The AI-driven, white-label solution has been authorized by HMRC to manage and submit tax obligations

Strands’ AI-driven BFM platform has been successfully authorized by HMRC to manage and submit tax obligations in the United Kingdom. With this certification, the white-label FinTech software developer holds a strong position to keep helping banks empower British SMEs to keep on top of their finances.

What is ‘Making Tax Digital’?

Each year, the United Kingdom government loses around nine billion pounds in unpaid taxes, most of which weren’t paid due to avoidable filing mistakes. As a result, HMRC, the U.K.’s tax, payments and customs authority, has introduced Making Tax Digital (MTD), a system that will change the way businesses in the country declare their taxes.

The MTD initiative aims to digitize the U.K.’s tax system. By 2021, all British SMEs will be required to maintain digital accounting records and to submit their returns using MTD-compatible accounting software, such as Strands’ business financial management (BFM) solution.

“Not long ago, many SMEs were using Excel files to calculate their taxes and submitted them physically. With the introduction of MTD, everything will be digitized and businesses will be able to file their tax returns through accessible, customer-centric FinTech platforms. This will make it easier for SME owners to keep track of their finances and get their tax right,” says Strands’ Head of Product Management Stefi Gual.

HMRC’s certification is yet another example of Strands’ product and engineering teams’ efforts to adapt the company’s white-label FinTech solutions to new regulations and to keep supporting banks in their digital transformation journey. BFM gets regularly updated with new functionalities, granting fast integration and onboarding processes.

How British SMEs can file tax returns using Strands’ BFM

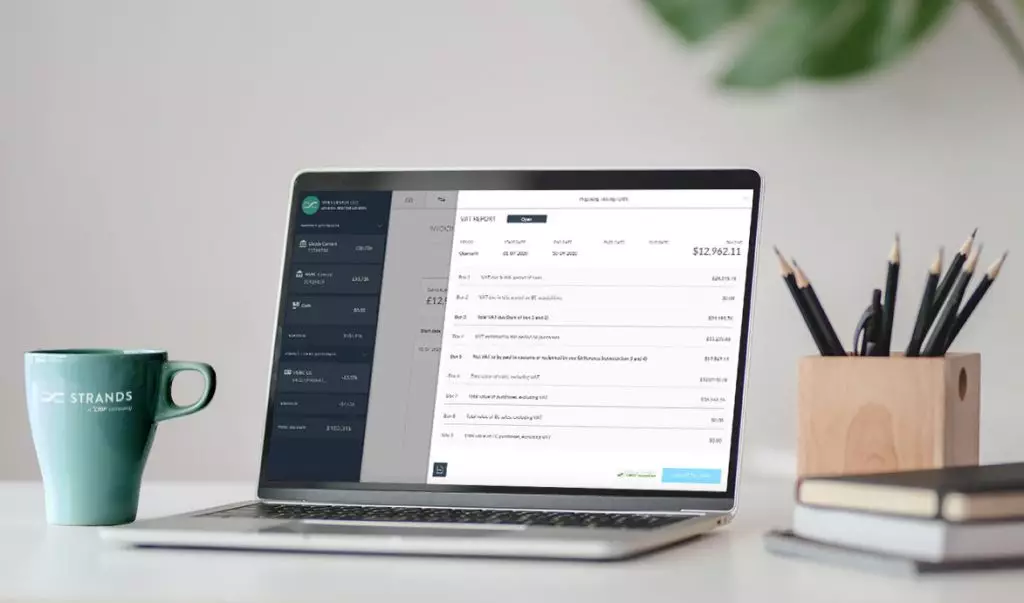

Strands’ AI-driven BFM provides a comprehensive dashboard that displays each customer’s total income and spending flow. However, thanks to Open Banking, this data isn’t limited to a user’s primary bank account. By leveraging Strands’ Open Hub solution, it is possible to connect external accounts and third-party services – such as accounting packages Quickbooks, Xero and Sage – into a single platform. This way, SMEs get a full view of their cash flow situation, income, and expenses, which is essential to properly manage a business.

Furthermore, thanks to Strands’ artificial intelligence capabilities, BFM is able to reconcile transactions with specific invoices. Without leaving their primary bank’s application, small businesses can create invoices, check their status, and file them with the tax authorities.

Strands’ BFM allows SME owners to declare taxes and submit MTD returns to HMRC in three simple steps.

- Register the SME with HMRC. The obtained username and password will allow the user to log into BFM and to connect the platform to HMRC.

- Let the system read and classify quarterly invoices, calculate tax returns and liabilities, and fill every box required by HMRC.

- Review the suggested file and confirm everything is correct. Clicking on “submit” will be enough to declare taxes.

Through Strands’ Engager engine, BFM is also capable of generating insights. This is incredibly helpful for those companies that require some financial advice. For instance, the solution’s personalized alerts let SMEs know about expected payments, potential liquidity issues, or cash flow forecasts. By combining this technology with features such as a calendar and BFM’s transaction categorization engine, SME owners can easily understand where their money is coming from and where it is going.

Now more than ever, BFM allows SMEs to spend less money and time in accounting, and to focus on what really matters: growing their business.