Traditional banking is being challenged by the ever-growing digitalization of financial services. Neobanks, often referred to as “challenger banks”, compete with traditional banks because they offer 100% online and thus easily accessible banking services, which poses a real threat to banks struggling to adapt to the market.

What is a neobank

A neobank is any financial institution that delivers its services exclusively digitally, cutting down on operating costs to offer lower fees and higher interest rates. At the expense of lacking a physical branch, neobanks gain competitive advantage being convenient and easy to use.

Neobanks vs. Online banks

Neobanks are often confused with online banks, as they both deliver banking services online. However, there is a difference between these two terms.

- Online banking: this term refers to the digital channel through which almost all traditional banks offer most services traditionally available to their users.

- Neobanking: being 100% digital, neobanks put more focus on user experience to offer a more nimble and transparent service, which may strongly appeal to the needs for banking personalization of the youngest generations.

The neobanking industry has been on the rise since the COVID-19 pandemic and the growing demand for digital financial services. According to a study by eMarketer (Insider Intelligence), the US has one of the highest numbers of digital-only bank account holders at 29.8 million. It is expected to retain this growth due to the country’s massive population and the fact that the US has one of the world’s oldest digital-only banks. Overall, there will be 47.8 million digital-only bank account holders in the US by 2024, accounting for 17.9% of the national population. However, traditional banks still have many advantages in the battle to improve the financial wellness of their customers.

Strengths and vulnerabilities of neobanks

The revolution of digital banking has created new expectations for us all. Having a digital presence can be an advantage for most banks, but operating online-only might come at a cost. Here are some benefits and vulnerabilities of neobanks:

Benefits of Neobanks

- Lower fees and higher rates: with no branch maintenance costs, fewer regulations and no credit risks, neobanks can benefit from fewer operational costs.

- Time saving: innovation and technology allow processes that usually take up some time, such as loan requests.

- Seamless experience: neobanks put most of their business focus on improving UX, which results in an optimized interface and easy 24/7 access.

Neobanks are particularly successful in markets where most people never had a bank account, but 7 out of 10 people own a mobile phone. In an article published on World Finance, emerging markets such as South America prove to be solid ground for them. In December 2021, Brazil’s Nubank became the most valuable financial firm in South America with a valuation of almost $50bn and over 50 million users.

Vulnerabilities of Neobanks

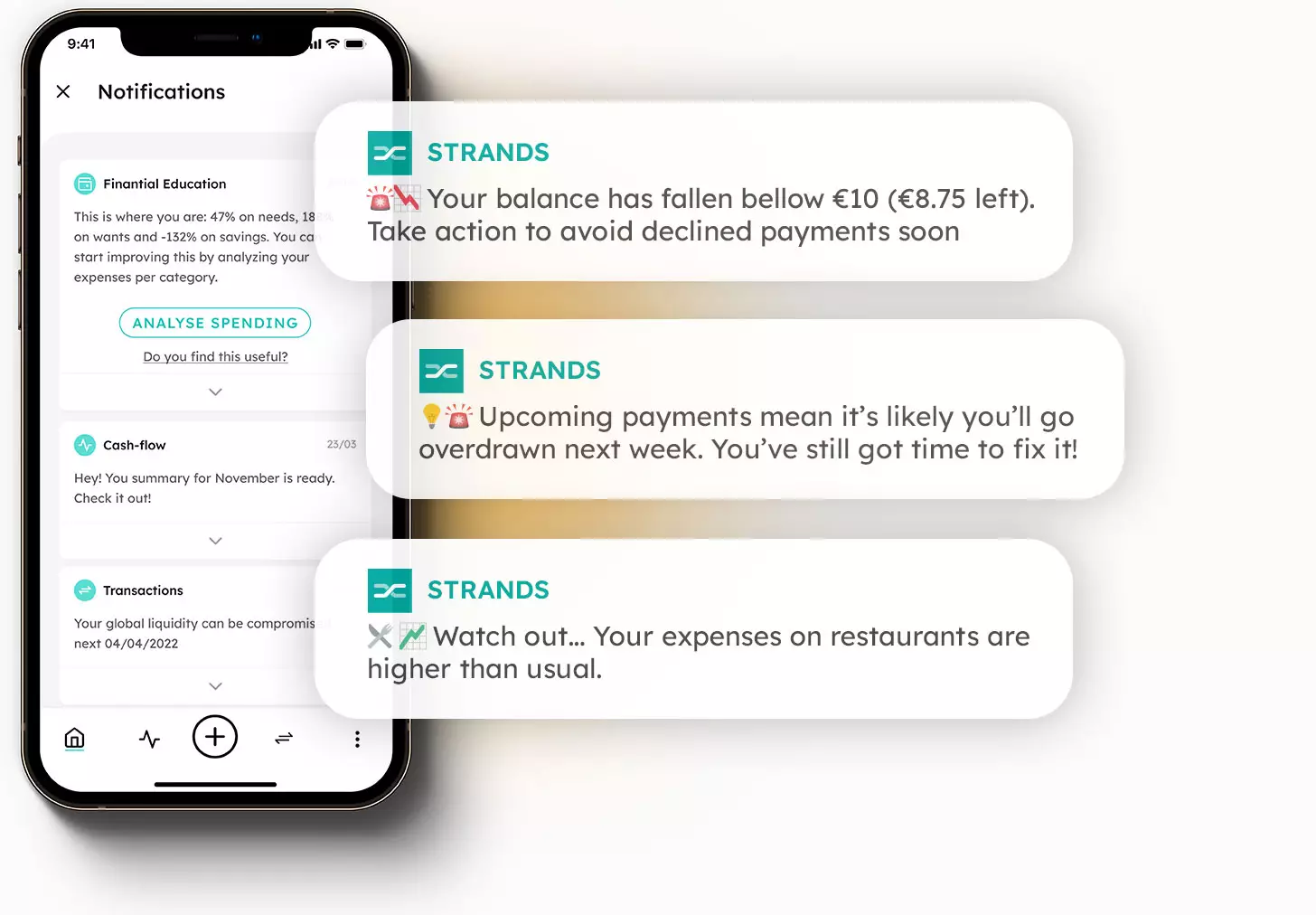

- Lack of personal touch: not having a physical branch may come as an advantage for the operational business models of neobanks, but using a machine alone may inspire distrust, especially when it comes to complex financial matters. That’s why Strands has developed a solution that provides actionable insights to your customers, tailored to their individual needs. All they will have to do is click on their push-notifications and choose from a selection of ad-hoc tips: smart advice, made easy and reliable.

- Technological education: digital and mobile banking services are not intuitive for everyone. With neobanks, the oldest generation may struggle to perform even the simplest actions, such as a transaction online. At Strands, we provide educational insights based on your customers’ spending habits to engage with them effectively, no matter their digital education. All in a simple, seamless interface.

A personal touch

With neobanks taking the lead on digital banking technology, traditional banks must look for ways to adapt to the market via personalized digital banking solutions. Partnering with fintechs that will help you accelerate the process is a great way to learn how to market your financial services online. At Strands, we have developed a set of groundbreaking solutions to keep you connected to each of your customers’ needs. With our innovative Engager, your customers will receive push-notifications with personalized banking insights and educational tips based on their spending behavior – all in real time and directly on their phone or computer. Whether you have a physical branch or not, Strands can gear you up with the right tools to make your customers feel safe and in control.

Are you interested in learning more about how partnering with Strands can benefit your bank? Request a demo and one of our sales reps will get back to you as soon as possible.