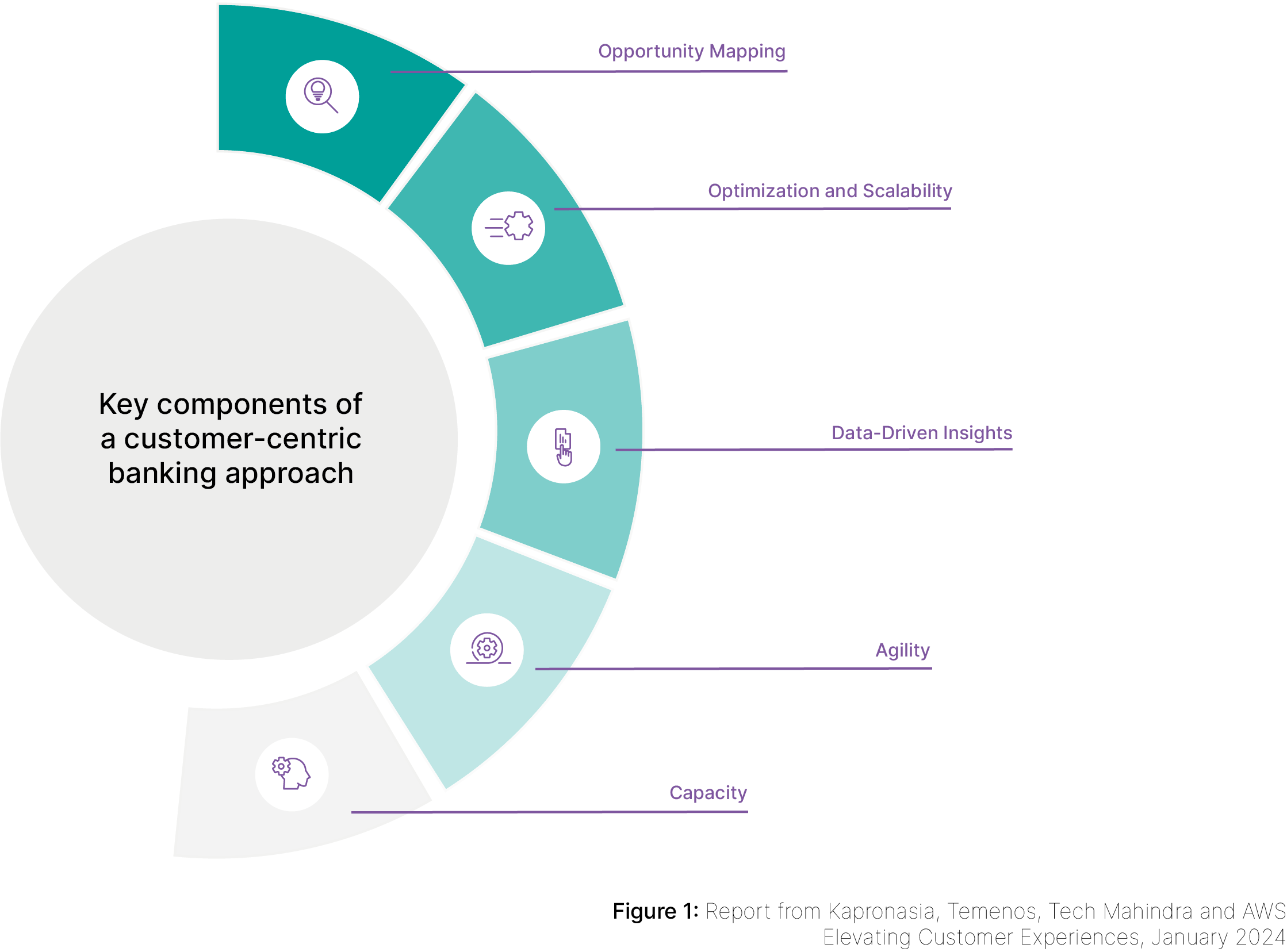

In today’s digital era, customer expectations are evolving at an unprecedented pace, fueled by personalized experiences delivered by tech giants and e-commerce leaders. Customers now expect banks to provide the same level of tailored service and seamless interactions, driving a paradigm shift towards customer-centricity within the banking industry.

Legacy banks, focused on traditional revenue streams, often struggle to adapt to this customer-centric approach, leading to siloed operations and diminished innovation. In today’s competitive landscape, banks can no longer rely on generic products. Instead, they must enhance customer loyalty and drive profitability by offering tailored financial products, 24/7 service, and customized solutions.

Strands offers a modular and cloud-ready SaaS banking platform that allows financial institutions to tailor their digital offerings according to their unique needs and preferences. Plug-and-play best-in-class features and the highest security standards to deliver a seamless and secure banking experience to your retail and business customers.

This Strands’ cloud-ready banking SaaS technology presents a transformative opportunity for banks to enhance the customer experience by leveraging agility, flexibility, and innovation, boosting time to market and capitalizing on emerging opportunities more quickly. By leveraging these plug & play solutions and rapid feature delivery, banks can stay ahead of the competition and meet evolving customer expectations with ease.

Strands’ SaaS banking platform is designed to scale seamlessly, allowing banks to accommodate growing transaction volumes and user bases without compromising performance or reliability. With continuous improvements and updates, banks can ensure that their digital offerings remain competitive and relevant in today’s fast-paced market.

Revolutionize Your Customer Experience

With over 35 million customers served through Strands’ SaaS platform, banks can unlock new insights and opportunities for growth like never before. By harnessing the power of data categorization and enrichment and AI-driven insights, banks can deliver personalized experiences that resonate with retail and business customers and drive long-term loyalty.

Let us help you start your innovation journey by contacting us today

Ask an Expert

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.