According to an Accenture research, 75% of consumers are more likely to switch to a bank competitor that offers personalized services. This shows that engagement and loyalty are closely tied to the level of personalization their banking provider is bringing to them.

Engaging customers can be challenging for banks due to several factors. Not being aware of the digital banking benefits or the lack of personalized experiences can be some of the most common reasons that users don’t show much interest in digital banking platforms.

And it even gets more difficult when it comes to younger generation users, since they expect highly personalized and fast experiences. More than ever, building trust through personalized advice and delivering unique customer-centered experiences is crucial for a bank’s success.

Use case: Vincent, a Gen Z digital nomad

To learn how to increase engagement through personalization in digital banking, we’ll take a closer look at a fictional character named Vincent. We’ll explore how Strands solutions and technology can play a pivotal role in solving his financial needs through personalized advice.

Vincent is a 26-year-old guy from Lyon, France. He’s a freelancer video editor and became a digital nomad a year ago. He loves traveling and exploring new places all over the world, spending up to six months in one spot. Due to his environmental couniousness, he likes to get around by using bicycles and is always seeking for adopting new sustainable habits.

Vincent is a 26-year-old guy from Lyon, France. He’s a freelancer video editor and became a digital nomad a year ago. He loves traveling and exploring new places all over the world, spending up to six months in one spot. Due to his environmental couniousness, he likes to get around by using bicycles and is always seeking for adopting new sustainable habits.

Vincent, as well as his generation peers, is tech-savvy and adapts quickly to new technologies. He’s comfortable with exploring various options, which makes him open to switching his bank provider if he find better digital products or services.

Vincent expects very personalized and fast experiences. For this reason, banks that fail to deliver this level of personalization may struggle to engage with him and his peers.

How can you enhance Vincent’s engagement with your digital platform?

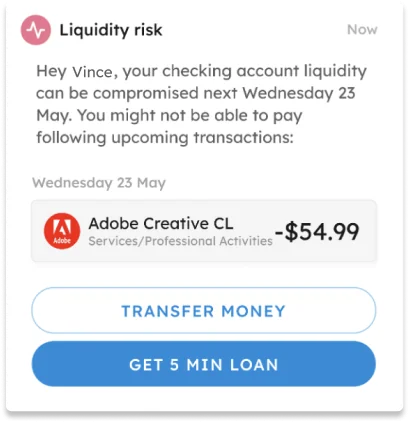

1.- Liquidity risk management:

Due to Vincent’s lifestyle and freelance work model, he can’t track nor anticipate his income and spending with certainty.

Through AI and ML technologies, Strands solutions are able to extract, analyze and enrich transactional data and to identify patterns and predict financial changes.

With Strands Engager, you can use this information to send real-time push notifications and alert about his financial situation from your bank’s digital platform.

By doing so, you can help him to prevent issues such as late payment charges while he can take preventive measures, positioning your bank as a trusted advisor.

What can you propose?

What can you propose?

- Increase credit limit

- Transfer money from another account

- Offer a credit/loan solution

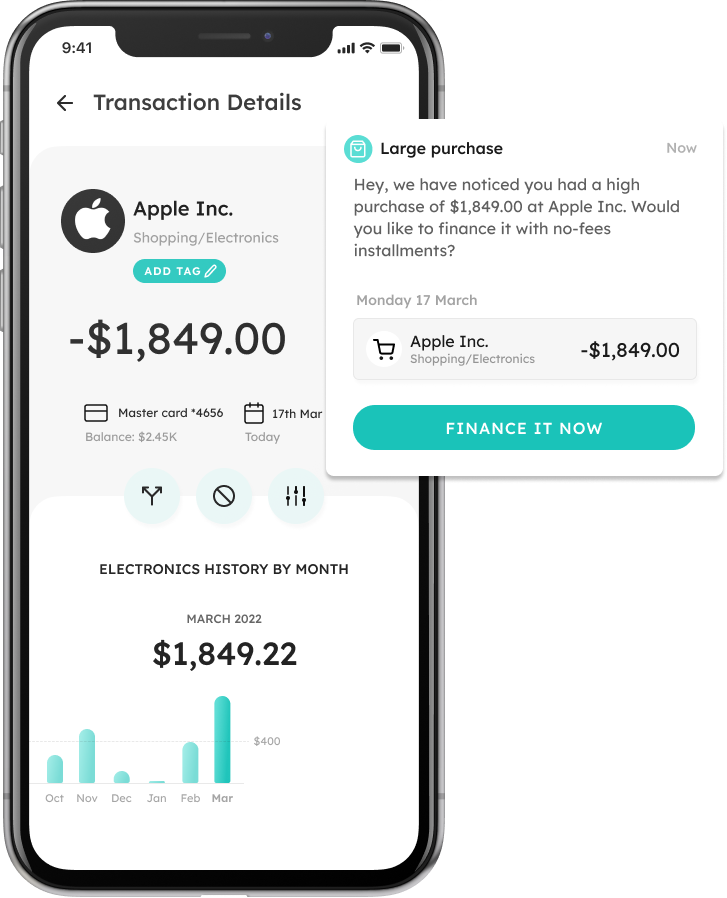

2.- Large purchase detection:

Due to Vincent’s lifestyle and freelance work model, he can’t track nor anticipate his income and spending with certainty.

Working as a digital nomad has a lot of benefits; flexibility, work-life balance, travel opportunities… But it can carry some financial risks as well, such as credit card data extraction and fraudulent purchases. Vincent should take security measures to protect his financial information, but banks can also help to keep him aware of any suspicious transaction done through his credit cards.

With Strands Engager, you can keep Vincent informed on his financial transactions, specially those that can be suspicious. For instance, you can notify him when a transaction exceeds a predefined threshold and is not responding to any pattern.

You can also adapt your messages according to the customer segment you’re addressing. For example, you can use a different vocabulary and style to engage with younger users.

What can you propose?

What can you propose?

- Special insurances to protect him in front of fradulent charges

- Messages to double check if the transaction is correct

- BNPL solutions

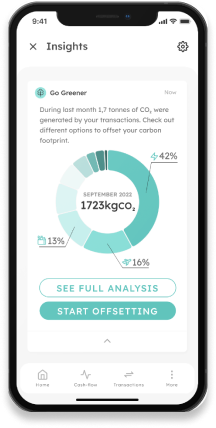

3.- Green banking gammification:

Gen Z enjoys interactive learning experiences. And gamification provides an engaging way to educate them about sustainable financial practices and eco-friendly options within banking.

Gen Z enjoys interactive learning experiences. And gamification provides an engaging way to educate them about sustainable financial practices and eco-friendly options within banking.

Based on the desired levels of carbon emmissions defined by Vincent, you can trigger insights that help him reduce the CO2. Every month that he achieves his desired levels of CO2, you can reward Vincent with points, that afterwards can be used for specific actions of your choice.

This is a way to position your bank as a referral for him in terms of sustainability.

Boost customer engagement with Strands Engager

Engage your customers with 100% personalized communications based on their behavior to help them control and better understand their finances:

- Information in real-time about their financial health

- Notifications about upcoming expenses

- Travel or transportation insurance recommendations

- Sustainable habits suggestments

And much more!

Ask an Expert

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.