Foster stronger connections with environmentally-conscious customers

Analyze your customer base to discern green habits and preferences. gaining insights about their emissions from mobility, purchases etc.

Get assessed on how customers are purchasing goods, shedding light on potential areas for carbon footprint reduction.

Enable an accurate customer profiling and decreasing funding costs through bond market access.

Engaging customers through gamification and insights

Inspire customers to adopt sustainable financial habits thanks to gamification, tailored content and engaging challenges.

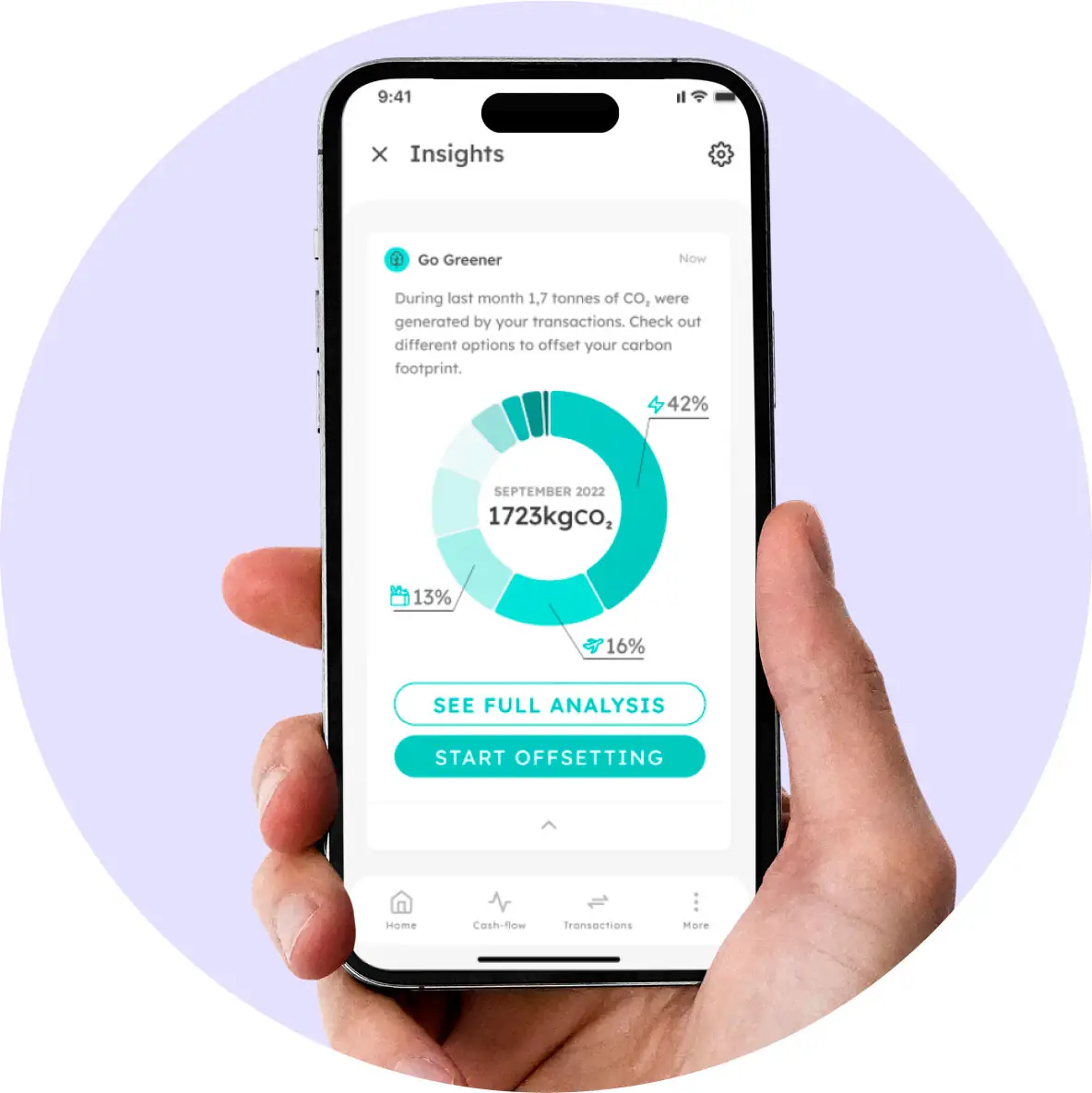

Make customers aware of their environmental impact by visualizing their finances alongside CO2 equivalence.

Encourage digital adoption providing additional details about their habits and preferences.

Support Cross-Selling with Sustainability

Guide customers in lifestyle changes and emission offsetting for a sustainable life while improving their financial wellness.

Personalize the approach empowering customers to make meaningful strides in reducing their carbon footprint.

Promote environmentally friendly products and alternatives and encourage green investments creating new revenue streams.

RESOURCES

Keep updated with our related digital banking resources

Unlocking Green Banking

In the current market context, individuals are actively pursuing avenues to minimize their carbon footprint…

Banking on banks

Inflation and rising prices are wreaking havoc on the finances of millions of beleaguered households across Europe today…

Digital Banking and Beyond: The Value of Personalization

Elevate customer engagement by leveraging Open Finance for data-driven interactions…

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.