Digital banking fintech solutions for better channel engagement

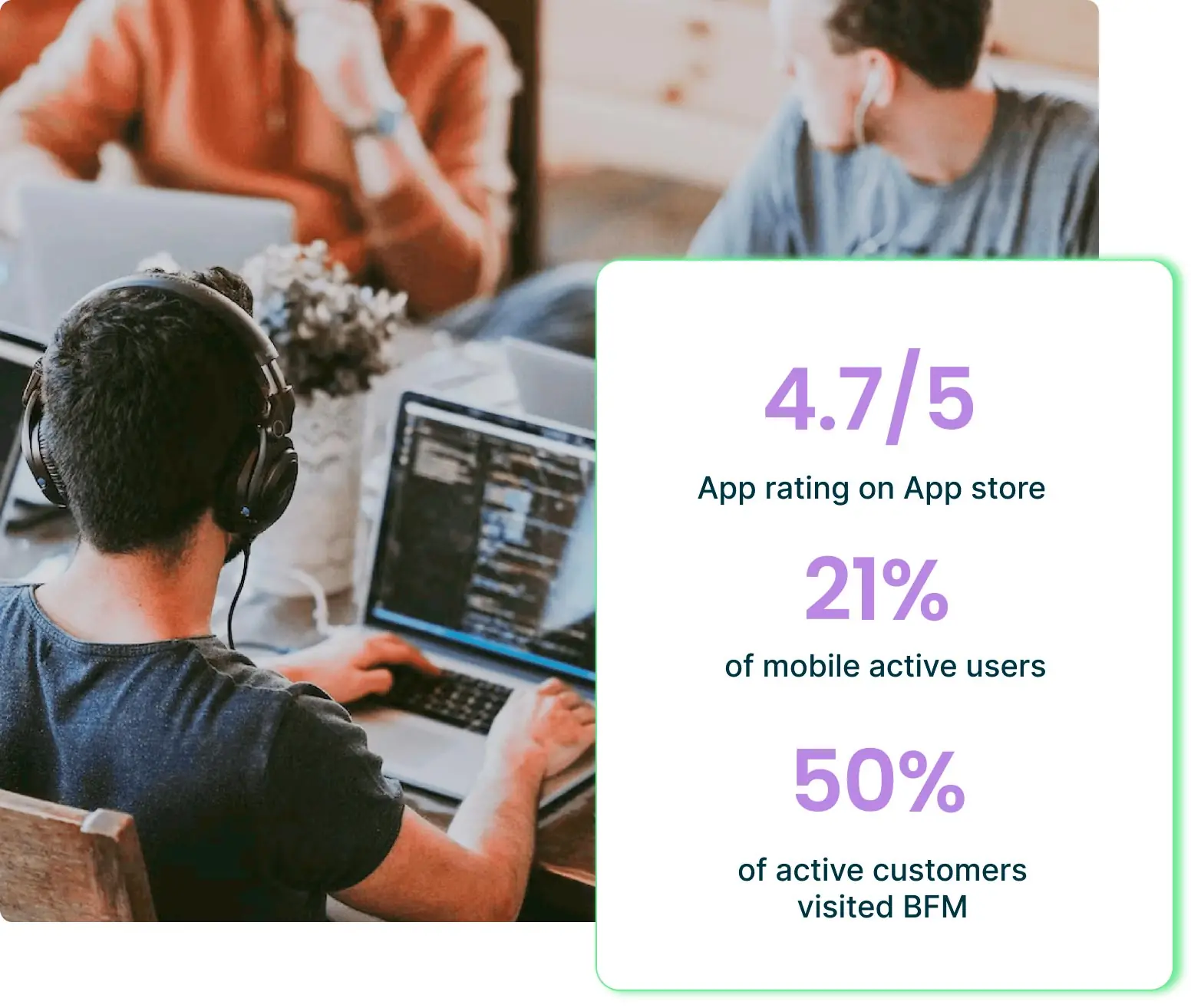

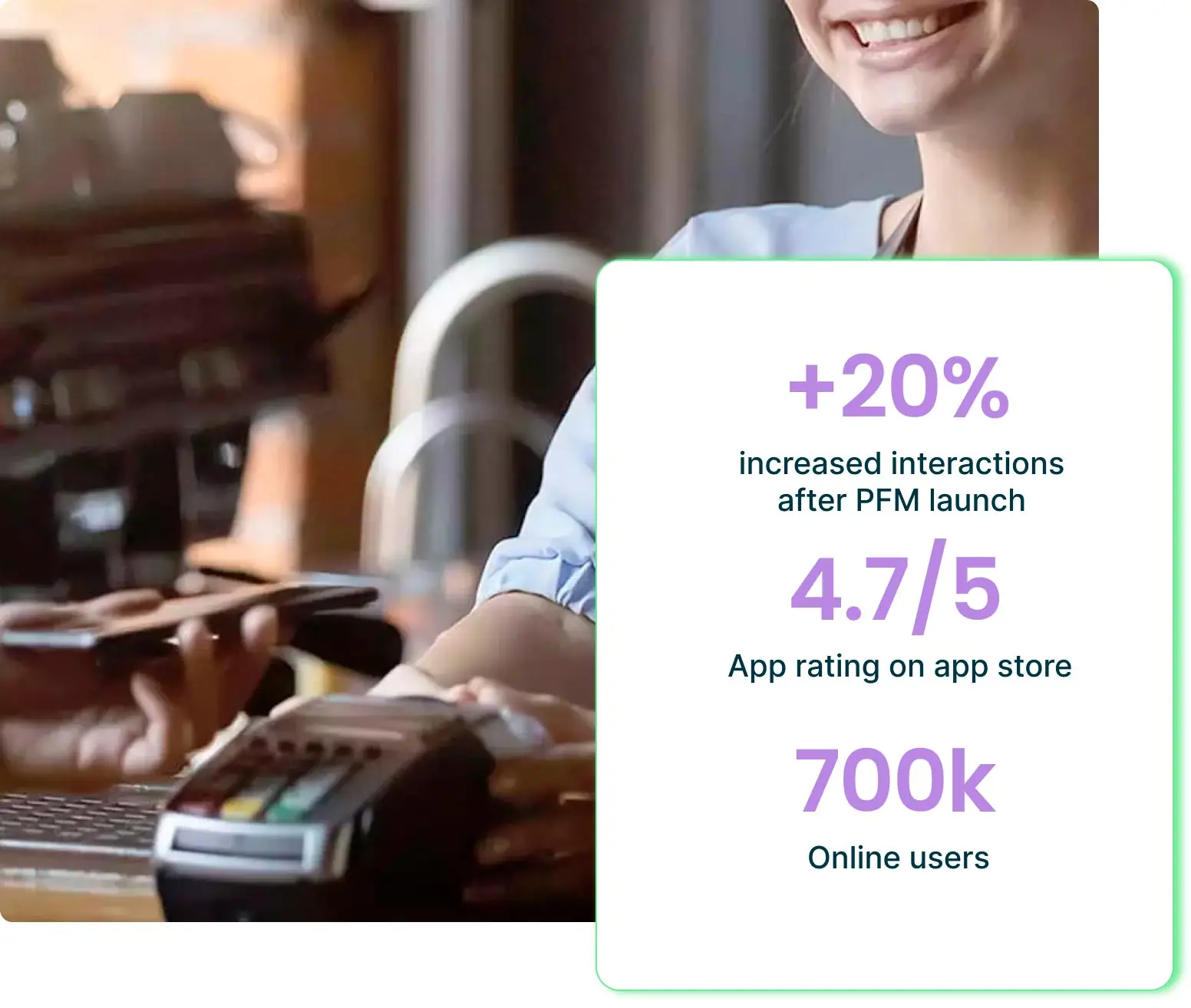

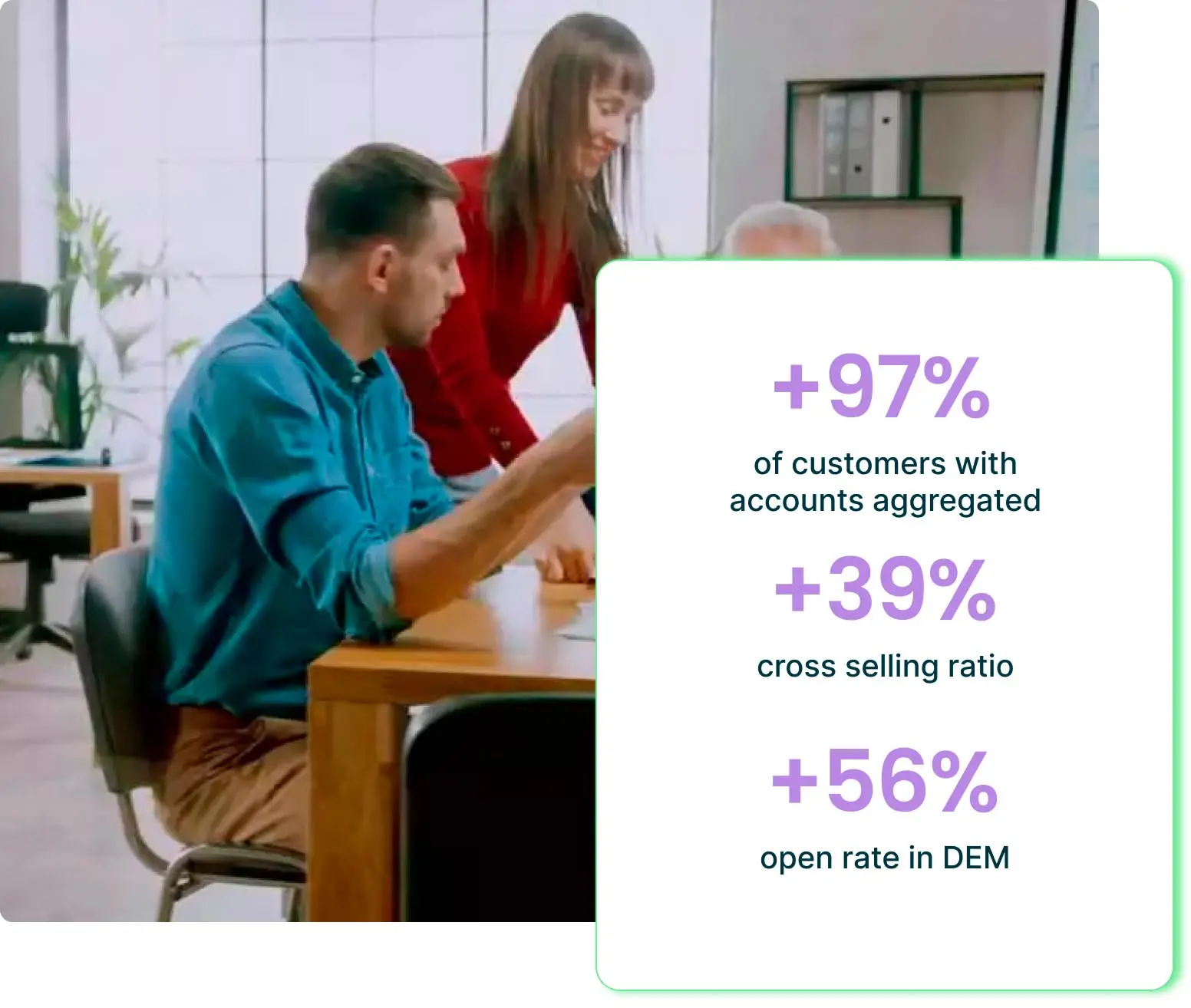

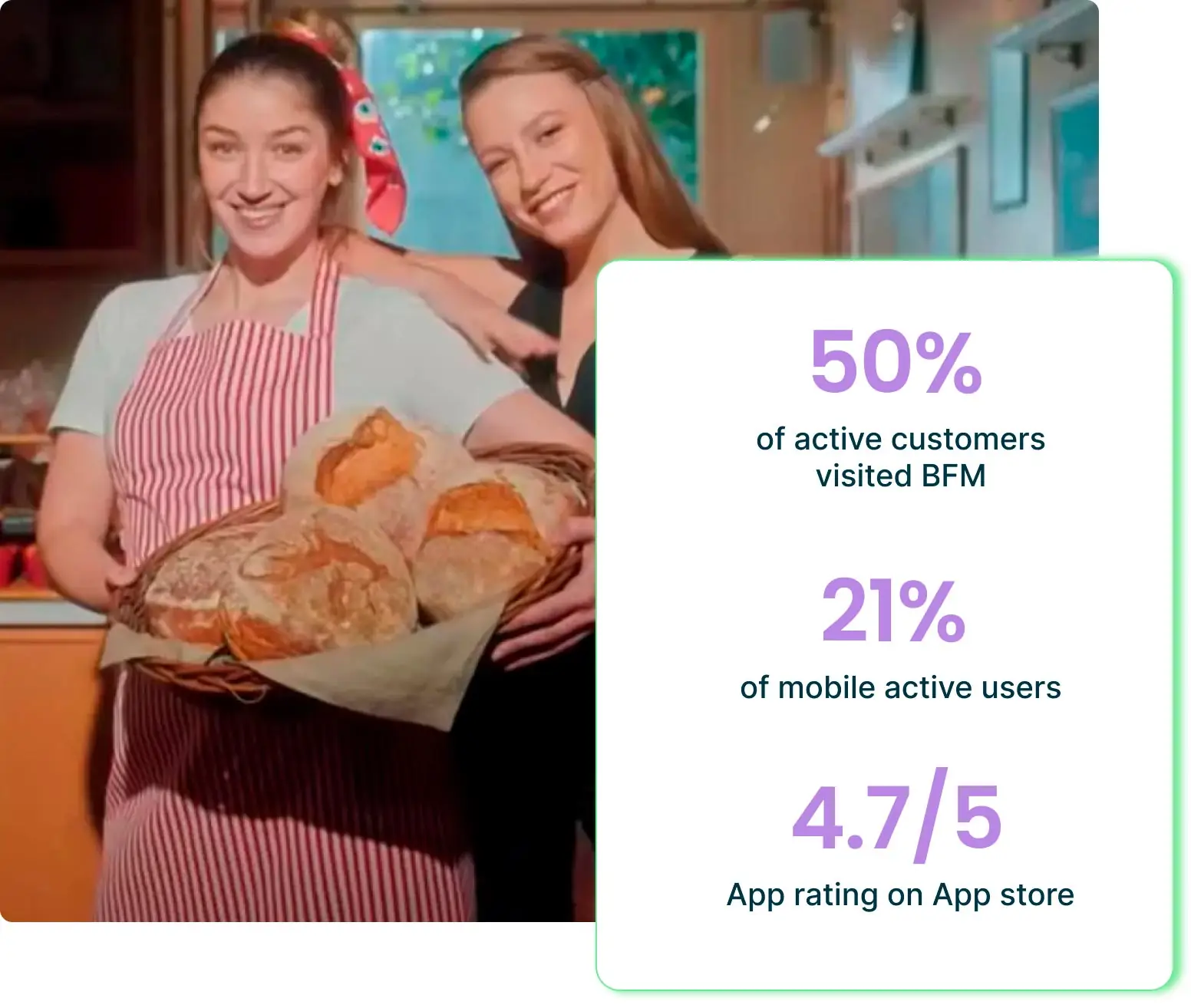

