Helping SMEs Streamline Finances

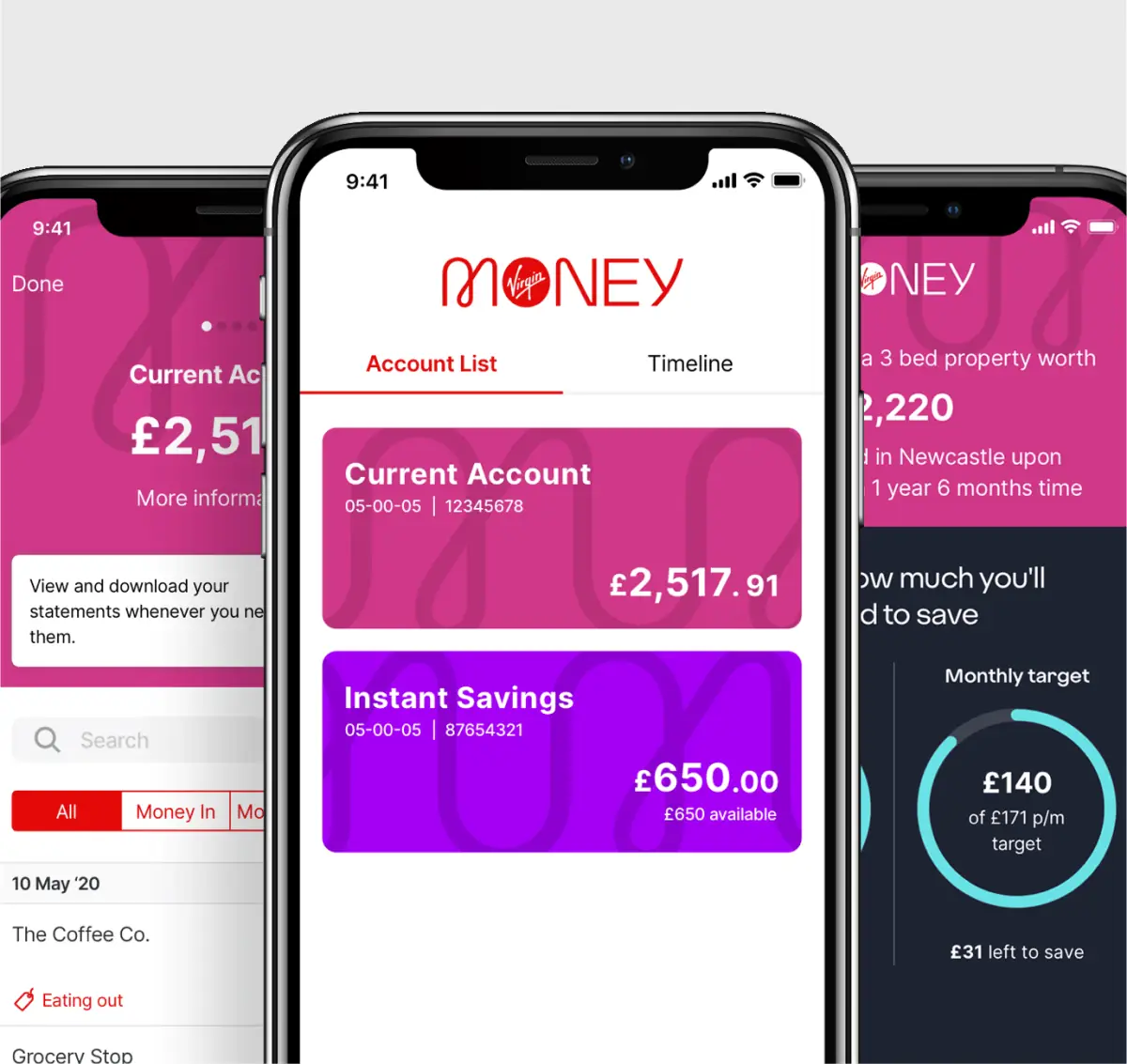

Virgin Money has launched a free, full money management package to support small business customers with their day-to-day financial operations and ensure they have a complete view of their past, current and future financial position.

Powered by Artificial Intelligence, Money Management, provides an innovative and personalised banking experience allowing Virgin Money’s Business Current Account customers to make more informed financial decisions through clearer insights and analysis of their financial position via a range of features.

The free tool is accessed through the Bank’s online desktop business platform and is underpinned by 24-hour chat support with a dedicated web team, to help customers manage their accounts.

Story Overview

Client:

Virgin Money

Country:

UK

Solutions:

Deployment:

On Premise

Launched:

2022

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.