How Gamification Solves These Challenges

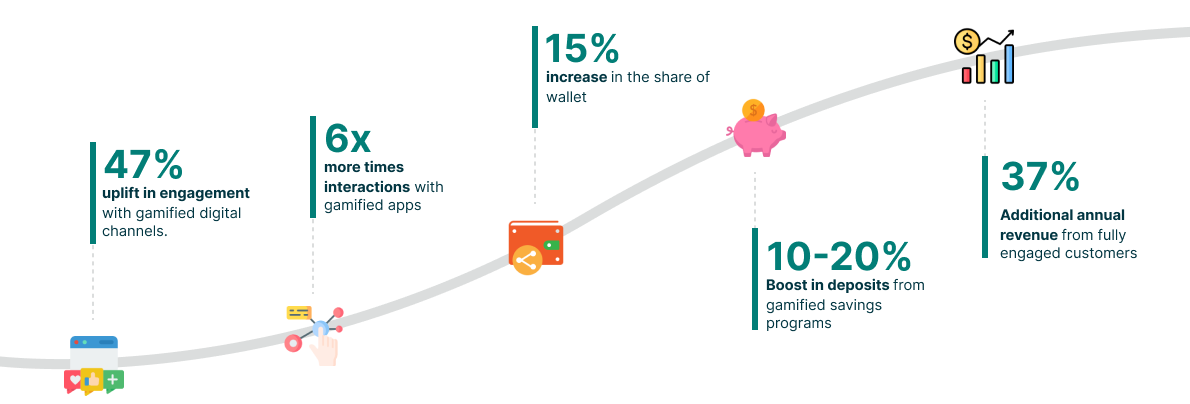

Gamification is more than just adding fun to banking—it’s a transformative approach that addresses the core challenges faced by financial institutions. By integrating game-like mechanics into digital platforms, banks can unlock unprecedented levels of engagement, loyalty, and positive financial behaviors.

1. Increased Engagement

Gamified elements, such as badges, rewards, and challenges, encourage users to interact more frequently with digital banking platforms. These features transform routine financial activities into engaging and habit-forming experiences.

CASE IN POINT

A major digital bank in Singapore used stamp campaigns to incentivize everyday transactions. Customers earned stamps for activities like referrals, card usage, and foreign transactions, leading to a 70% average engagement rate per user and generating $6.6 million in revenue over six months.

2. Enhanced Loyalty

Personalized rewards create an emotional connection with customers, making them feel valued and understood. This connection fosters deeper loyalty and increases the likelihood of long-term relationships.

CASE IN POINT

A leading bank in the Philippines combined loyalty programs with gamification, allowing customers to redeem points for vouchers from partner merchants. The initiative resulted in an earn-burn ratio of 32%, well above the industry average, driving stronger brand loyalty and engagement.

3. Improved Financial Habits

Challenges and mini-games promote positive behaviors such as saving, budgeting, and mindful spending. These gamified features encourage users to adopt better financial habits while making the experience enjoyable.

CASE IN POINT

A European bank launched a gamified savings program where customers earned rewards for meeting monthly savings goals. This program led to a 20% increase in deposits, as users became more engaged with managing their financial goals through the bank’s app.

Transform Your Digital Banking Experience

Strands and Perx Technologies bring together complementary strengths to revolutionize customer engagement in digital banking. By combining Strands’ AI-powered insights, which provide deep customer understanding and hyper-personalized journeys, with Perx’s engaging rewards and interactive gamification features, banks can offer playful and rewarding experiences that captivate users.

This powerful collaboration empowers financial institutions to overcome challenges in customer adoption and engagement, fostering deeper loyalty and driving sustainable growth. With gamification at the core, every interaction becomes an opportunity to delight customers while achieving business goals.

Ready to take your digital banking to the next level?

Download our eBook now to discover the full potential of gamified banking journeys or contact our experts to have a personalized demo.

Ready to take your digital banking to the next level?

Download our eBook now to discover the full potential of gamified banking journeys or contact our experts to have a personalized demo.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.