In order to succeed in the lucrative SME banking segment, financial management solutions need to make a difference in customers’ lives.

The short answer to the question in the headline would be: “by granting them access to solutions for whatever financial need they may have.” The longer answer is a little more complex and leads us to another question: Who should lead the Open Banking movement and make its advantages available to SMEs?

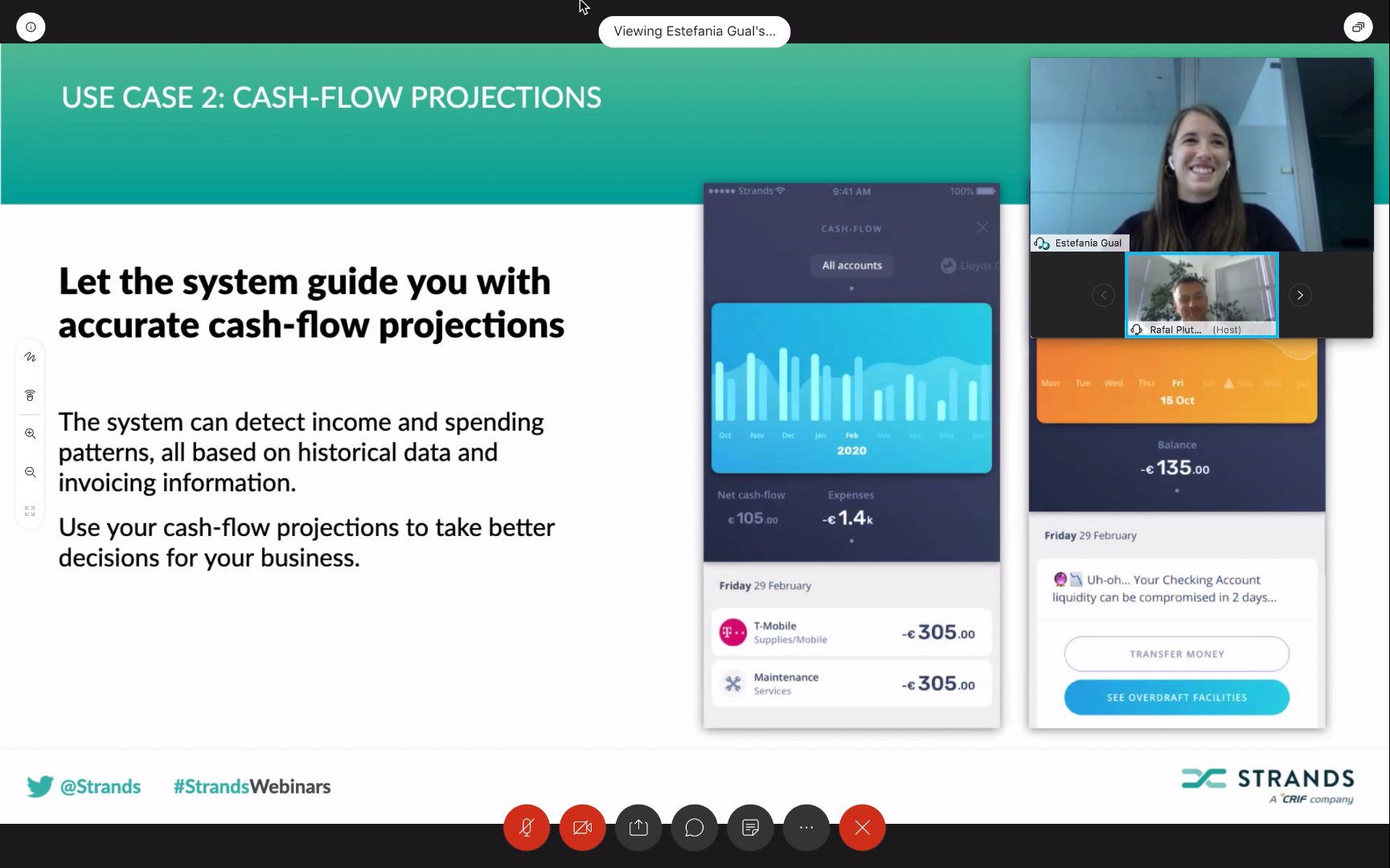

Earlier this week, Rafal Plutecki, Head of Banking & Insurance at CRIF Poland, and Stefi Gual, Head of Product Management at Strands, hosted a webinar focused on what Open Banking could mean for the SME banking segment, particularly in the Polish market. Rafal and Stefi discussed Open Banking functionalities, the banking needs of small businesses, and why it’s so important for banks to aim attention to the SME market segment. If you missed it, worry no more. Here are some highlights from the conversation.

SMEs: An underserved segment

SMEs represent a highly valuable segment for financial institutions. Data shows that over 500 million SMEs all over the world generate over 50% of total employment, as well as yearly revenue of around 46 trillion dollars. However, most SMEs are not properly served by their banks and are forced to look for alternative ways to get their needs met.

For instance, cash flow forecasting is a critical pain point for SMEs. A lot of these businesses also lack formal access to credit and financial advice from their banks. This context has led countless financial technology (FinTech) companies to step in and build the solutions that SMEs needed and weren’t getting from their banks.

With the launch of Open Banking, many of these companies have made strides in this lucrative market segment, and have found themselves inhabiting the ground between banks and their customers. For example, accounting platforms often provide financial services to SMEs without a banking license.

In other words, the Open Banking regulation fostered innovation and allowed new players to enter the financial services space. It opened the market and made it more dynamic.

Challenges of crafting a real value proposition

This obviously poses some challenges to financial institutions. With so many FinTech solutions available, succeeding in the SME banking segment doesn’t come down to having a robust brand and being well-positioned in the market. Now, financial management solutions need to bring value and make an actual difference in customers’ lives. A truly customer-centric approach is not a “nice to have”, it’s a must.

Secondly, if banks are really committed to crafting a value proposition and helping their SME customers –and if they want a real chance of beating challengers and FinTechs–, they need to invest in technology and adapt to this new framework. Any financial institution that wants to open their APIs needs to have the corresponding infrastructure in place. And that requires investment.

What’s in it for banks?

The good news is that banks are in a unique position to lead the Open Banking revolution and establish themselves as innovative actors. All they have to do is find the right partner to help them equip their SME customers with a business financial management (BFM) platform capable of aggregating third-party services and facilitating secure data sharing.

For starters, banks own an incredibly valuable asset: transactional data. AI and machine learning technologies allow data scientists to use this data to detect recurrences and establish patterns, which can help banks to better understand their customers, enhance their offering and make their products and services available for SMEs at the right time.

Another vantage point for banks is that SME owners would rather manage their finances from their primary bank’s application than through multiple third-party providers. Like we mentioned earlier, there are many different tools available for SMEs to manage their day-to-day activities, and many of these businesses are using a different solution for each task. The lust for convenience is a major asset for banks.

To sum up, by making an AI-driven BFM available to their SME customers, banks could leverage Open Banking to become a central marketplace and bring third-party services and offers to their SME customers. This would reduce operating costs, increase customer satisfaction and retention rates, boost revenue (deposits are 4 times greater), cross and upsell their products, and improve their underwriting capabilities.

Do you work in a financial institution and want to empower your most lucrative segment? If you are interested in finding out how Strands can help your bank, or if you would like to get a Free Demo of our AI-powered Financial Management solutions, please fill out this form and one of our Sales Reps will get back to you as soon as possible.