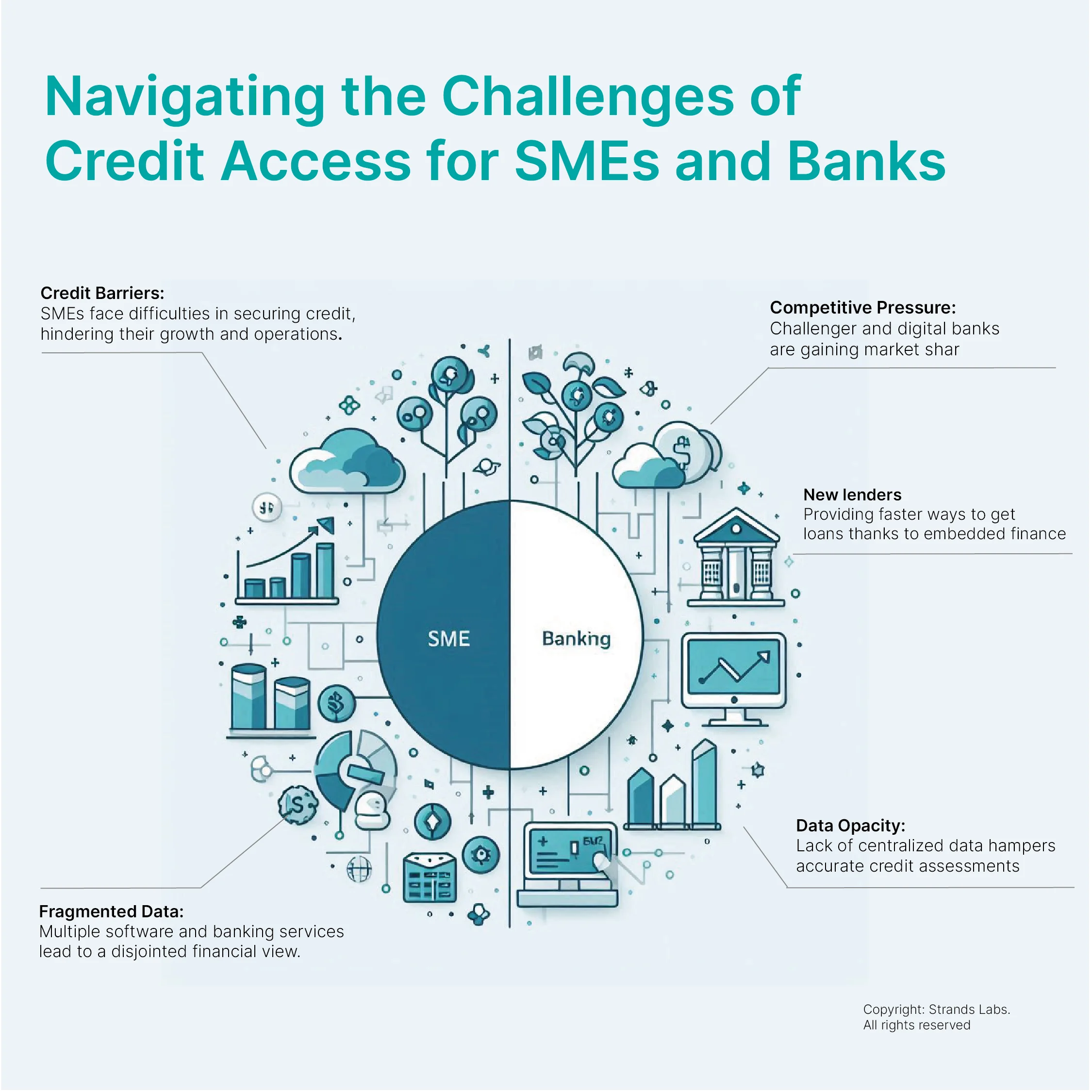

Credit access remains one of the most significant challenges for both small and medium-sized enterprises (SMEs) and financial institutions. SMEs frequently encounter barriers when seeking credit, which can significantly hinder their ability to expand and sustain operations.

Simultaneously, banks and financial institutions struggle with assessing the creditworthiness of SMEs due to fragmented data and insufficient financial insights. This dual challenge necessitates innovative solutions that can bridge the gap between SMEs and lenders.

Enhancing Credit Access with Strands Compass: A Solution for Banks and SMEs Alike

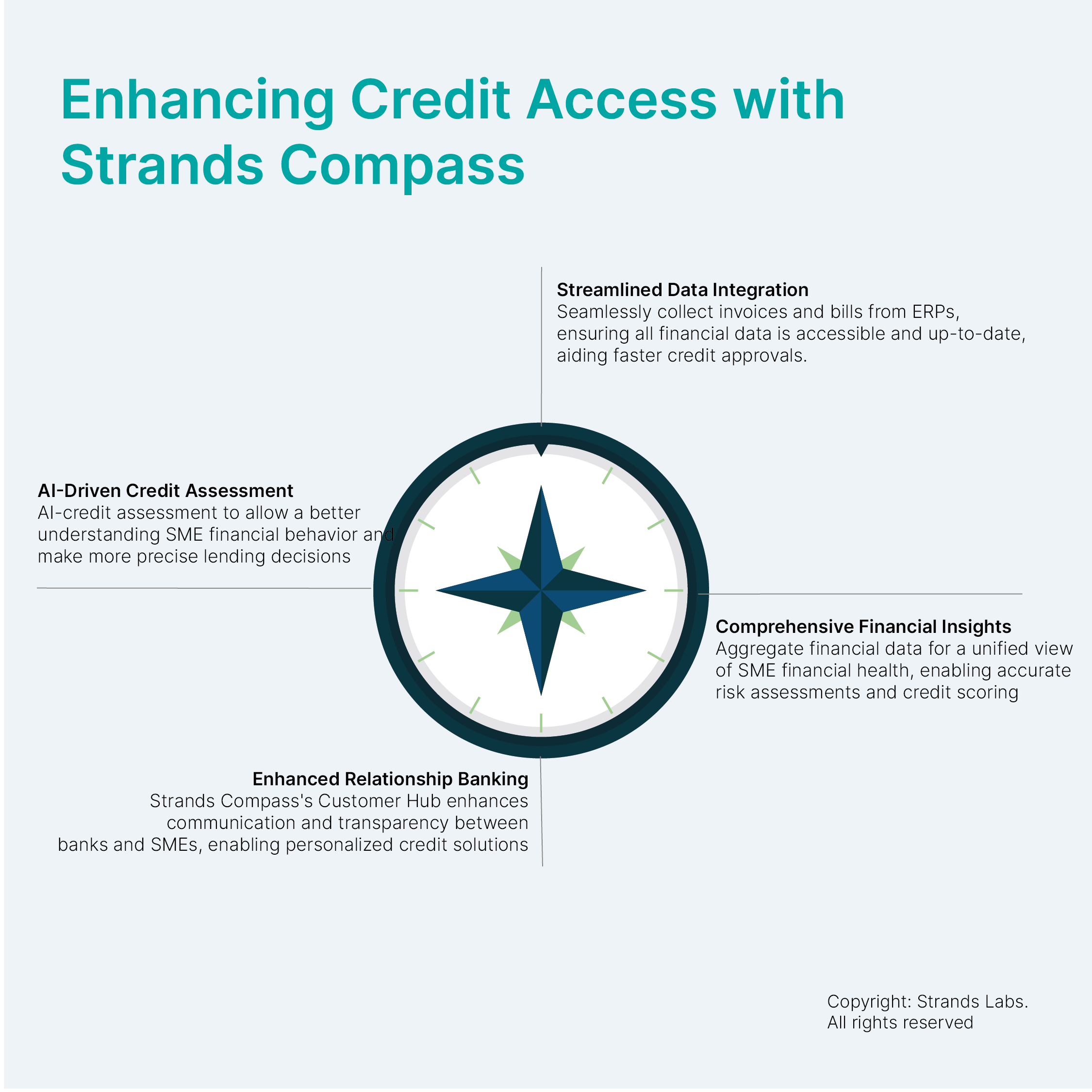

Strands Compass is designed to tackle these challenges, among others head-on by providing a suite of integrated tools and features that enhance credit access and streamline the credit granting process.

Transforming the Credit Access Landscape with Strands Compass

Implementing Strands Compass can significantly benefit both SMEs and financial institutions, creating a transformative impact on the credit access landscape. For SMEs, Strands Compass means increased loan approvals with a lower risk for Banks and Financial Institutions, and, of course, a better efficiency in credit approval processes. By providing a more accurate financial profiling and improving risk assessments, the platform enables Banks and Financial Institutions to provide a better overview of the SME worthy to access a credit line and also helps SMEs to access credit more easily, fostering business growth and stability.

For banks, the benefits are equally profound. Strands Compass reduces the risk of lending through enhanced credit assessment processes, allowing banks to confidently extend credit to deserving SMEs. Moreover, adopting this cutting-edge technology gives banks a competitive advantage, enabling them to stay ahead of challenger banks and fintech competitors by offering superior and more adequate lending solutions to their SME customers.

Strands Compass is revolutionizing the credit access landscape for both SMEs and banks. By providing to the bank integrated financial insights about SME financial health, AI-driven credit assessments, and an enhanced relationship platform that strengthen the communication with their SME customers, Strands Compass bridges the gap between SMEs and lenders, fostering a healthier, more dynamic financial ecosystem.

Empower your bank and SME clients with Strands Compass – the future of digital banking solutions. Contact us now to learn how we can transform your relationship with SME customers.

Contact us now to learn how we can transform your relation with SME customers.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.