The climate crisis is transforming the way consumers shop – and also changing their banking habits. The 2022 survey by Deloitte finds Gen Z and millennials particularly concerned about the global situation and balancing the challenges of their lives with their desire to drive change. To grow, banks and financial institutions must find ways of engaging with their young customers and adapt to their banking habits while also aligning to their values.

Who are Gen Z and what are their banking habits?

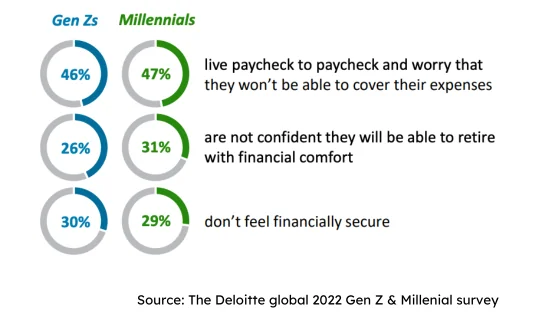

Generation Z consists of people born between 1997 and 2012. They follow on the heels of millennials, who were born between 1981 and 1996. As a result of the COVID-19 pandemic, members of Gen Z face a more uncertain future compared to previous generations. Figures show that 46% of GenZ and 47% of millennials live paycheck to paycheck and worry they won’t be able to cover their expenses. Though older Gen Z have firm plans for retirement, they haven’t gone very far in starting their savings for it.

A PwC survey about Europe Consumer Insights Series highlights which financial activities Gen Z conduct online. Among these we can find money transfers (40%), invoice payments (34%) and credit card requests (18%). Only 10% and 5% use internet banking for their financial planning or to get in touch with a financial advisor, which highlights the need to push for personalized banking services in order to better engage with them.

As for P2P payments, which showed a sharp increase in the last 2 years, Gen Z members prefer Paypal, Cash App (46%), Apple Pay (44%) and Venmo (40%). Usage continues to trend upward due to benefits such as overall convenience, speed of money transfer and peer usage of specific apps, which poses a challenge for traditional institutions in their banking evolution.

Digitalization is not just an option

According to a report by PWC, GenZ received their first smartphone at 10 years old and spend 9 hours in front of a screen every day. Life without smartphones and social media would simply be unimaginable for them. As this generation is now conquering the market and setting new standards, banks must rise to the challenge of attracting them through innovative, more personalized approaches.

Interestingly, Gen Z are turning to alternative methods to learn how to handle their finances. Based on a survey by GoBanking, they don’t believe they were properly educated on finance in school. As a result, over a third of them are learning how to manage their personal finance from social media (34% citing TikTok specifically) in comparison to 17% learning from a high school or college class.

This is a concerning trend that could mislead them and stresses the need for a traditional banking evolution enhancing financial services personalization and a more direct and reliable approach.

Aligning with new generations’ values

In order to foster engagement among young people, aligning to their values is as crucial as meeting their banking habits. According to Deloitte’s report, protecting the environment is a top priority for Gen Z and millennials. The vast majority (90%) of Gen Z and millennials are making an effort to reduce their personal impact on the planet with small everyday actions and don’t believe business and governments are as strongly committed. Many declare they’re ready to pay more for a product if it has sustainable benefits.

Carbon Footprint Tracker

Engaging with digital natives while providing sustainable solutions is something we pay careful attention to at Strands. We know the offset of carbon emissions is a shared goal among several industries, and that’s why we want to help banks and financial institutions integrate a Carbon Footprint Tracker into our product suite solutions.

Find out how you can help individuals and small to medium businesses:

- Track their carbon footprint based on their consumption habits

- Benefit from better-informed choices by showing them the carbon footprint of different purchases

- Encourage them to set sustainable goals and recommend actions to offset their footprint

Customers all around the world enhance their sustainable behavior with our Carbon Footprint Tracker. Interested in knowing how you can better connect with younger generations with our green banking solutions?