Tracking, reporting and taking action on environmental, social, and governance (ESG) issues is increasingly important across industries. As these themes gain more attention from the community, banking and financial institutions executives should identify the steps required to build an optimal ESG strategy in banking. This includes considering how ESG in banking can be integrated into their general model, as well as exploring opportunities to develop new products and services that align with sustainable principles. Banks must now ensure that their policies are communicated clearly and transparently to all stakeholders, and that they have effective monitoring and reporting mechanisms in place to track their progress towards ESG goals. Overall, a strong focus on ESG in banking is critical for banks to remain competitive and meet the evolving needs and expectations of their stakeholders.

What is ESG in banking

ESG in banking refers to the integration of environmental, social, and governance factors into the strategies, operations, and decision-making processes of banks and financial institutions. More specifically, each character within ESG accounts for:

- E: all environmental criteria, including the energy that banks take and waste it discharges, the resources it needs and the consequences for living beings. Environmental criteria encompasses carbon emissions and climate change. As every company uses energy and resources, every company affects and is affected by the environment.

- S: social criteria, addressing the relationship banks and the reputation it fosters with people and other institutions. It includes labor relations, diversity and inclusion.

- G: governance criteria is the internal system of practices, controls and procedures companies adopt to govern themselves, make effective decisions by complying with the law and meeting the needs of external stakeholders. Every bank and financial institution is a legal creation which requires governance.

Just as ESG is a comprehensive view of how organizations act, the 3 elements shaping it are all interconnected. For example, social issues often overlap with environmental issues and with governance, when companies have to respond to environmental laws and broader concerns about sustainability.

ESG reporting: a regulatory overview

Banks and financial institutions are highly regulated, scrutinized and under growing pressure from new competitive forces with different business models. Governments, companies, banks and 196 countries adhered to the 2015 Paris Agreement to reduce emissions, become carbon neutral by 2025 and prevent an average global temperature rise of 2°C above the pre-industrial era.

In the EU, political agreement has been reached on the new Corporate Sustainability Reporting Directive (CSRD), in force since this year. The CSRD makes reporting mandatory for large EU companies of more than 250 employees and with €500 million annual turnover, and public and private non-EU companies.

In the UK, large companies with £36 million annual turnover, £18 million balance sheet total, or 250 employees are required to report on their UK energy use and carbon emissions within scope 1 and 2 within their annual reports through the Streamlined Energy and Carbon Reporting. Starting in this 2023, ESG reporting in the UK will be further formalized through the Sustainability Disclosure Requirements (SDRs).

In the US, there is a parallel, yet more limited move toward an expansion of mandatory ESG reporting obligations. The SEC (Securities and Exchange Commission) has adopted an approach that focuses on specific ESG topics, rather than requiring broad ESG reports. In particular, the SEC has proposed climate change and cybersecurity reporting rules.

Targeted ESG strategy for banks

The far-reaching impact of ESG issues and the comprehensive scope of ESG strategy in banking can be overwhelming. There isn’t a single ESG approach for all financial institutions. Instead, each bank should adopt a customized ESG strategy that aligns to its own purpose and mission.

Responding to customer demand and recognizing market need, CRIF has drawn on its experience and methodology as a global credit rating bureau and invested in research and development to design a new solution enabling clients to mitigate risk by validating the ESG information provided by their supply chain companies. The ESG score developed by CRIF validates and scores the supplier against five key areas: business, environmental, social, governance and industry.

In order to achieve an ESG score, suppliers are required to complete a detailed online self-assessment questionnaire, uploading documents and data via CRIF’s ESG digital platform.

A coordinated approach to cut carbon emissions

A coordinated ESG banking strategy encompasses the following main steps:

- Benchmarking: to identify where they are and where they want to be, banks should inventory their community initiatives, green products, fair-lending, consumer protection, and anti-money laundering compliance programs. They should conduct a thorough carbon management inventory of their own energy consumption and emissions within scope 1 and 2. Moreover, banks larger than $100 billion in assets should be identifying sources of information to include Scope 3 emissions data in their lending and investment portfolios.

- Disclosure preparation and assurance: as the ultimate outcome of a bank’s ESG efforts should be the development of regular external disclosures of ESG performance indicators complying with recognized standards, to meet stakeholder expectations, banks should consider establishing external assurance processes to validate the measured outcomes of their efforts as their programs mature.

Internal action, backed by external action

In the context of ESG in banking, a carbon manager can be an important component of a bank’s overall strategy, as it can help banks align their investments and lending activities with their sustainability goals. By identifying carbon-intensive assets and investments, banks can develop strategies to reduce their exposure to carbon risk and align their portfolios with a low-carbon economy. This can help banks manage their financial risks more effectively, improve their ESG performance, and strengthen their reputation as a socially responsible institution.

It’s now evident that banks must strive towards their green transition plans to build a more sustainable model. Carbon footprint is one metric that can help banks and financial institutions balance their impact on the environment while making more sustainable decisions. Using renewable energy, recycling waste, taking public transport and using less plastic are just some actions that can reduce our carbon footprint, help protect the environment and guarantee the resources people and other living things will need in the future.

On top of handling your own carbon management, as a bank, you can contribute to a more sustainable finance industry by raising awareness on environmental issues and promoting green finance and sustainable investments of your customers. The first step in this is tracking the co2 emissions of your customers, based on their spending, and keep them aware of them through your banking app.

