As part of its recently updated growth plan, Strands is making a strategic move to offer its AI-driven digital money management solutions in a SaaS Software, plug & play model. With this approach, the company aims to optimize internal processes and make its highly-customizable FinTech solutions available to a broader group of financial institutions worldwide.

This move reflects Strands’ commitment to foster inclusive growth in the financial services industry. Traditional banks are facing cutthroat competition from challengers and Big Tech, and providing them with lower-cost, more accessible financial management solutions can empower them to reshape their customer relationships and consolidate their position in the market.

As such, the adoption of cloud-based solutions is poised to become one of the biggest banking trends this year. Here are the 4 reasons behind this industry shift:

- Cost efficiency

SaaS software solutions don’t require high internal IT investments. Lower running costs enable a more variable cost structure, which is very appealing to smaller financial institutions and could help them strengthen their digital capabilities and market position. - Shorter time to market

Plug & play solutions enable banks to bring more products to market faster. This technology allows them to support new implementations without the need to increase exponentially its IT staff, which can now focus on growing their business, rather than on implementation processes. - Scalability

SaaS solutions allow for more flexibility. Instead of committing to multiple, costly tools, financial institutions can now pick single services and benefit from continued releases that will constantly improve their online banking platform. - Open Banking strategy

Open Banking is unlocking new value with data-sharing, strategic partnerships, as well as an increasingly fruitful market. By investing in SaaS solutions, banks effectively position themselves to leverage an out-of-the box, open solution and connect with third-party services.

What about data protection?

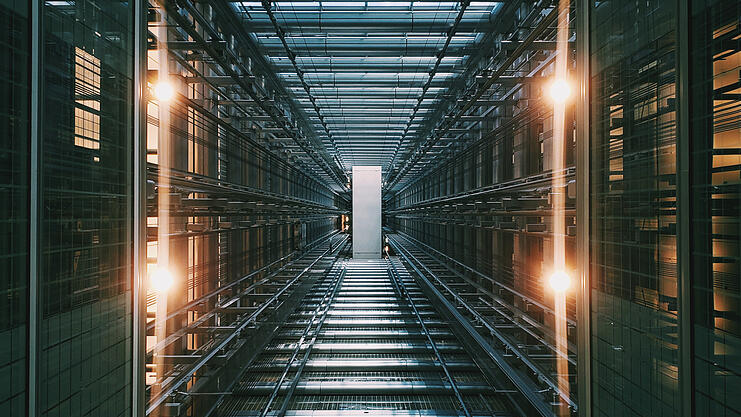

To meet the highest data security, privacy and availability requirements, Strands’ software solutions for retail and SME banking require robust infrastructure and databases. That is why, until recently, these solutions were only within reach of big banks with dedicated on-premise data centers.

As such, it is understandable to wonder if a cloud-based product suite can ensure the same levels of data security. And while Strands’ SaaS software package allows for a remarkable reduction in costs, it doesn’t jeopardize any sensitive data.

By leveraging CRIF’s private cloud, Strands guarantees state of the art data protection. CRIF, Strands’ parent company, brings over 30 years of expertise meeting the highest security standards. Also, the Group owns two datacenters, which are located in Italy and completely managed by its own team.

If you are interested in finding out how Strands can help your bank, or if you would like to get a Free Demo of our AI-powered Financial Management solutions, please fill out this form and one of our Sales Reps will get back to you as soon as possible.