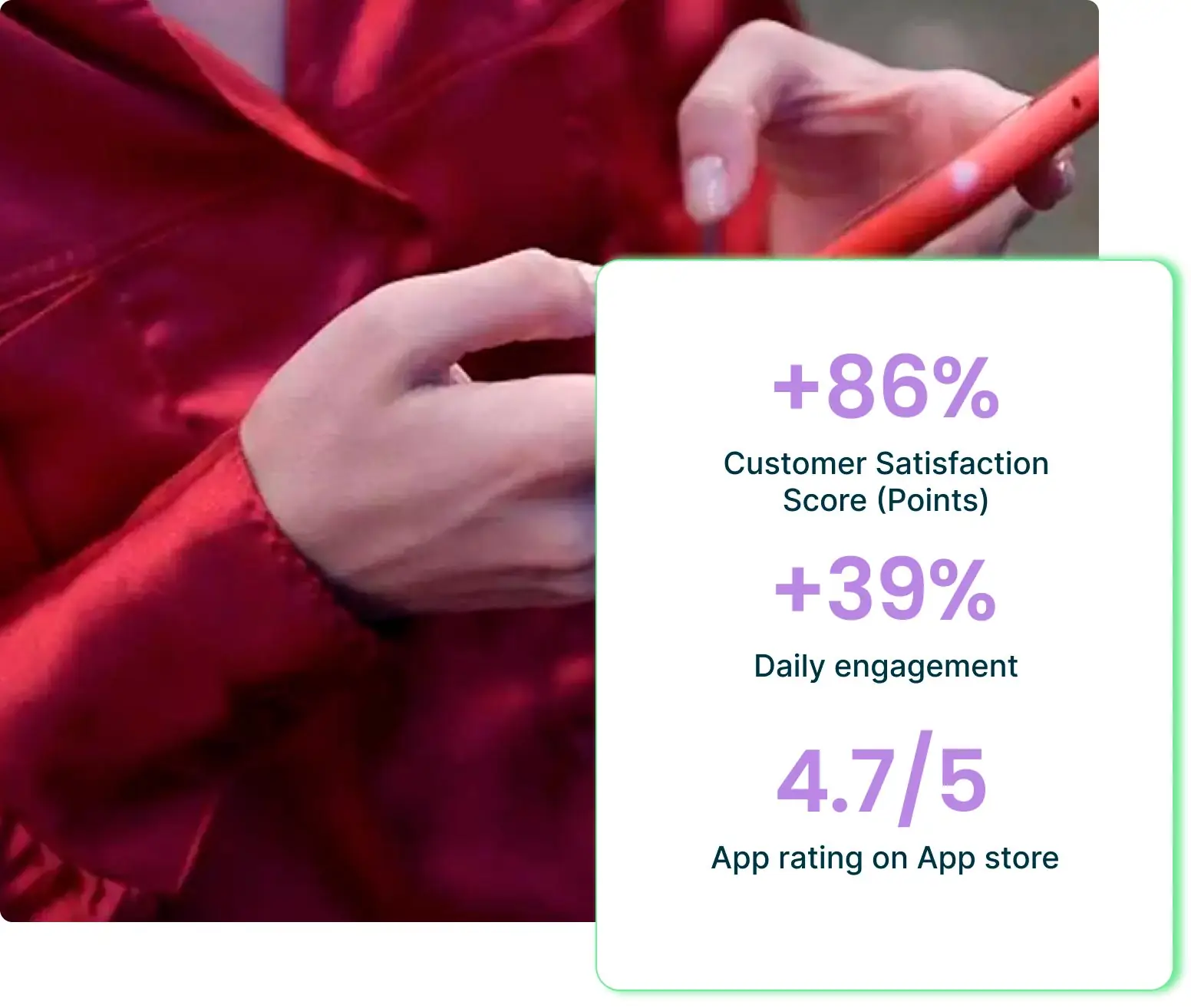

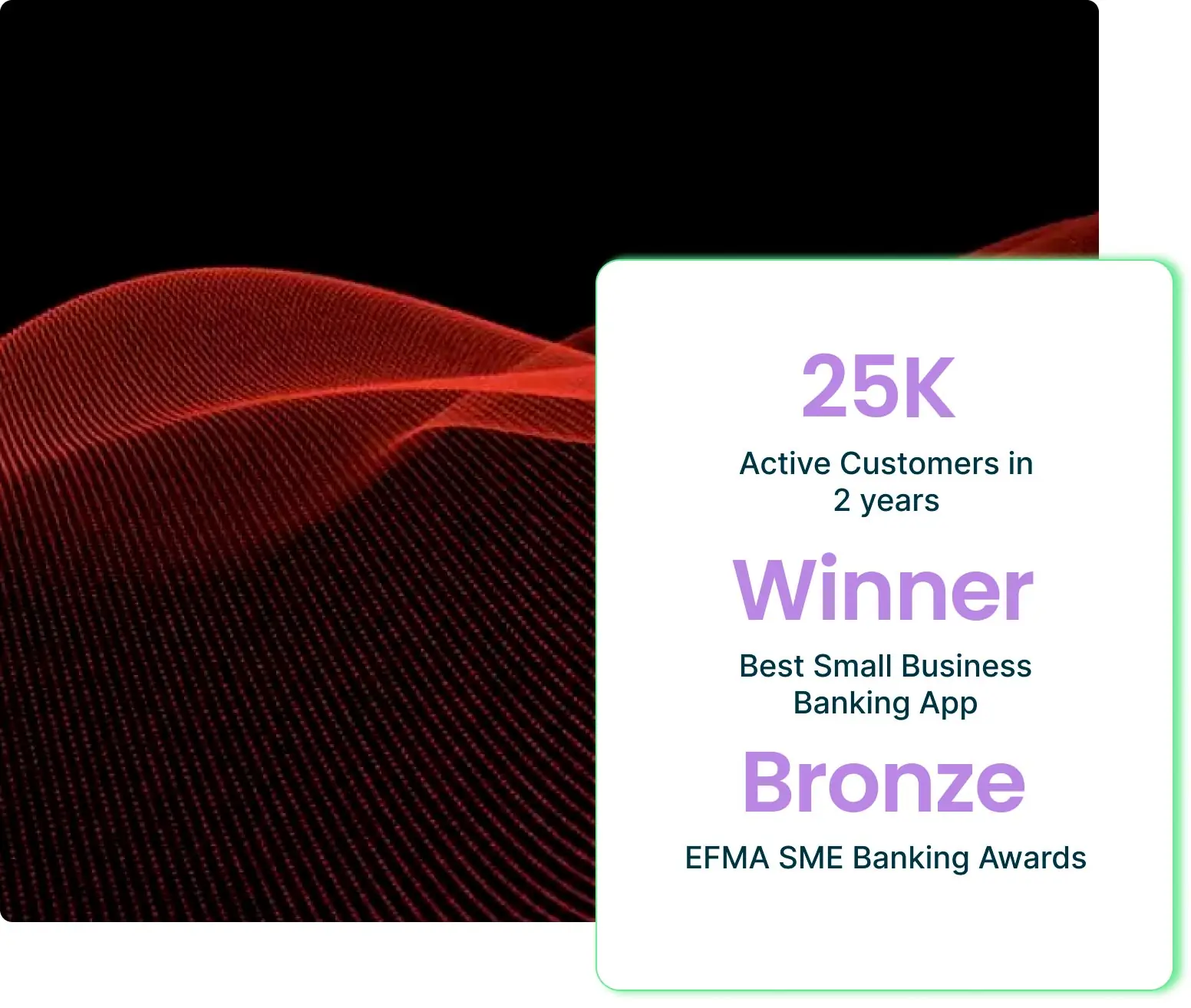

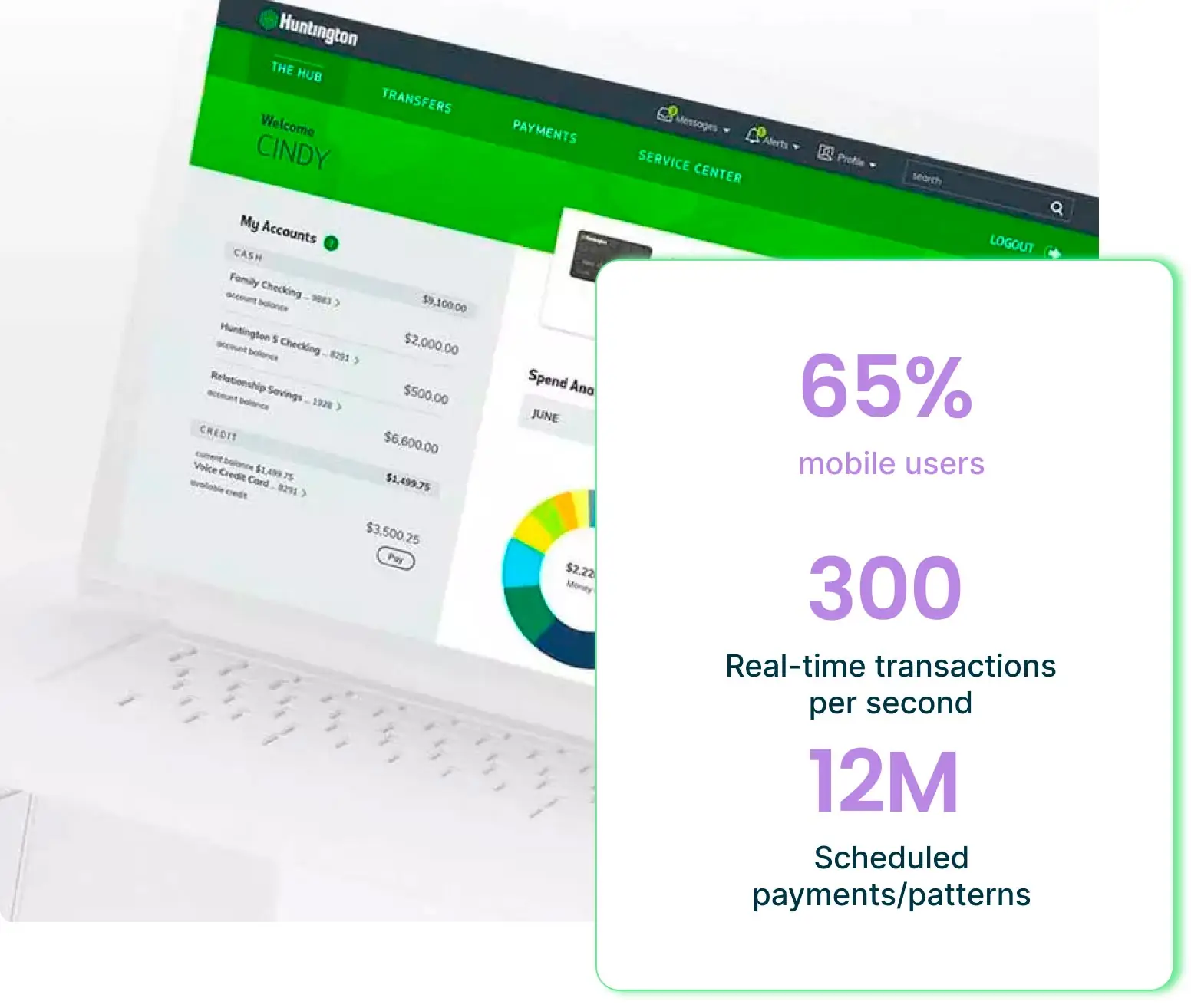

Top banks worldwide are increasing their digital engagement and growth with Strands solutions.

How we do it?

A customer centric journey based on data-driven personalization

Make the most out of digital banking with our modular solutions, dedicated to boost customer adoption, engagement and retention. Increase cross-selling opportunities and revenues through personalized actionable insights.

A UNIQUE OFFERING

Addresing the digital banking needs of financial institutions

Increase your revenue by building tailored and data-driven money management experiences for retail and business customers.

ATTRACT

Enhance digital channels adoption by improving digital banking proposition.

RETAIN

Create real-time experiences to anticipate and meet customer needs and expectations.

ENGAGE

Improve customer experiences with AI-based personalization.

Learn from our resources

Feel the FinTech pulse

Revolutionizing Zakat Collection and Distribution with Strands Islamic …

Zakat, one of the Five Pillars of Islam, is a form of almsgiving treated as a religious obligation...

Empowering Nordic Banks through Open Banking Innovation

Digital Transformation & Open Banking: Strategies for Success in Nordics In the rapidly...

Latin American Banking Digital Transformation

1. IntroductionLatin America's banking sector is undergoing a pivotal transformation. Despite a...