Supporting your customers with a carbon tracker

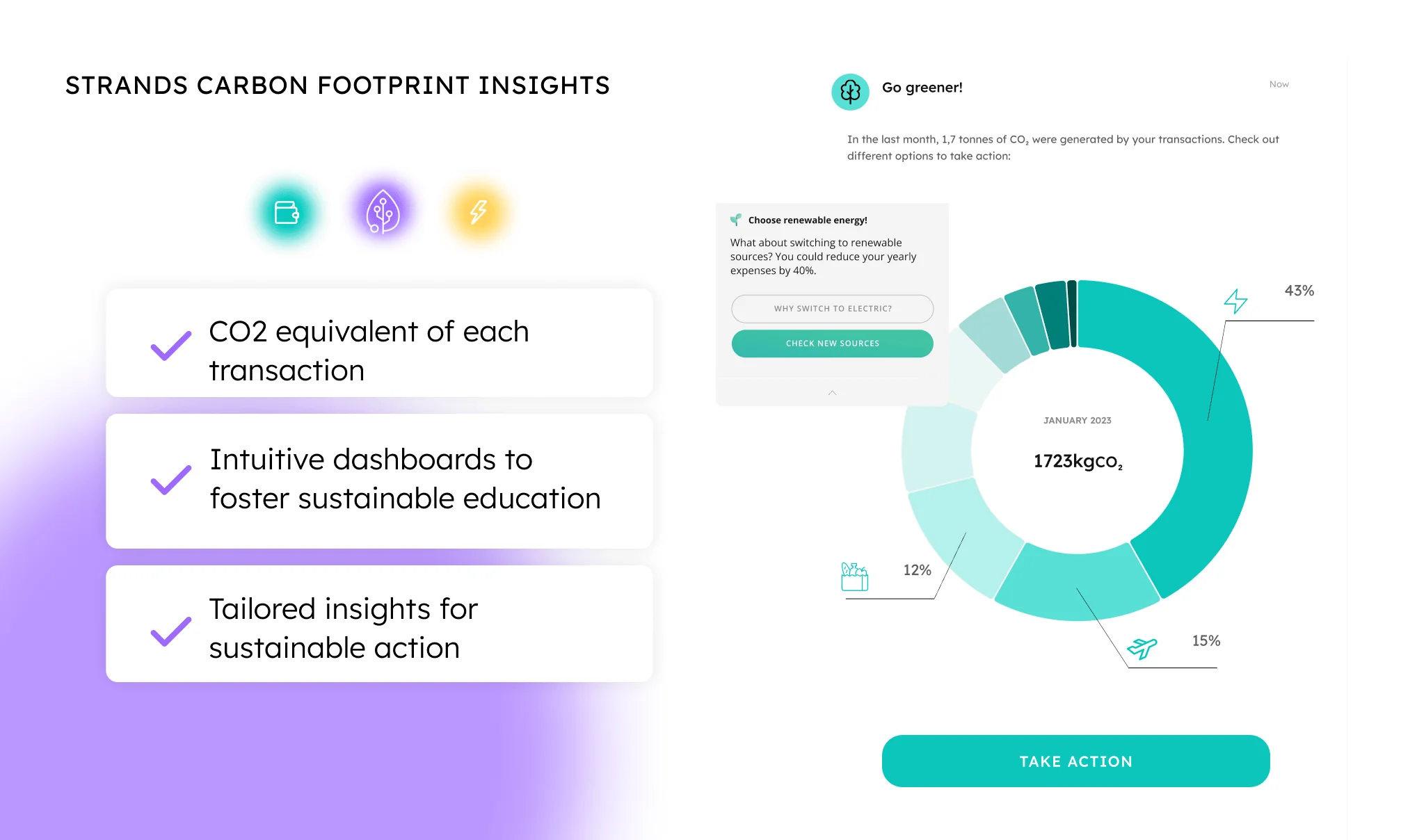

With Strands Carbon Footprint Insights, bank transaction and open bank’s data get enriched in three steps: amount identification, category calculation and co2 scope attribution, to provide a complete overview of the user’s spending-based emissions. New insights and suggestions are generated according to the user’s behavior, to advise them on the best next choices to take in order to take action and reduce their carbon footprint.

Informing your customers about their CO2 impact to promote environmental education and supporting them in having a more sustainable lifestyle has never been more easy!

Fostering sustainable choices

In the last year, 1 in 2 consumers spent an average of 59% more in sustainable or socially responsible products. Today, you have a chance to support your retail customers:

- Providing them a transaction categorization overview based on their carbon emissions

- Helping them to make informed decisions by sharing their top carbon spending categories

- Suggesting them how to take action, with personalized insights offering green products or services

Strands’ carbon manager and insights

At Strands, we know that taking action to reduce carbon emissions is crucial among several industries. That’s why we want to help banks and financial institutions integrate our Carbon Footprint Insights in their digital banking apps.

Discover how you can help retail customers:

- Track their carbon footprint based on their spending, with every transaction being turned into its CO2 equivalent.

- Make better-informed choices by showing them the carbon footprint of all their different purchases.

- Encourage them to set sustainable goals and recommend actions to offset their footprint.

Become a valuable partner for your customers in this sustainable era: