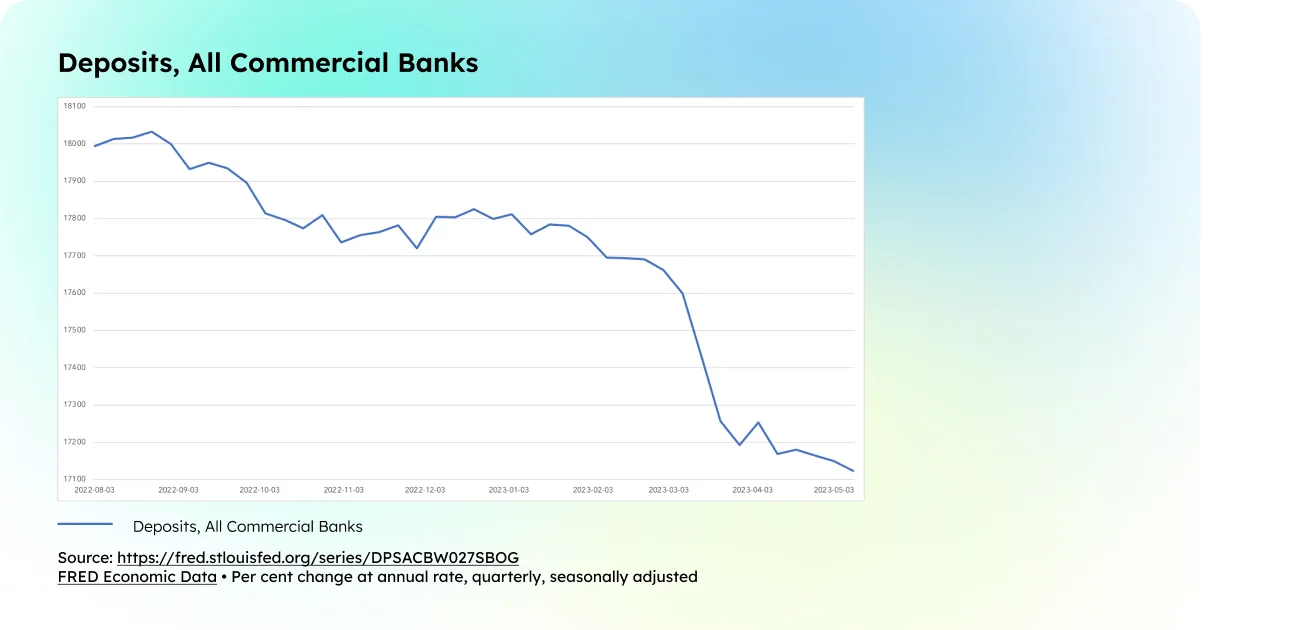

Ever since last October, banks are starting to feel the struggle to retain and grow customer deposits worldwide. But with the current digital landscape, increasing interest rates might not be enough to retain customers and keep customer deposits afloat. Banks will need to not only keep security and risk management at their core when it comes to money saving capabilities, but also put a focus on connecting with customers at deeper levels.

Reimagining Customer Acquisition Strategies

Surprisingly, a recent study by the BSA revealed that 23% of savers don’t even bother to check the interest rates before opening an account. Instead, customers yearn for genuine connections and top-notch personalized guidance.

Forrester research also unveiled that 75% of surveyed Europeans believe their banks don’t act in their best interest. To dominate the deposits war, banks must recognize that incentives alone won’t suffice. They need to embrace innovation and hyper-personalization to differentiate themselves and outshine the competition.

Branding: A Gateway to Success

Increasingly, customers are trusting banks and financial institutions based on their brand identity, as it is consistently conveyed throughout the entire end-to-end customer experience that they perceive. In instances where a product fails to meet expectations, banks rely on the values and mission statement outlined in their brand guidelines to guide their response. This encompasses the bank’s problem-solving approach, the insights provided to the customer, the range of services made available… Ultimately, the key factor lies in how effectively the bank communicates its genuine concern and care to the customer.

However, initiating the branding process from its foundation may appear costly and time-consuming, further compounded by the fact that it entails collaboration beyond the scope of the marketing team. Branding is not just about more than mere aesthetics; it embodies the fundamental essence of an organization and should permeate throughout its entire hierarchical structure.

Many worldwide banks decide to rely on fintech’s expertise to help their financial entity engage with customers and forward that mission. Collaborative partnerships have demonstrated their value in the branding process, not only expediting its progress through the partner’s robust value proposition but also infusing creativity from external influences. This collaborative approach empowers banks to establish a distinct voice that aligns with their branding objectives.

The role of hyper-personalization

In spite of the fact that branding is indeed a way to differentiate an institution, the core banking products need to be current with the latest technological advancements and meet customer expectations. This alignment between branding and product development ensures that they can effectively distinguish themselves from the competition and reach the ultimate goal: customer loyalty.

To foster complete customer satisfaction and trust in depositing funds, banks must prioritize assisting customers in enhancing their financial well-being. Leveraging customer financial data to generate actionable insights is key to achieving this objective. These insights can be utilized to provide timely and relevant financial advice tailored to the customer’s specific needs. By addressing deposit-related challenges and identifying instances when customers have surplus cash that can be transferred to their savings accounts, banks can foster engagement, cultivate loyalty, and increase the likelihood of customers retaining their savings within the bank.

In the race to enhance deposits within their client base, banks must gain a deep understanding of optimal opportunities by refining their brand proposition and implementing data-driven personalization strategies. It’s evident that this endeavor is far more complex than following a traditional approach. If you’re eager to learn how Strands can help you deliver more customer-centric saving capabilities and engage with customers proactively and efficiently while leveraging your brand identity, our experts are ready to assist you. Fill out the form below to get in touch and explore the possibilities.

Ask an Expert

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.