As inflation is going up and energy prices are skyrocketing, the cost of living is becoming a major source of financial stress for many. To navigate these difficult times, open banking could be a real game changer. With 8 in 10 people using digital financial apps and services, companies have a chance to better support their customers through financial stress by enabling them to connect their accounts. And the good news is, access to financial data is becoming safer and easier to enable.

Coping with inflation: the cost of living crisis

For millions of consumers, the cost of living crisis has defined 2022 and is most likely to define 2023. According to an EIU report, global prices have risen by more than 8% on average in 2022, sparked by the war in Ukraine and zero-covid restrictions in China. Just recently inflation eased slightly, such as to 10.7% in the UK, but the cost of living crisis grinds on. It’s hard to keep up with the rising costs of living when wages don’t adjust, money loses its value and the outlook is grim around the world. That’s why, in this climate of financial stress, having the support of the right bank and financial control is essential.

The role of banks in easing money stress

Besides the pandemic giving rise to supply-chain problems and shortages in products, the Russian invasion of Ukraine threw the supply of gas and food into disarray.

Many European governments have introduced measures to ease the financial pressure on consumers, as highlighted in CRIF’s whitepaper “Banking on banks”. The French government has nationalized energy company EDF to tackle the energy crisis and shore up domestic supplies, Germany introduced a €9 per month ticket and Spain encouraged people to use public transport with free monthly passes for local and medium-range intercity routes.

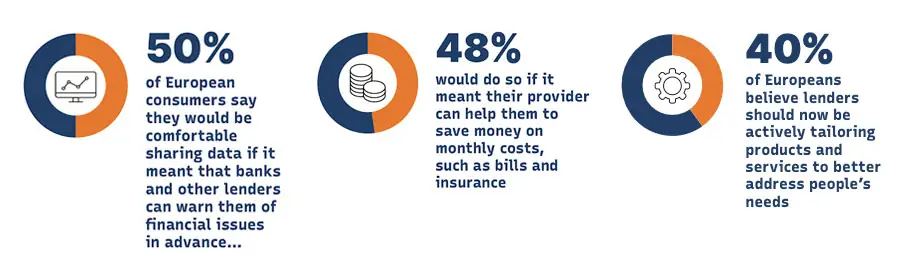

Despite these interventions, the situation is still set to worsen in 2023, and people need help and support. CRIF’s survey of 7,000 consumers across 6 European markets stresses that, regardless where they live in Europe, people have a mutual opinion: they want their banks and other lenders to do much more than they are to support them in this cost of living crisis – and therefore through financial stress. But how can this be done?

From CRIF’s report “Banking on Banks”

From CRIF’s report “Banking on Banks”

The promise of connecting financial data

Picture every household or SME having instant visibility into their whole financial lives, from weekly shopping and monthly supply to mortgages and pensions – all in one place. They wouldn’t need to search too far. New deals would be automatically suggested to them as their spending behavior changed. And even though banks might not be able to control inflation or wages, they can certainly turn into valuable partners when dealing with money stress.

More insights for better lending

Responsible lending has never been more important in the context of inflation, overwhelming energy prices and tax hikes. With open banking, financial institutions have the power to elevate the financial wellness of millions of people. Through a deeper understanding of their customers, they can lend with more confidence, ensuring that people who may be rejected in other conditions can now get the support they need to weather this storm, without increasing risk. Providers, on the other hand, can enable consumers to access this support in a convenient and intuitive way, thus complementing the rest of their digital experience.

From traditional to open banking

Open banking is a real driving force of innovation. By relying on networks instead of centralization, it can help customers to securely share their financial data with other institutions, with no need to switch between accounts. Everything is readily available, all on the same platform. And customers are the ones in power, as they choose who to grant permission to. The open banking APIs analyze consumers’ transaction and financial data to identify the best financial products and services for them, such as a new savings account that could earn a higher interest rate, a different credit card with a lower interest rate and other money management support.

Unlocking the potential of financial data

At Strands, we know empowering customers with financial control is crucial in these unprecedented times. That’s why we have developed Open Hub, a cutting-edge solution that enables individuals and SMEs to securely connect to multiple external services in one place, offering a clear overview of their financial and non-financial third-party data. Your customers can link multiple bank accounts and get a holistic view of their finances thanks to our third-party aggregation partners. We select the best aggregators in every geographic region to provide the best coverage.

With our solutions, your customers are in control. Third-party providers APIs can use your customer’s shared data and data about their financial counterparties once they’ve granted access. As a bank, you can take benefit from this technology to strengthen your customer relationships and loyalty by providing them more personalized information and therefore added value.

We know that the cost of living crisis will be a problem for millions of consumers. By accessing financial data, we help your customers with money saving, loan requests and a number of third party services. Become your customers’ everyday bank in these challenging times; give them simple access to all their accounts, in one single place.

Interested in knowing how to empower your customers through open banking solutions?