Behavioral science can not only be used to influence consumer behavior but also to understand customers and motivate sustainable healthy financial habits. However, understanding when and why customers may behave in a specific way is not an easy task. While Neobanks and challenger banks have bet on tech and customer centric approaches, traditional banks still have a long way to go.

Banks could have the upper hand since they are the major owners of the customer’s first-party data and insights; but they first need to have a deeper understanding of human behavior. By leveraging the vast amount of data they own, they could achieve their business goals to retain, engage, and motivate customers. Such is the case that according to Gallup:

Totally engaged clients generate 37% more annual revenue than those who are not.

Banking strategies based on behavioral principles

Social proof and novelty: addressing emotions

As humans, we are driven by emotions. Whether it is about uncertain situations impacting our way of living, or even how we feel about other people’s thoughts and behavior; we are constantly being influenced by our surroundings.

For instance, Robert Cialdini sets social proof theory on his most popular work, The 6 Principles of Persuasion. This theory explains the psychological effect of other people’s behavior on us, which can lead us to copy it and bias our decision-making process in situations of uncertainty. Nowadays, social proof is constantly used in digital marketing to prove the veracity of a product, and influence decisions based on societal norms and expectations. Banks can leverage this to increase their visibility in the market, deliver new added value programmes, and understand their customers.

Having understood that our brain is attracted by emotions, banks should also consider the impact of innovation on customer behavior. Neuroscience research also suggests that we are attracted by novelty since novel stimuli generate dopamine and activate brain regions. For banks, providing fresh and innovative financial solutions to clients, will aid them create more engaging and stimulating experiences. In order to do so, they will have to play more strategically and leverage the power of attraction to novelty with emotions’ influence over decision-making in product and marketing strategies.

Instant gratification: taking advantage of goals

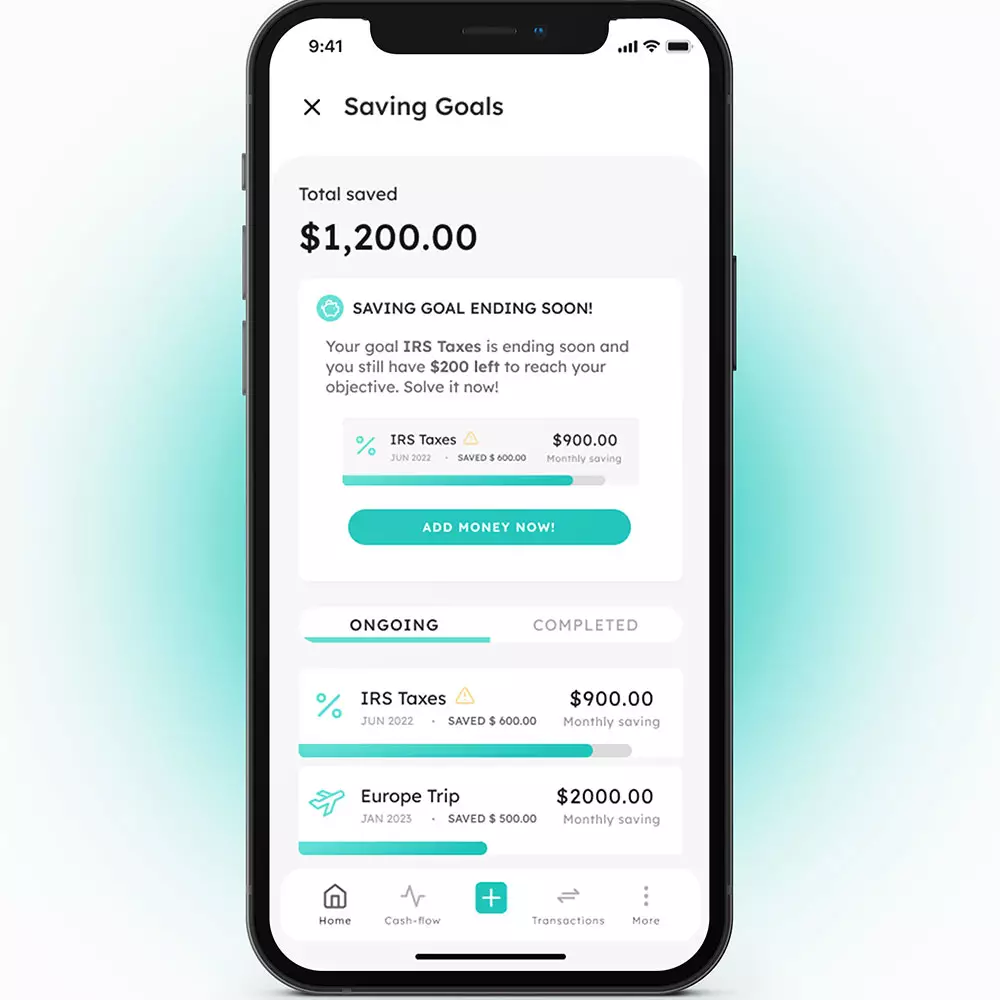

Another behavioral science concept to take into account is the instant gratification bias. It refers to the need from humans to receive immediate rewards at the expense of long-term goal achievement. Banks and financial institutions could drive profit from people’s “must have it now” mindset by creating goal-based experiences to visualize goals.

A very good example of how this can take part in financial product development is incorporating goal-oriented features in the digital banking app. Strands’ PFM solution has Saving Goals that can help customers achieve their financial goals faster and more efficiently, improving their saving capacity. As customers start achieving their short-term goals, they will benefit from the rewarding feeling of accomplishment; helping them stay innerly motivated and reinforced to commit to them.

Approaching behavioral science in finance

All in all, banks need to understand that customer-centric approaches will be the way to go to retain customers and have a strong brand position. However, the first step to take in order to plan a good business strategy around this, is to understand how and why we might take different actions at different times. That is why behavioral science is so important, since it opens the door to a wide range of possibilities that help predict consumer behavior.

With the currently delicate economic situation, banks need to provide a clear view of how they will obtain a better money management experience that can help them sustain their financial goals. Considering behavioral science impacts such as the instant gratification bias or the social proof theory, could help them make the first move. Combined with data-driven strategies, an unbeatable business strategy is bound to be set.

Data opens up an array of opportunities for traditional banks to bring innovation into their businesses, and begin to venture into what neobanks are already doing such as merchant affiliate cards or instant credit lines – but as a hybrid. As a result, Open Banking is set to be the way to help banks engage with customers based on their lifestyles, spending habits, or even their personal values; making them feel more like individuals rather than merely customers. Additionally, with our Strands Engager solution, we use the enriched data that Financial Institutions collect (from transactions, credit scores, or third-party data) in order to detect different behaviors of customers and offer them the right next best action according to their current need in a timely and relevant manner.

Most successful banks lean on fintech leaders that provide innovative and customer-focused solutions. With their use of first-party data, and the fast adoption of new financial trends of these fintechs into their solutions; banks can benefit from the competitive advantage that delivering these experiences faster than others will bring. If you are interested in learning more about how partnering with a fintech company can be beneficial for your bank, request a demo and one of our sales reps will get back to you as soon as possible.