When will I receive my electricity bill? Why am I unable to save for that trip? Will I even make it to the end of the month?

These are recurring questions from a significant portion of your bank platform users. And they ask it repeatedly every single month.

So yes, financial wellness matters. Especially during periods of economic uncertainty when individuals’ economic health can be significantly affected.

This is one of the reasons why customers are becoming increasingly demanding, expecting their digital banking experience to be convenient, intuitive, and contextual.

Addressing financial wellness use cases with proper strategies has become essential in digital banking. Are you aware of the benefits of meeting these demands?

To learn the benefits and understand the different financial wellness use cases, we’ll take a closer look at a fictional character named Emily. We’ll explore how Strands solutions and technology can play a pivotal role in solving her financial concerns and helping her achieve her financial goals.

Financial wellness as a driver of engagement and adoption in digital banking

Improving your customers’ financial wellness helps boost engagement and enables you to establish relationship-based banking. The objective is to help customers enhance their financial wellness, through digital banking solutions or simply with better money-management habits.

In addition, by offering tailored financial insights and knowledge, you can enhance users’ financial literacy and confidence, and thus, you can significantly see an enhancement of your digital banking platform adoption.

If you’re considering improving this area, you must take into account two main solutions. A robust next-generation PFM that offers clear visibility of the financial situation to your users, with intuitive dashboards, financial calendars, and options to save money.

And also a solution that allows you to engage in direct conversations with them, in order to provide them with personalized advice in real-time to improve their financial management.

Benefits of the different Financial Wellness use cases for banks

The benefits of implementing a personalized strategy to address financial wellness are huge. Here are just some of the most common benefits of doing so:

- Adoption improvement

- Engagement increase

- Journey personalization

- Improved turnover (and loyalty)

- Advanced knowledge of your users

- Possibility of enriching your own CRM

- New cross-sell opportunities

- Revenue growth

Financial Wellness Use Case: Personalized Solutions for Emily

Let’s bring these concepts down to reality with the case of a fictitious persona, Emily.

Emily, a business student at the University of Illinois and part-time Walmart employee, loves eating out and traveling. Emily has specific financial goals and frustrations that her personal bank can address through tailored solutions. In addition, she’s worried about the environment and she’s looking to reduce her impact on the planet.

Emily, a business student at the University of Illinois and part-time Walmart employee, loves eating out and traveling. Emily has specific financial goals and frustrations that her personal bank can address through tailored solutions. In addition, she’s worried about the environment and she’s looking to reduce her impact on the planet.

Keep reading to explore how you, as a bank, can cater to Emily’s needs and provide a holistic banking experience:

Financial Planning and Savings

Emily’s frustration stems from her inability to save much money. The bank can offer personalized financial planning tools to help Emily create a budget, set savings goals, and track her progress.

Through the bank’s mobile app or online platform, you can send Emily real-time insights and recommendations on how to optimize her spending habits and save more effectively.

Budgets

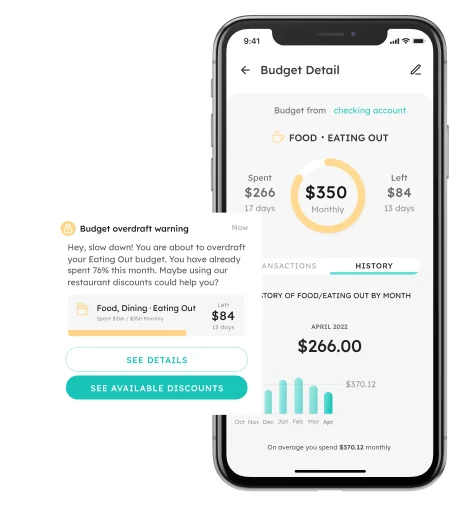

By allowing Emily to keep her expenses under control, you can boost her financial wellness significantly. With budget solutions, she’s able to create budgets to cut unnecessary expenses. Being aware of approaching limits in advance gives Emily, and other users with similar situations, the opportunity to act in time and optimize their overall financial health.

- Warn them if they’re approaching their budget limit in any category

- Allow them to take action, boosting their saving capacity

Goal-Based Savings for Travel

To fulfill Emily’s dream of traveling to Europe, you can introduce a Moneybox savings account specifically designed for her to allocate money anytime according to her different life goals.

In addition, she can set up periodic allocations or roundups of her purchases in those accounts to save money without realizing it. Her bank can also provide travel tips, exclusive offers, and even partner with travel agencies to assist Emily in planning her trip when she’s ready to release her savings.

MoneyBox

With MoneyBox, you can help Emily to put money aside for different personal goals by leveraging data-driven money management to help them stay on top of their financial game.

- Allow them to create one or multiple goals within their Moneybox

- Enable manual or periodical allocations, or roundups to the nearest unit

- Offer them the chance to realize the funds at their most convenient time

Financial Support for Moving Out

To support Emily’s goal of moving out from her parent’s house, you can provide different financial solutions like:

- Mortgage pre-approval services

- Renter’s insurance options

- Personalized loan offerings with competitive interest rates

- Guidance on finding affordable housing options

- Provide financial calculators

All these solutions will help Emily make more informed decisions and build a trusting relationship with her.

Socially Responsible Banking

Addressing Emily’s concern about the climate crisis and her belief that the world is unfair, the bank can emphasize its commitment to sustainability and corporate social responsibility. With Carbon Footprint Insights, Emily can track her carbon footprint from each purchase and be aware of changing her consumption habits accordingly.

You can also offer green banking options, such as paperless statements, carbon offset programs, and partnerships with environmentally conscious organizations.

Lifestyle Benefits and Partnerships

Understanding Emily’s interests in food, sports, social networks/influencers, and fashion, the bank can collaborate with local restaurants, sports teams, influencers, and fashion brands to offer exclusive discounts, rewards, and experiences tailored to her preferences. These partnerships enhance Emily’s banking experience and create a sense of personalized engagement with the bank beyond traditional financial services.

Final thoughts

By addressing Emily’s financial wellness and going beyond banking services, the bank can build a strong relationship with her. This personalized approach demonstrates that the bank understands her needs, values, and aspirations. It fosters long-term loyalty and positions itself as a trusted financial partner throughout her journey from student life to her professional career and beyond.

To achieve this, banks and financial institutions often don’t possess all the necessary technological infrastructure. They place trust in specialized Fintech companies to design tailored solutions that not only meet these requirements but also enhance customer engagement and loyalty.

If you’re keen on enhancing financial wellness use cases for your users, we encourage you to get in touch with one of our experts. They will provide you with personalized information tailored to your bank’s different needs.