NCBA Loop from Commercial Bank of Africa

Africa’s largest privately-owned bank and the biggest commercial bank in Kenya, Commercial Bank of Africa (CBA), launched their money management tool ‘CBA Loop’ in 2017, in collaboration with Strands.

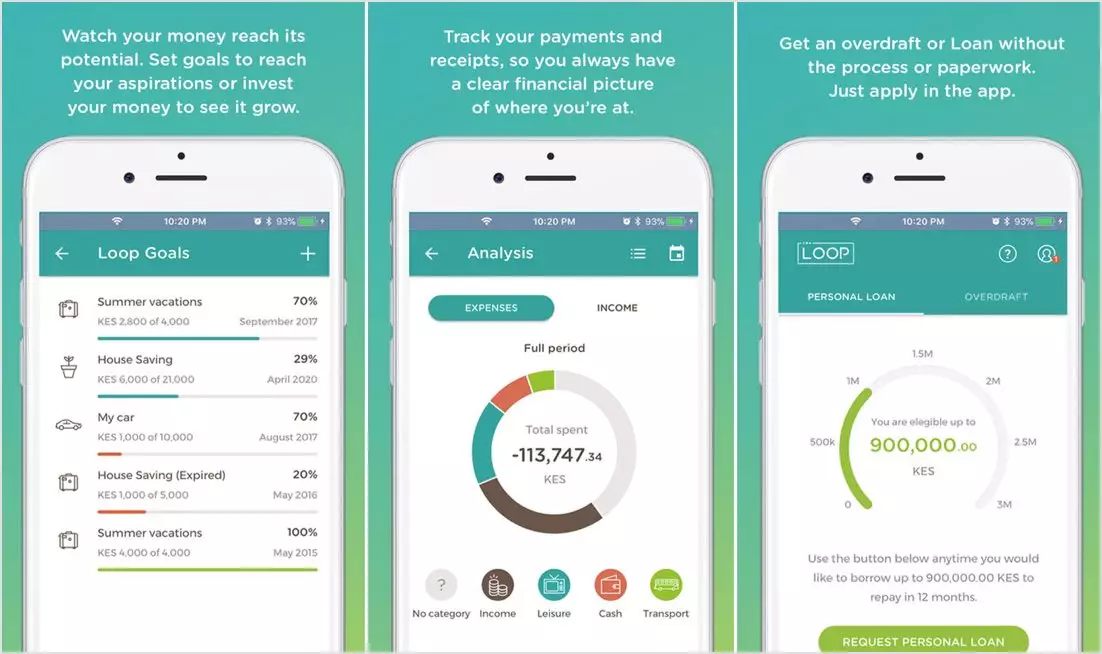

This mobile-first tool currently includes PFM and is under development to incorporate BFM functionality, tailor-made for the SME customers across Eastern Africa. CBA Loop offers digital solutions to their increasingly mobile population and aims to address the needs of the unbanked areas of the country.

This digital banking experience with integrated PFM & BFM solutions provides insights that had not previously existed. The new CBA Loop Banking Service incorporates intuitive money management tools, enabling customers to track, plan and analyse their income against expenditure on a regular basis and providing financial education combined with a community widget that addresses the social aspect of banking in this region.

Related Success Stories

A Leading Universal Bank in Georgia

By all accounts, the bank is on to something – it’s converting customers over to digital channels.