Why partner with Strands

Proven track record

Experts in Big Data, AI and Machine Learning since 2004, Strands creates highly-customizable digital money management software for top-tier financial institutions worldwide, and empowers people to be smarter with their money. Strands has carried out more than 700 worldwide implementations to date in 30 countries.

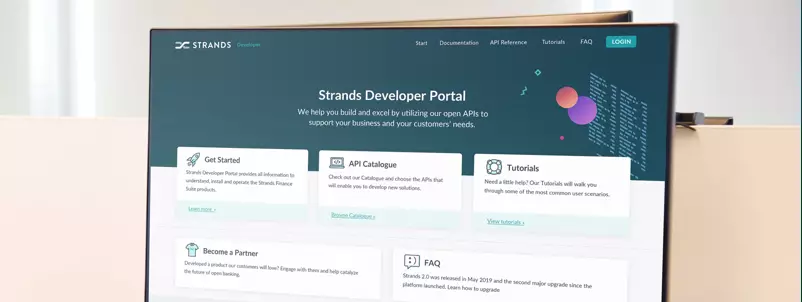

Strands Developer Portal

We provide our partners with the right tools so they can create or enhance their digital banking solutions. Use our open APIs and follow the steps of leading banks in the digital transformation process. Plus, get access to all the necessary information to install and operate the Strands Finance Suite products.

AI-driven financial technology

Strands’ core tech is based on Artificial Intelligence and Machine Learning. Its financial management software enables banks to offer their customers-both individuals and SMEs—personalized recommendations and solutions that are tailored to their situation, needs and consumer habits.

Become a partner

At Strands, we believe that collaboration is the true backbone of innovation. Are you interested in partnering with us and help seize the opportunities that AI opens up for financial institutions?

Get spend management in line with your growth.

Let us help you scale.

PRIVACY NOTICE

This form collects your basic personal information so that we can continue to send you relevant information and updates about the world of Fintech.

By giving your consent, you'll stay on our distribution list and more importantly, in the loop about the latest Strands news.